Web3, Blockchain & Crypto Weekly Report: Insights and Analysis

The post Web3, Blockchain & Crypto Weekly Report: Insights and Analysis appeared first on Coinpedia Fintech News

This analysis report, backed by quality data, covers the major developments that the Web3, Blockchain, and Crypto sectors have experienced this week.

1. Breaking News This Week- Voyager Digital Recovers $484.35 M in Settlement Amid Bankruptcy Proceedings

Voyager Digital announces successful recovery efforts, securing significant funds from settlements with FTX, Three Arrows Capital, and insurance, aiding creditor, reimbursement amidst financial turmoil.

- MarginFi Founder Resigns, Causing $120 Million TVL Plunge

Edgar Pavlovsky’s sudden departure triggers investor withdrawals, leading to a drastic $120 million decline in MarginFi’s Total Value Locked (TVL) following internal disputes within protocol builder, Mrgn.

- SEC Issues Wells Notice Againt Uniswap Labs in DeFi Crackdown

The US SEC targets Uniswap Labs, issuer of the largest decentralised exchange, issuing a Wells Notice as part of its intensified scrutiny on the decentralised finance (DeFi) sector.

- Circle’s USDC Now Supported on zkSync, Expanding Accessibility

Circle integrates native USDC on zkSync, a prominent layer 2 rollup solution, facilitating enhanced accessibility for developers and users without the need for bridging, extending USDC’s reach to 16 blockchain networks.

- Wilder World Partners With Samsung to Expand Virtual Metaverse

Samsung collaborates with Wilder World to introduce the multiplayer virtual world to millions of households through smart TVs, leveraging its extensive distribution network to widen the metaverse’s audience reach.

- Chinese Authorities Investigate Filecoin-Based STFIL Protocol Team

The core technical term behind the Filecoin-based STFIL protocol faces investigation by Chinese authorities amid suspicious updates and fund transfers, raising concerns over the protocol’s integrity and compliance.

- Circle Extends Support for Web3 Services on Solana Blockchain

Circle announces support for Web3 services on Solana’s Layer 1 blockchain network, emphasising the growing importance of stablecoins like USDC in fostering a more inclusive financial ecosystem.

- Polkadot Community Selects IndyCar Star Conor Daly as Ambassador

In a historic move, the Polkadot community votes to sponsor IndyCar racing star Conor Daly as brand ambassador for the prestigious Indianpolis 500, making the first athlete selected via blockchain for a sponsorship deal.

- Chinese Equity Funds Seek Approval for Spot Bitcoin ETFs in Hong Kong

Chinese mainland-based equity funds apply to introduce spot Bitcoin exchange-traded funds (ETFs) through Hong Kong subsidiaries, capitalising on the region’s effort to establish itself as a global fintech hub amid crypto market surge.

- dYdX Community Votes to Stake 20 Million DYDX Tokens for security

dYdX community approves proposal to stake 20 million DYDX tokens, bolstering security measures for its decentralised crypto exchange, amidst heightened trading activity, aiming to protect against potential security threats.

- Former OneCoin Officer Sentenced to Four Years in Prison

Irina Dikinska, former legal and compliance officer of OneCoin, receives a four-year prison sentence for her role in the extensive OneCoin fraud scheme, serving as a significant development in the legal pursuit against cryptocurrency fraud.

- Google Files Lawsuit Against Developers for Fraudulent Crypto Apps

Google initiates legal action against developers for uploading nearly 90 fraudulent crypto investment applications on its Play Store, impacting round 100,000 users, highlighting ongoing efforts to combat scams within the digital asset space.

2. Blockchain PerformanceIn this section, we will analyse two factors primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

2.1. Top Blockchain Performers by 7-Day ChangeThis week’s top blockchain performers, based on their 7-day change, are Linea, Chiliz. Base, Blast, and opBNB.

Blockchain 7-Day Change (in %)TVLLinea+51.0%$208,101,809Chiliz+31.4%$172,516Base+24.3%$1,566,130,148Blast+23.9%$1,667,240,804opBNB+17.9%$21,336,115

Blockchain 7-Day Change (in %)TVLLinea+51.0%$208,101,809Chiliz+31.4%$172,516Base+24.3%$1,566,130,148Blast+23.9%$1,667,240,804opBNB+17.9%$21,336,115

Linea experienced the highest 7-day change at +51.0%, indicating significant growth. Following closely, Chiliz surged by +31.4%, while Base and Blast showed notable increases of +24.3% and +23.9%, respectively. opBNB exhibited a comparatively lower but still considerable rise at +17.9%.

