Time to research: Ethena

Ethena is a synthetic dollar protocol built on Ethereum that will provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible dollar denominated savings instrument — the ‘Internet Bond’.

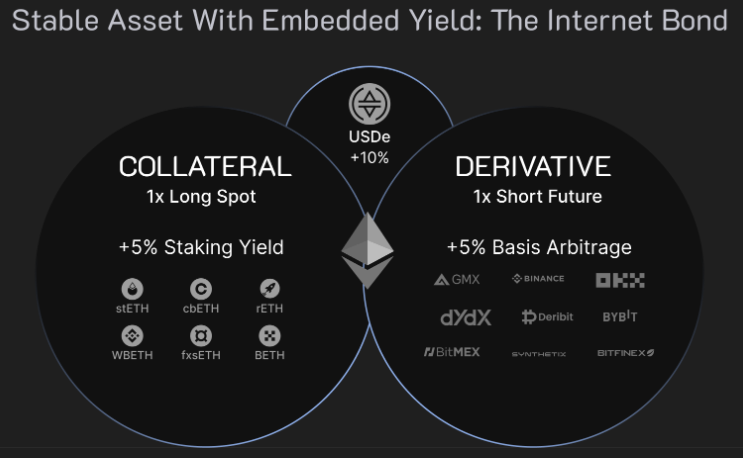

The ‘Internet Bond’ will combine yield derived from staked Ethereum as well as the funding & basis spread from perpetual and futures’ markets, to create the first onchain crypto-native ‘bond’ that can function as a dollar-denominated savings instrument for users in permitted jurisdictions.

Ethena Labs believes a delta-neutral synthetic dollar that holds collateral outside the banking system and that can access centralized liquidity addresses the challenges of existing stablecoin designs.

- Delta neutral is a portfolio strategy with multiple positions balancing positive and negative deltas so that the overall delta of the assets is zero. Options traders use delta-neutral strategies to profit from implied volatility or the time decay of options. These strategies are also used for hedging.

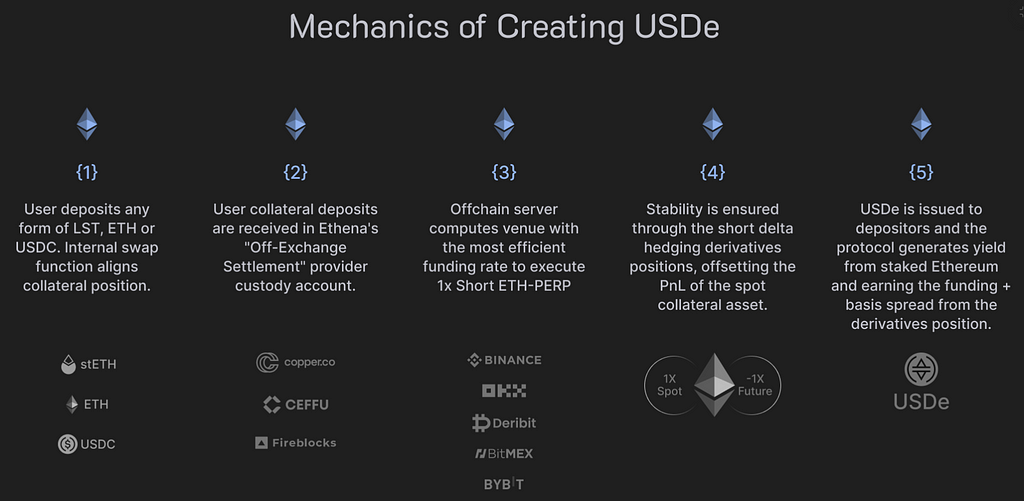

$USDe is enabled by Ethena Labs via hedging the delta of spot assets backing the token during minting. As a result, $USDe provides the following benefits:

- Scalability

- