Why This Financial Firm Is Postponing Bitcoin ETF Onboarding

LPL Financial Holdings, one of the largest independent broker-dealers in the US, is biding time before offering Bitcoin exchange-traded funds (ETFs). The company will evaluate ETF risks over three months to minimize investor and corporate losses to minimize potential losses.

LPL Financial is postponing offering Bitcoin ETFs for three months to ensure the new ETFs are not hyped products lacking legs.

Why LLP Will Delay a Bitcoin ETFThe broker-dealer will only offer spot Bitcoin ETFs once it can assess their sustainability. During the three-month maximum due diligence period, the company wants to avoid losses while the funds give a truer reflection of their investment utility. According to Rob Pettman, investors and companies investing in Bitcoin can be hurt badly if the product fails to accumulate enough assets.

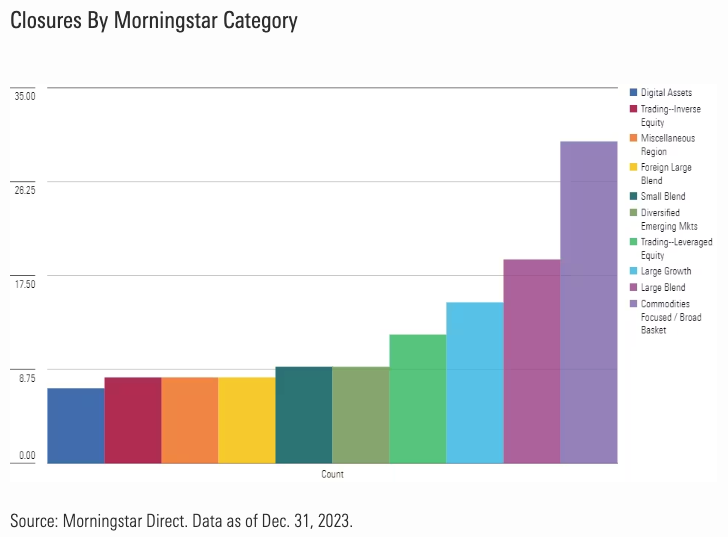

ETF Closures in 2023 | Source: Morningstar

ETF Closures in 2023 | Source: Morningstar

“[A failure] can be a very negative experience for the investor, for the financial adviser. It’s also incredibly costly for a firm like ours operationally to help to facilitate that.”

LPL Financial Holdings services 475 mutual funds and 35 exchange-traded product issuers. The only Bitcoin ETF the company has onboarded is Grayscale’s Bitcoin Trust. ETFs from other firms, including BlackRock and Fidelity, are still being reviewed.

Read more: Top 11 Crypto Companies To Watch in 2022

The large disparity in the funds invested with different providers may also be a concern. Excluding Grayscale, the largest Bitcoin spot ETF holds $3 billion, while WidomTree’s Bitcoin fund has under $12 million.

BlackRock and its CEO don’t seem fazed. According to Larry Fink, Bitcoin ETFs are just the start. The company expects the blockchain tokenization of financial assets to increase what investment firms can offer.

“We believe this is just the beginning. ETFs are step one in the technological revolution in the financial markets. Step two is going to the tokenization of every financial asset.”

Does Bitcoin Price Justify LLP’s Approach?Still, it’s worth noting that 244 ETFs were closed in 2023. Among them were six crypto ETFs from ARK Invest partner 21Shares. The VanEck Digital Assets Mining ETF (DAM) and the Volt Crypto Industry Revolution products were also shuttered.

Richard Bernstein, chief investment officer at Bernstein, said investors would be wise to wait before investing in Bitcoin ETFs. He likens crypto to the housing and technology bubbles that caused unexpected risks that institutions didn’t bank on.

“Well-established financial institutions might want to be wary…The [ETF-induced]] spread of Bitcoin speculation and any subsequent deflation could expose similar risks to [the technology and housing bubbles].”

Read more: Cryptocurrency Trading: How To Trade Bitcoin for Beginners

Following the initial hype, Bitcoin ETF trading strategies involve selling more than buying, according to ETF Store CEO Nate Geraci. The price of Bitcoin has accordingly not moved as high as the market may have expected post-ETF approval, which could be concerning for investors in the medium term.

BeInCrypto has reached out to LPL Financial but has yet to hear back at the time of publication.

Top crypto platforms | February 2024The post Why This Financial Firm Is Postponing Bitcoin ETF Onboarding appeared first on BeInCrypto.