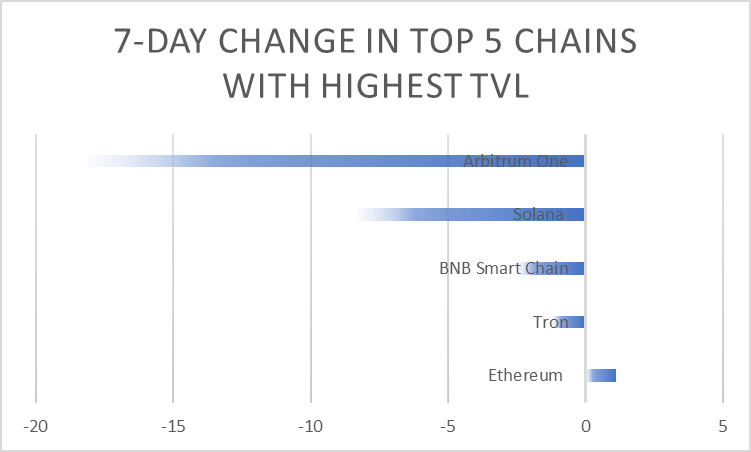

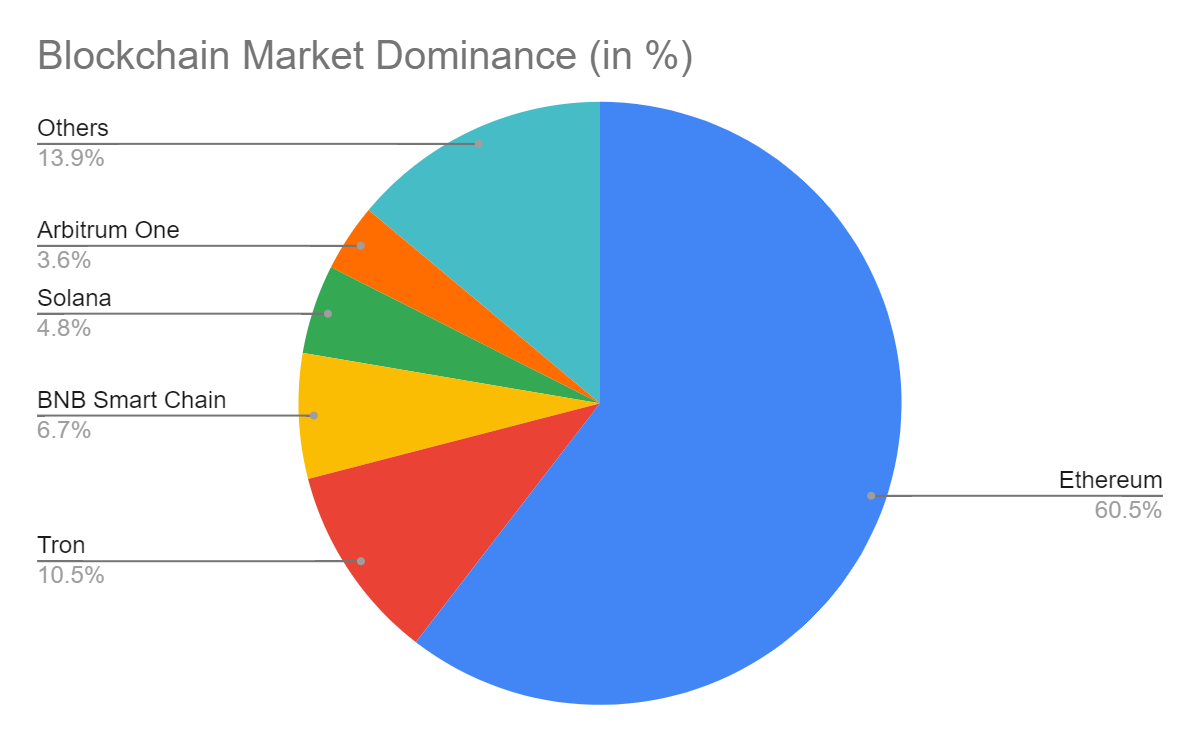

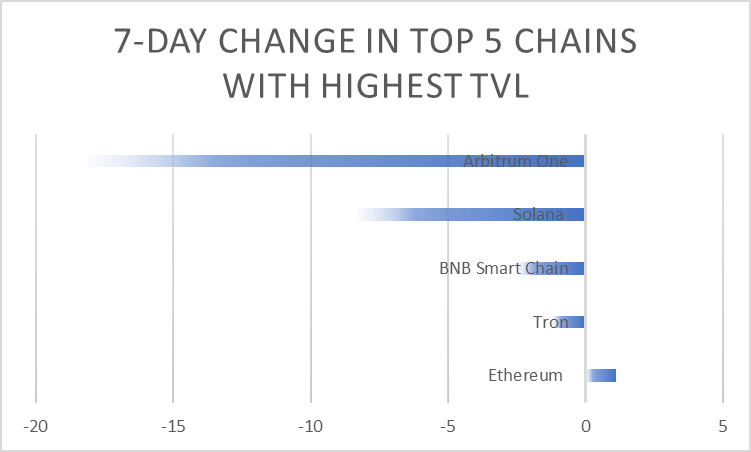

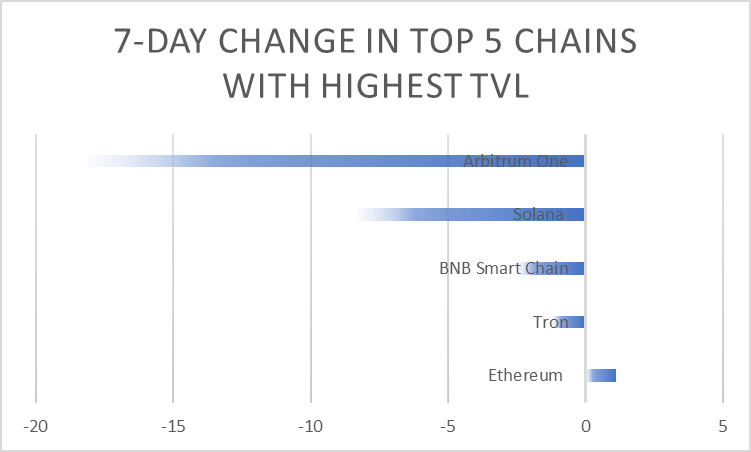

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVLEthereum, TRON, BNB Smart Chain, Solana, and Arbitrum One are the top five blockchains in the market on the basis of TVL and market dominance. Let’s see how the top five blockchains have performed this week, using 7-day TVL change.

Blockchain Dominance (in %) 7d Change (in %) TVL (in Billion)Ethereum 60.45%+1.1$55,289,662,828Tron10.51%-1.2$9,614,712,439BNB Smart Chain6.71%-2.5$6,136,168,463Solana 4.78%-8.3$4,373,877,279Arbitrum One3.62%-18.1$3,313,131,126Others13.92%

Blockchain Dominance (in %) 7d Change (in %) TVL (in Billion)Ethereum 60.45%+1.1$55,289,662,828Tron10.51%-1.2$9,614,712,439BNB Smart Chain6.71%-2.5$6,136,168,463Solana 4.78%-8.3$4,373,877,279Arbitrum One3.62%-18.1$3,313,131,126Others13.92%

Among the top five blockchains, Ethereum showed a modest increase of +1.1% in 7-day change, while others experienced declines. Arbitrum One witnessed the most significant decrease at -18.1%, followed by Solana (-8.3%), BNB Smart Chain (-2.5%), and Tron (-1.2%).

3. Crypto Market AnalysisThe crypto 7-day price change and dominance analysis and top gains and losers analysis are the two prime areas of the crypto market analysis.

