U.S. Tariffs Spark Crypto Sell-Off: What’s the Next Move for BTC and ETH?

The post U.S. Tariffs Spark Crypto Sell-Off: What’s the Next Move for BTC and ETH? appeared first on Coinpedia Fintech News

The cryptocurrency market faced a steep sell-off this week as the United States officially rolled out its latest wave of trade tariffs, shaking investor confidence across both traditional and digital asset markets. Bitcoin price dropped below the key $115,000 level, while Ethereum price slumped toward the $3,600 zone. The pressure wasn’t limited to majors—altcoins like Solana, Cardano, and Dogecoin also plunged by over 5–8%, signalling widespread market panic.

But what exactly is fueling this downturn, and where might the crypto market head next?

Why U.S. Tariffs Are Tumbling the Crypto MarketThe recently implemented U.S. tariffs—targeting critical sectors such as Chinese tech imports and rare earth materials—have created a ripple effect throughout the global financial ecosystem. Historically, the crypto market reacts sharply to macroeconomic uncertainty, and this episode is no different.

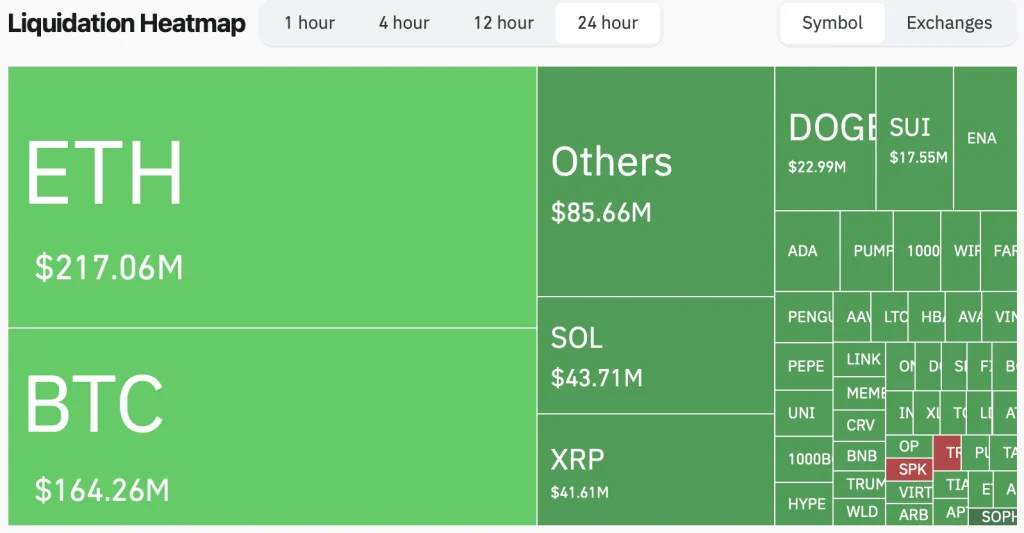

As tariffs stoke inflation fears and disrupt global trade, investors tend to move their capital into safer, less volatile assets. This “risk-off” approach leads to heavy selling in speculative assets like cryptocurrencies. Within 24 hours of the tariffs coming into effect, over $500 million in leveraged long positions were liquidated across major exchanges. That level of liquidation accelerated downward price momentum and added to the fear-driven sell-off.

Bitcoin, Ethereum Under Pressure—But Not BrokenBitcoin’s drop below $115,000 is technically significant. While the $120K zone had acted as a psychological barrier for weeks, the recent breakdown hints at further downside unless a reversal builds quickly. Ethereum, too, is feeling the pinch, trading near $3,600 with weak volume support and eyes on the $3,400 floor. On the other hand, the drop was supported by over $680 million in long liquidations, with Ethereum recording the highest.

As per the data from Coinglass, more than 180K traders were liquidated, while the total liquidation comes in at $727.29 million. However, analysts remain divided on whether this marks the start of a larger correction or a healthy shakeout before the next leg up. Historically, Bitcoin has responded positively after global market shocks once uncertainty clears. If inflation data stabilises and central banks signal dovish shifts, crypto assets could rebound swiftly.

What to Watch Going ForwardAs the markets digest the geopolitical and economic fallout of the US tariff move, traders will be watching 2 main key factors.

- Can the bulls defend Bitcoin’s key support between $112K and $110K, if the price continues to drop further?

- Now that the ETH price is heading close to $3600, can it hold $3400 as a drop below the range could trigger steeper declines?

- Thirdly, the reaction of the global central bank to any dovish pivot could act as a catalyst for a strong recovery

The recent U.S. tariffs have undoubtedly rattled the crypto market, triggering short-term pain. However, if inflation fears intensify and fiat currencies weaken, Bitcoin and other digital assets could see renewed interest as safe-haven plays. Until then, expect volatility to remain elevated, but opportunities may emerge for those ready to play the long game.