What Crypto Whales Are Buying After Trump’s 100% China Tariffs Crashed The Market

The market tumbled after Donald Trump announced a 100% tariff on Chinese imports, wiping out nearly $19 billion in crypto liquidations within a day. Yet while traders panicked, crypto whales were seen buying.

On-chain data shows large investors added exposure across three altcoins — signaling confidence that this sell-off was sentiment-driven, not structural. Here’s a look at what whales are buying and why these tokens could lead the next rebound.

Chainlink (LINK)Donald Trump’s 100% China tariffs triggered one of the steepest market-wide selloffs in months. While most altcoins crumbled under pressure, Chainlink (LINK) drew quiet accumulation from large holders — and the data backs it up.

According to Nansen, whale wallets holding over 100,000 LINK boosted their positions by 22.45%, bringing total holdings to 4.16 million LINK. That means whales added roughly 0.76 million LINK, worth about $13.7 million at the current LINK price.

The top 100 addresses also increased their balance by 0.14%, bringing their collective stash to 646.48 million LINK — a net addition of around 0.90 million LINK, or $16.3 million.

LINK Whales: Nansen

LINK Whales: Nansen

The accumulation wasn’t random. Nansen’s data also shows that smart money wallets rose 1.51% (expecting a bounce), and public figure wallets climbed 1.97%. Meanwhile, exchange balances grew 5.85%, meaning retail traders were likely selling.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This move aligns with Chainlink’s strong fundamentals. During the selloff, Chainlink’s oracles delivered real-time pricing data that reportedly allowed Aave to process over $180 million in liquidations without downtime.

The network’s reliability under stress likely reinforced whale conviction in LINK’s DeFi role.

While painful, days like today highlight the true resiliency of DeFi and the infra that powers it

Even during the most extreme market volatility and blockchain network congestion, protocols like @aave operate flawlessly@Chainlink oracles delivered accurate pricing data… https://t.co/o95lbLEtyf

Technically, LINK trades inside a symmetrical consolidation channel, showing tightening price action before a potential breakout.

On the two-day chart, a bullish RSI divergence has formed: while prices made a lower low near $7.90, RSI made a higher low, hinting at a fortune reversal or at least a rebound.

LINK Price Analysis: TradingView

LINK Price Analysis: TradingView

The Relative Strength Index (RSI) measures how strong buying or selling pressure is on a scale from 0 to 100, helping identify when assets are overbought or oversold.

At press time, LINK trades near $17.70, just under resistance at $18.40. A breakout above $21.30 could open the path toward $24.90, and a 2-day close above $27.90 might send LINK toward $35.50.

However, if the 2-day candle closes under $16.40, we can expect the bears to dominate.

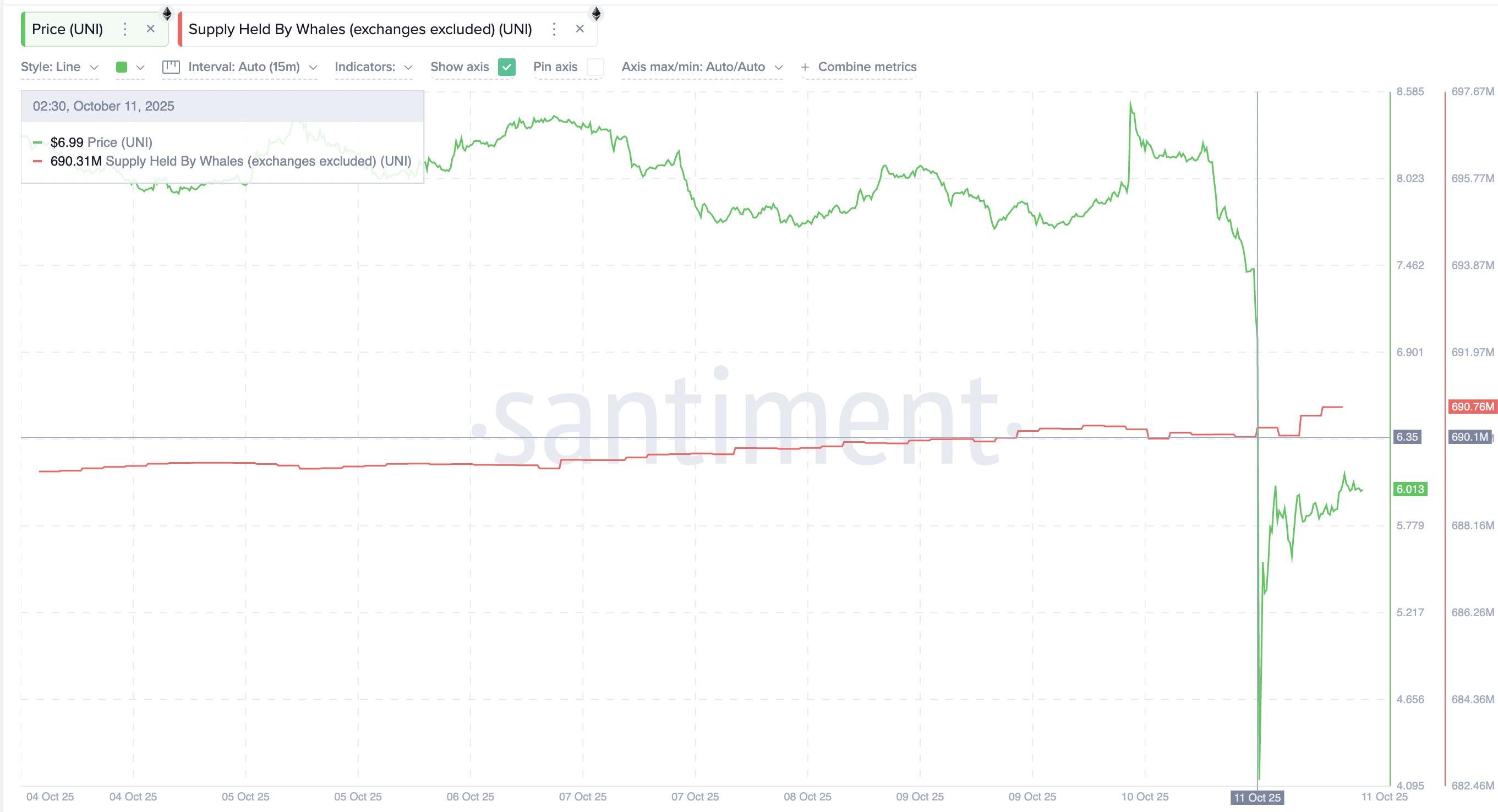

Uniswap (UNI)While the wider market absorbed the tariff shock, Uniswap (UNI) saw quiet whale accumulation. Wallets holding large amounts of UNI increased their balances from 690.10 million to 690.76 million, adding roughly 0.66 million UNI, worth about $4 million at the current UNI price.

Uniswap Whales: Santiment

Uniswap Whales: Santiment

The move came as Uniswap processed nearly $9 billion in daily trading volume, its highest in months, and did so without downtime or network stress — a sign of DeFi stability even in extreme volatility.

Large sell offs are good reminders of how DeFi is simply built different

Uniswap did close to $9b in trading volume today – well above the norm – with no stress or downtime https://t.co/z9SFPCKx1Q