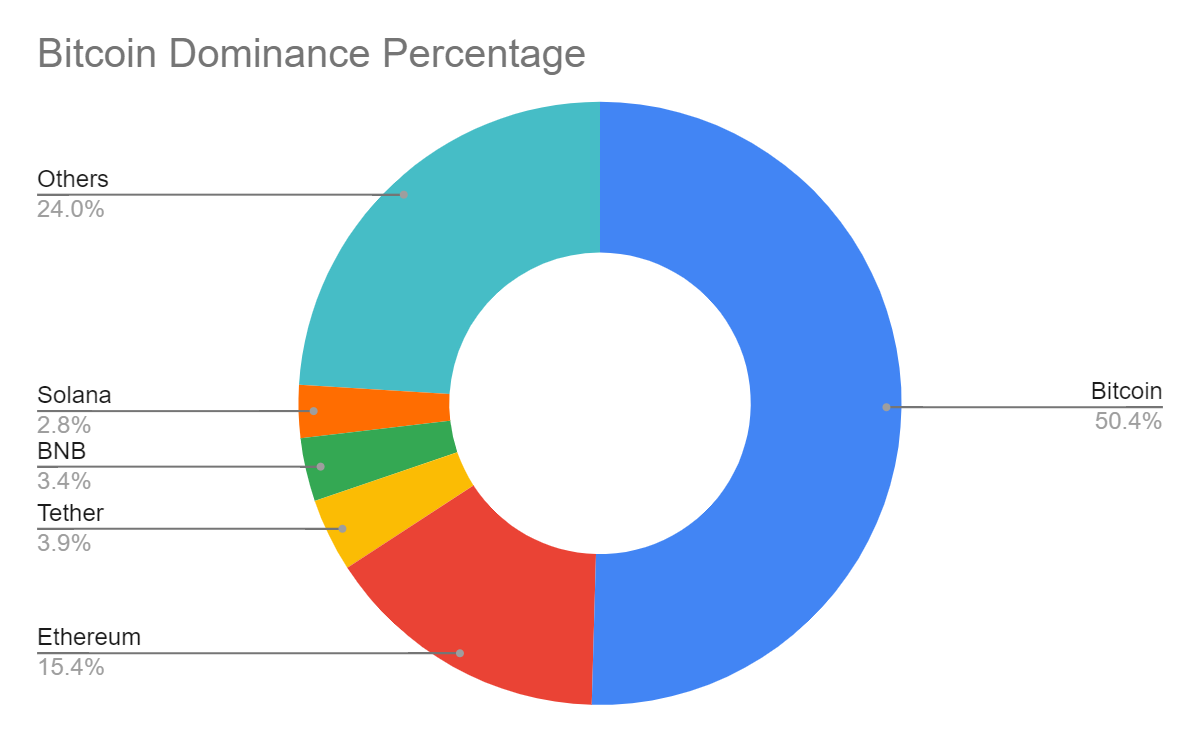

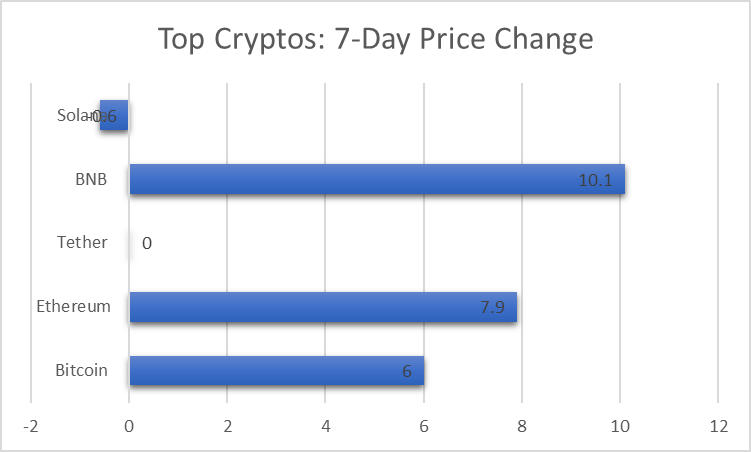

3.1. Crypto 7-D Price Change and Dominance AnalysisBitcoin, Ethereum, Tether, BNB, and Solana are the top cryptocurrencies as per the market cap and dominance indices. Let’s analyse their seven-day price change.

Cryptocurrency7-D Change (in %)Dominance Percentage PriceMarket CapBitcoin +6.0%50.43%$70,889.52$1,395,446,403,438Ethereum+7.9%15.4%$3,532.60$424,485,000,023Tether -0.0%3.92%$1.00$107,309,126,011BNB +10.1%3.41%$625.40$96,227,964,347Solana -0.6%2.82%$174.53$78,132,432,736Others 24.02%

Cryptocurrency7-D Change (in %)Dominance Percentage PriceMarket CapBitcoin +6.0%50.43%$70,889.52$1,395,446,403,438Ethereum+7.9%15.4%$3,532.60$424,485,000,023Tether -0.0%3.92%$1.00$107,309,126,011BNB +10.1%3.41%$625.40$96,227,964,347Solana -0.6%2.82%$174.53$78,132,432,736Others 24.02%

Among the top cryptocurrencies, BNB exhibited the highest 7-day change at +10.1%, followed by Ethereum at +7.9% and Bitcoin at +6.0%. However, Solana remained nearly unchanged at -0.6%, while Tether showed zero change.

Click Here To Read Ripple (XRP) Price Prediction 2024 – 2025: Buying XRP Before $1, Is It Worth The Risk?

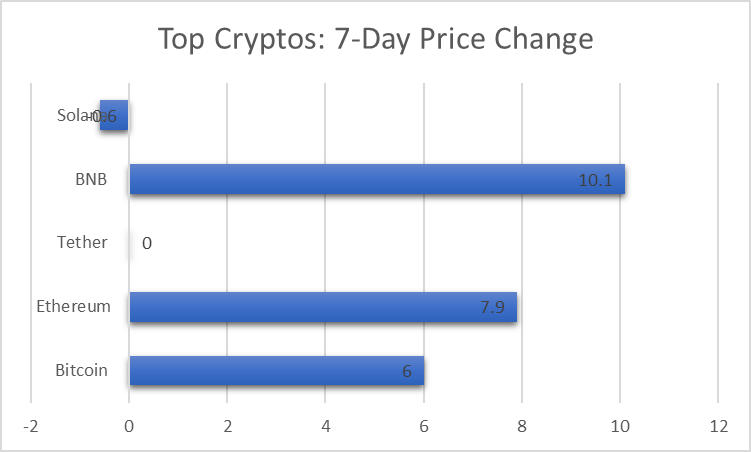

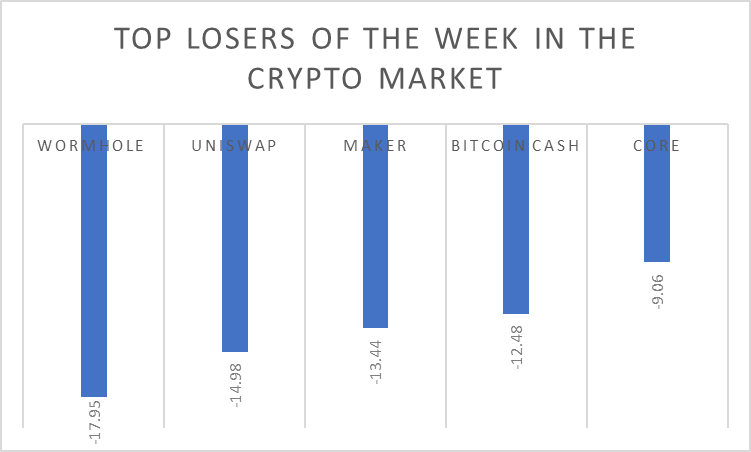

3.2. Top Gainers & Losers of the Week in Crypto MarketHere is the list of top gainers and top losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indices.

3.2.1. Top Gainers of the Week in Crypto Cryptocurrency 7-Day Gain Price Nervos Network+79.16%$0.03197Ethena+57.80%$1.48Neo+47.11%$22.07Toncoin +39.27%$7.12JasmyCoin +27.26%$0.02366

Cryptocurrency 7-Day Gain Price Nervos Network+79.16%$0.03197Ethena+57.80%$1.48Neo+47.11%$22.07Toncoin +39.27%$7.12JasmyCoin +27.26%$0.02366

In the past week, Nervos Network demonstrated the highest gain in the cryptocurrency market, soaring by +79.16%. Athena followed with a significant increase of +57.80%, while NEO, Toncoin, and JasmyCoin also experienced notable gains of +47.11%, +39.27%, and +27.26%, respectively.

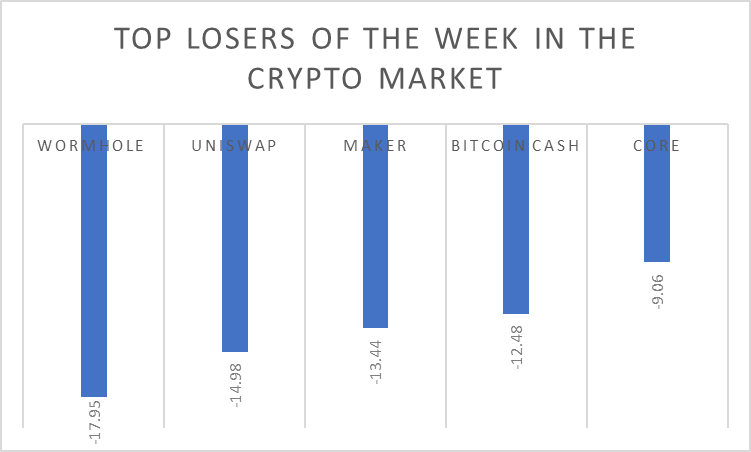

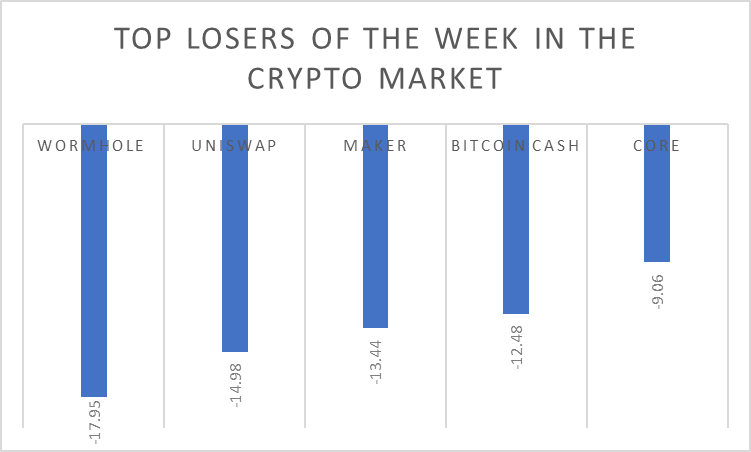

3.2.2. Top Losers of the Week in Crypto Cryptocurrency 7-Day LossPrice Wormhole -17.95%$0.8085Uniswap-14.98%$9.11Maker-13.44%$3,366.62Bitcoin Cash-12.48%$607.97Core-9.06%$2.19

Cryptocurrency 7-Day LossPrice Wormhole -17.95%$0.8085Uniswap-14.98%$9.11Maker-13.44%$3,366.62Bitcoin Cash-12.48%$607.97Core-9.06%$2.19

In the past week, Wormhole experienced the highest loss among cryptocurrencies, declining by -17.95%. Uniswap followed closely with a loss of -14.98%, while Maker, Bitcoin Cash, and Core also saw decreases of -13.44%, -12.48%, and -9.06%, respectively.

3.3. Stablecoin Weekly AnalysisTether, USDC, DAI, First Digital USD, and Ethena USDe are the top stablecoins in the market in terms of market capitalization. Let’s analyse their weekly performance using seven-day market capitalisation, market dominance and trading volume indices.

Stablecoins Market Dominance (7d) [in %]Market Capitalisation (7d)Trading Volume (7d)Market CapitalisationTether 70.85%$107,325,379,612$25,331,062,835$107,175,619,318USDC21.27%$32,222,451,400$5,480,105,243$32,247,982,588Dai3.22%$4,876,219,863$297,674,228$4,869,268,921First Digital USD2.20%$3,331,782,740$7,572,075,338$3,339,365,033Ethena USDe1.56%$2,362,488,381$143,805,411$2,368,446,445Others 0.90%

Stablecoins Market Dominance (7d) [in %]Market Capitalisation (7d)Trading Volume (7d)Market CapitalisationTether 70.85%$107,325,379,612$25,331,062,835$107,175,619,318USDC21.27%$32,222,451,400$5,480,105,243$32,247,982,588Dai3.22%$4,876,219,863$297,674,228$4,869,268,921First Digital USD2.20%$3,331,782,740$7,572,075,338$3,339,365,033Ethena USDe1.56%$2,362,488,381$143,805,411$2,368,446,445Others 0.90%

Tether maintains the highest market dominance at 70.85%, followed by USDC at 21.27% and Dai at 3.22%. First Digital USD and Ethena USDe hold smaller portions of the market at 2.20% and 1.56%, respectively.

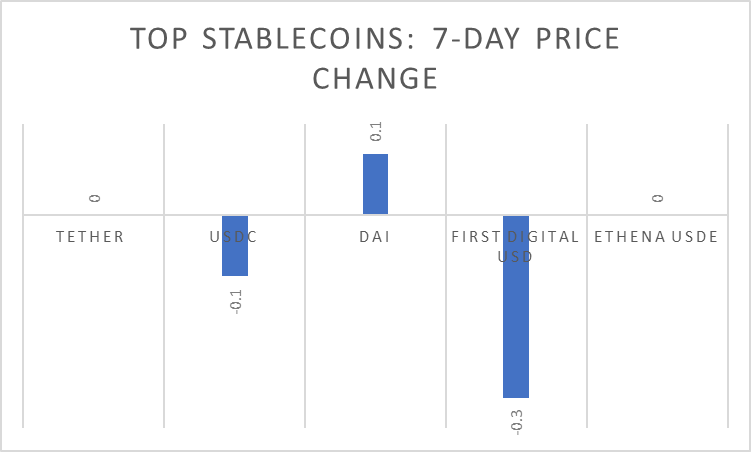

3.3.1. Stablecoin Weekly Price AnalysisLet’s analyse the weekly performance of the top stablecoins further using the seven-day price change index.

Stablecoins 7-Day Price Change (in %)PriceTether -0.0%$1.00USDC-0.1%$1.00Dai+0.1%$1.00First Digital USD-0.3%$1.00Ethena USDe+0.0%$1.00

Among the top stablecoins, Dai showed a slight increase of +0.1% in the past week, while Ethena USDe remained stable at +0.0%. Tether also remained unchanged at -0.0%. However, First Digital USD and USDC experienced marginal declines of -0.3% and -0.1%, respectively.

4. Bitcoin ETF Weekly AnalysisBitcoin Futures ETFs and Bitcoin Spot ETFs should be analysed separately, in order to get the right picture of the Bitcoin ETF market, as they represent two different segments. Let’s start!

4.1. Bitcoin Futures ETF Weekly AnalysisProShares (BITO), VanEck (XBTF), Valkyrie (BTF), Global X (BITS), and Ark/21 Shares (ARKA) are the top Bitcoin Future ETFs, as per the Asset Under Management index. Let’s use the price change percentage index to analyse these ETFs.

Bitcoin Futures ETFsPrice Change (Gain/Loss) [in %]Asset Under Management (in Billion)Price ProShares (BITO)+0.65%$598.78M$30.90VanEck (XBTF)+0.33%$42.41M$39.22Valkyrie (BTF)+0.24%$38.20M$20.84Global X (BITS)+1.36%$26.10M$67.50Ark/21 Shares (ARKA)+0.52%$8.01M$67.74

Bitcoin Futures ETFsPrice Change (Gain/Loss) [in %]Asset Under Management (in Billion)Price ProShares (BITO)+0.65%$598.78M$30.90VanEck (XBTF)+0.33%$42.41M$39.22Valkyrie (BTF)+0.24%$38.20M$20.84Global X (BITS)+1.36%$26.10M$67.50Ark/21 Shares (ARKA)+0.52%$8.01M$67.74

Among the top Bitcoin Futures ETFs, Global X (BITS) showed the highest price increase at +1.36%, followed by ProShares (BITO) with +0.65%. Ark/21 Shares (ARKA) and VanEck (XBTF) also saw gains of +0.52% and +0.33%, respectively. Valkyrie (BTF) trailed slightly with a gain of +0.24%.

Also Check Out : Bitcoin Halving 2024: Every Crypto Enthusiast Must NEED To Know About it

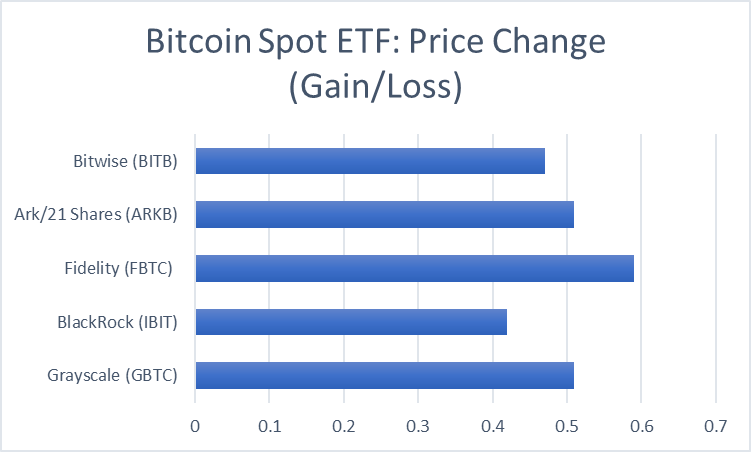

4.2. Bitcoin Spot ETF Weekly AnalysisGrayscale (GBTC), Blackrock (IBIT), Fidelity (FBTC), Ark/21 Shares (ARKB), and Bitwise (BITB) are the top Bitcoin Spot ETFs, as per the Asset Under Management index. Let’s analyse them using the price change index.

Bitcoin Spot ETFsPrice Change (Gain/Loss) [in %]Asset Under Management (in Billion)Price Grayscale (GBTC)+0.51%$24.33B$62.79BlackRock (IBIT)+0.42%$17.24B$40.17Fidelity (FBTC) +0.59%$9.90B$61.69Ark/21 Shares (ARKB)+0.51%$2.85B$70.51Bitwise (BITB)+0.47%$2.16B$38.43

Bitcoin Spot ETFsPrice Change (Gain/Loss) [in %]Asset Under Management (in Billion)Price Grayscale (GBTC)+0.51%$24.33B$62.79BlackRock (IBIT)+0.42%$17.24B$40.17Fidelity (FBTC) +0.59%$9.90B$61.69Ark/21 Shares (ARKB)+0.51%$2.85B$70.51Bitwise (BITB)+0.47%$2.16B$38.43

Among the top Bitcoin Spot ETFs, Fidelity (FBTC) exhibited the highest price increase at +0.59%. Ark/21 Shares (ARKB) and Grayscale (GBTC) closely followed with gains of +0.51% each. Bitwise (BITB) and BlackRock (IBIT) also showed positive price changes of +0.47% and +0.42%, respectively.

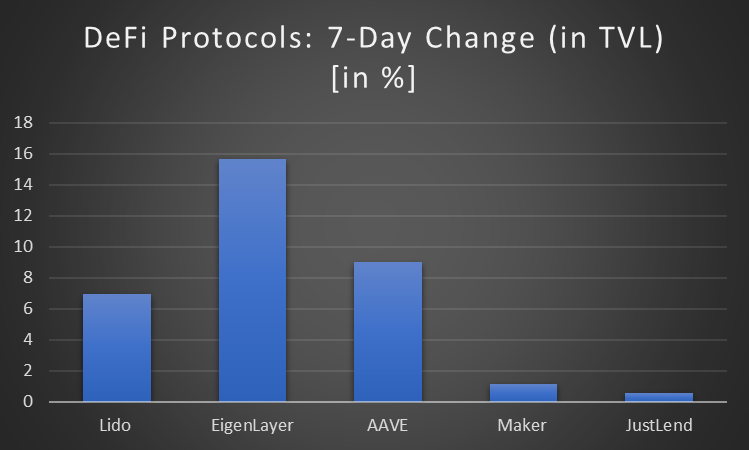

5. DeFi Market Weekly Status AnalysisLido, EigenLayer, AAVE, Maker, and JustLend are the five top DeFi protocols on the basis of TVL. Let’s analyse its weekly performance using the 7d Change index.

DeFi Protocols7d Change (in Total Value Locked) [in %]TVLLido +6.96%$33.539BEigenLayer+15.70%$13.75BAAVE+9.00%$11.563BMaker +1.15%$8.444BJustLend+0.57%$7.315B

DeFi Protocols7d Change (in Total Value Locked) [in %]TVLLido +6.96%$33.539BEigenLayer+15.70%$13.75BAAVE+9.00%$11.563BMaker +1.15%$8.444BJustLend+0.57%$7.315B

Among the top DeFi protocols, EigenLayer experienced the highest increase in Total Value Locked with a growth of +15.70% in the past week. AAVE and Lido followed with gains of +9.00% and +6.96%, respectively. Maker and JustLend showed more modest increases at +1.15% and +0.57%, respectively.

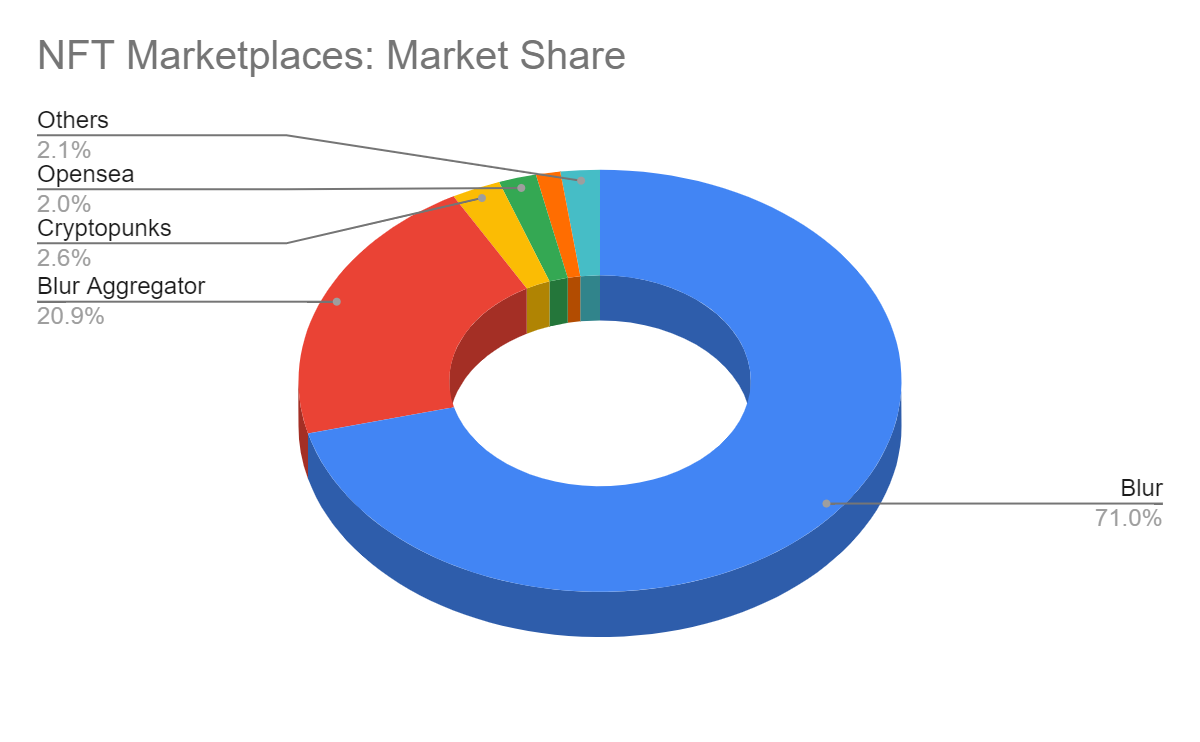

6. NFT Marketplace: A Basic Weekly AnalysisBlur, Blur Aggregator, Cryptopunks, Opensea, and Gem are the top NFT marketplaces on the basis of market share. Let’s analyse them using the Volume Change (change of last 7d volume over the previous 7d volume) index.

NFT Marketplaces Volume Change [Last 7 Day over the Previous 7 Day Volume]Market Share7-day Rolling Volume 7-day Rolling Trades Blur +3.40%70.98%14926.2423959Blur Aggregator -9.80%20.94%6888.0312572Cryptopunks +31.60%2.64%1010.6916Opensea-20.51%2.02%740.124373Gem-28.75%1.32%400.361858Others 2.10%

NFT Marketplaces Volume Change [Last 7 Day over the Previous 7 Day Volume]Market Share7-day Rolling Volume 7-day Rolling Trades Blur +3.40%70.98%14926.2423959Blur Aggregator -9.80%20.94%6888.0312572Cryptopunks +31.60%2.64%1010.6916Opensea-20.51%2.02%740.124373Gem-28.75%1.32%400.361858Others 2.10%

Among the top NFT marketplaces, Cryptopunks saw the highest increase in volume change at +31.60%, indicating a significant surge in trading activity over the past week. Blur followed with a slight increase of +3.40%. However, Gem and Opensea experienced notable decreases in volume change, with -28.75% and -20.51% respectively. Blur Aggregator also saw declines, though comparatively less pronounced, at -9.80%.

6.1. Top NFT Collectible Sales this WeekCryptoPunks #2306, Bitcoin Apes #42c2a, $PUPS BRC-20 NFTs #83c537e, $PUPS BRC-20 NFTs #e319c, and BOOGLE #FBg3qVP are the top NFT collectable sales reported this week in the NFT market landscape.

NFT Collectibles Price (in USD)CryptoPunks #2306$1,095,394.75Bitcoin Apes #42c2a$459,436.74$PUPS BRC-20 NFTs #83c537e$354,674.15$PUPS BRC-20 NFTs #e319c$309,808.69BOOGLE #FBg3qVP$296,112.82

Among the listed NFT collectibles, CryptoPunks #2306 holds the highest price at $1,095,394.75, indicating its significant value in the NFT market. Following it, Bitcoin Apes #42c2a is priced at $459,436.74, while $PUPS BRC-20 NFTs #83c537e, $PUPS BRC-20 NFTs #e319c, and BOOGLE #FBg3qVP have prices ranging from $296,112.82 to $354,674.15.

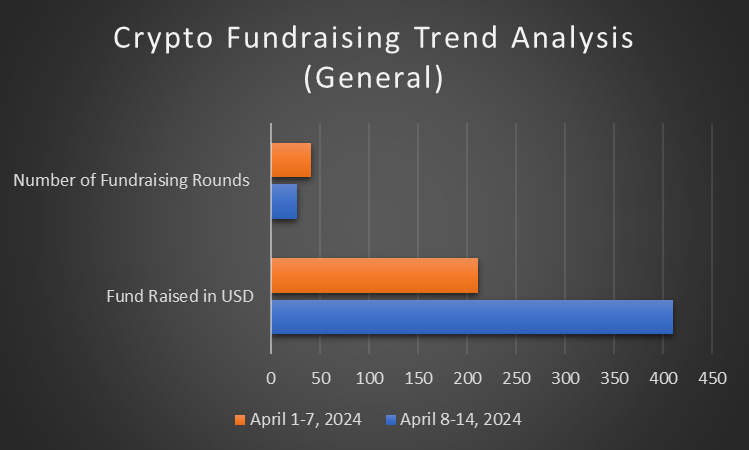

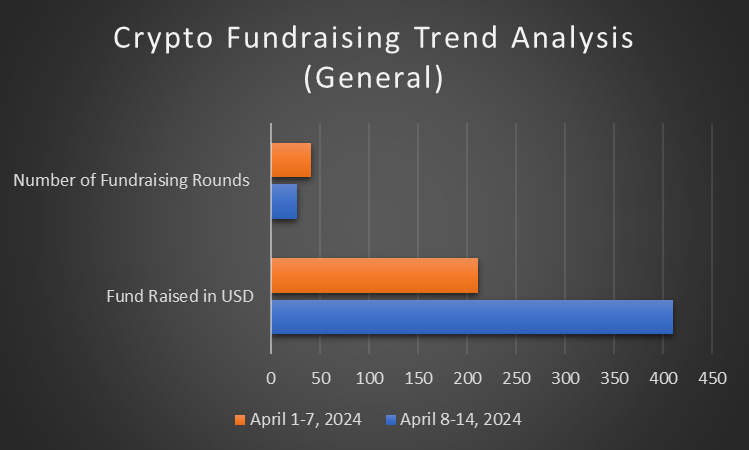

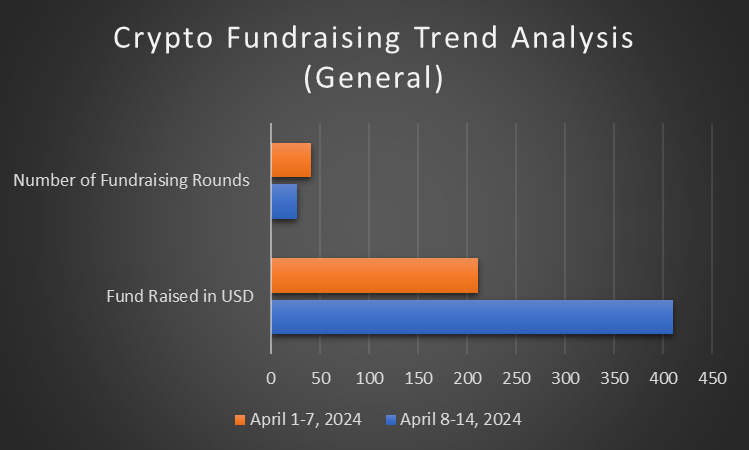

7. Web3 Weekly Funding Analysis 7.1. General Crypto Fundraising Trend AnalysisLet’s do a general crypto fundraising trend analysis using the two prime parameters, number of fundraising rounds and fund raised in USD.

Week Fund Raised in USDNumber of Fundraising Rounds April 8-14, 2024$409.50M27April 1-7, 2024$210.64M41

Week Fund Raised in USDNumber of Fundraising Rounds April 8-14, 2024$409.50M27April 1-7, 2024$210.64M41

As per the general crypto fundraising trend analysis, this week nearly $409.50M fund was raised. As in the last week the figure was only $210.64M, an increase is evident. Anyway, in terms of the number of fundraising rounds, the number of 27, marked this week, is lower than the number of 41, registered last week.

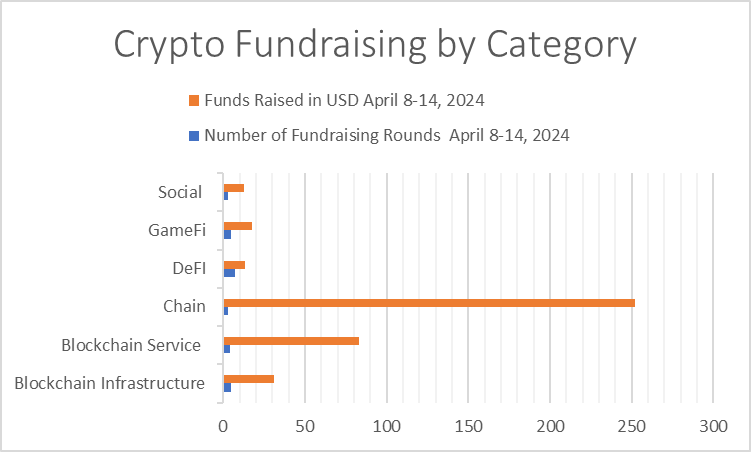

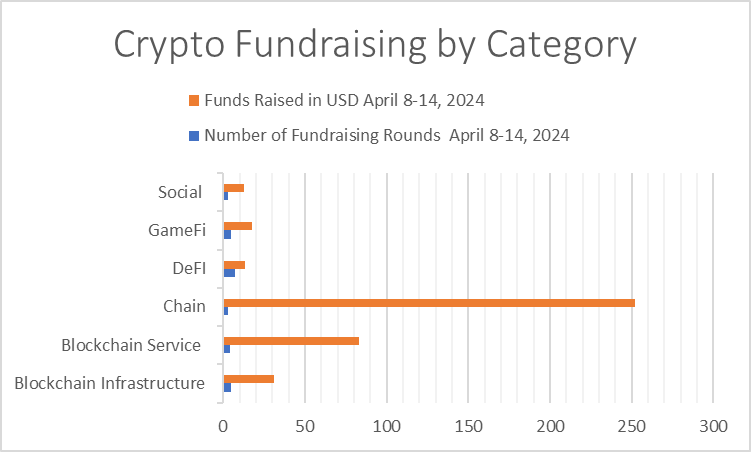

7.1.1. Crypto Fundraising by Category This WeekBlockchain Infrastructure, Blockchain Services, Chain, DeFi, GameFi, and Social are the categories which have witnessed activities this week. Let’s analyse them using the Number of Fundraising Rounds and Funds Raised in USD.

Category Number of Fundraising Rounds April 8-14, 2024Funds Raised in USDApril 8-14, 2024Blockchain Infrastructure5$30.85MBlockchain Service 4$83.00MChain3$252.00MDeFI7$13.20MGameFi5$17.75MSocial 3$12.70M

Chain raised the highest amount of $252.00M. Blockchain Service arrived second with $83.00M. Blockchain Infrastructure reached third with $30.85M. Following these top three categories, GameFi, DeFi, and Socal raised $17.75M, $13.20M, and $12.70M respectively.

In terms of the number of fundraising rounds, DeFi marked seven. GameFi and Blockchain reported 5 each. Blockchain Service reported around four. Social and Chain reported as little as three each.

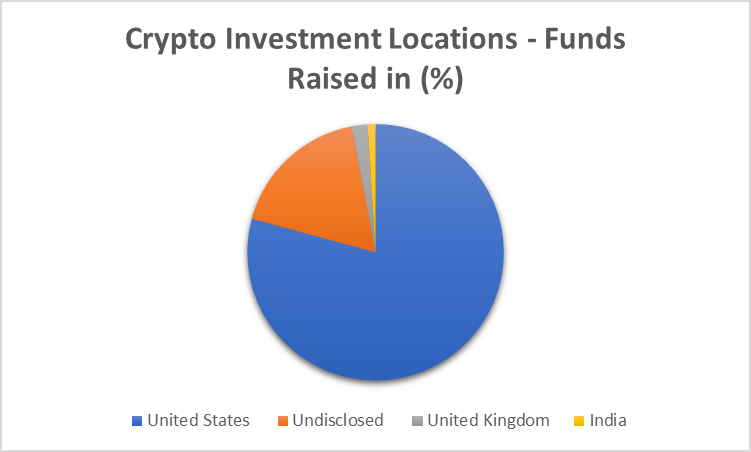

7.1.2. Top Crypto Investment Locations This WeekApart from undisclosed, the US, the UK and India are the top crypto investment locations this week.

Crypto Investment LocationsNumber of Fundraising Rounds in (%)Funds Raised in (%)Funds Raised in USDNumber of Fundraising RoundsUnited States 17.9%80%$326.00M5Undisclosed 64.3%18%$74.80M18United Kingdom7.1%2%$6.20M2India3.6%1%$2.50M1

Crypto Investment LocationsNumber of Fundraising Rounds in (%)Funds Raised in (%)Funds Raised in USDNumber of Fundraising RoundsUnited States 17.9%80%$326.00M5Undisclosed 64.3%18%$74.80M18United Kingdom7.1%2%$6.20M2India3.6%1%$2.50M1

The United States raised around $326.00M, the largest reported in this category, and reported nearly five fundraising rounds. Undisclosed raised nearly $74.80M, and reported over 18 fundraising rounds, the highest reported in this category. The United Kingdom raised nearly $6.20M and reported 2 fundraising rounds. Meanwhile, India, the least powerful among the four in terms of both funds raised and number of fundraising rounds, raised as little as $2.50M, and reported nor more than one fundraising round.

7.2. ICO Landscape: A Weekly OverviewPrivateAI, R Games, Truflation, Gam3S.GG, and eesee are the major ICOs that ended this week. Let’s analyse how much amount they received.

ICOFund Received Token Price Fundraising GoalTotal Tokens Token (Available for Sale)PrivateAI$1,860,000$0.333$666,667100,000,00010%R Games$1,840,000$0.0075$550,0001,000,000,00032%Truflation$10,000,000$0.075$400,0001,000,000,000N/AGAM3S.GG$4,000,000$0.03$500,000N/AN/Aeesee$3,550,000$0.018$700,0001,000,000,00030%

Truflation received the highest funding at $10,000,000, indicating significant investor interest. GAM3S.GG followed with $4,000,000 in funding, while eesee, PrivateAI, and R Games received $3,550,000, $1,860,000, and $1,840,000, respectively.

This might be Interesting For You : March 2024 NFT Report: Trends, Market Dynamics, and Future Projections

8. Weekly Blockchain Hack AnalysisAs of April 13, 2024, hackers have stolen a significant $7.77 billion. The majority, approximately $5.85 billion, targeted decentralised finance platforms. Another portion, roughly $2.83 billion, was taken from bridges connecting different blockchain networks.

Fortunately, no major hacks have been reported this month. However, late last month, the Web 3, Blockchain and Crypto ecosystem experienced three significant breaches. On March 29, 2024, Lava lost approximately $0.34 million to hackers. On the preceding day, March 26, 2024, Prisma Finance fell victim to hackers, losing $11.6 million. Also on March 26, 2024, Munchables was hacked using a storage slot exploit, resulting in a staggering $62.5 million loss, the largest reported this year.

Fortunately, the hackers returned the stolen Ether from the Munchables exploit. Additionally, the hackers behind the Prisma Finance theft claimed it was a ‘Whitehat Rescue’ effort. And, they sought guidance on returning the funds, describing their actions as aimed at identifying and fixing DeFi protocol security flaws, emphasising ethical intent.

EndnoteIn this week’s comprehensive analysis of Web3, Blockchain and Crypto, we have brought out powerful insights, which can be used to stay-to-data about the market developments. As the landscape evolves, the strategic integration of technology and data-driven decision-making becomes paramount for stakeholders navigating the dynamic realms of decentralised technologies.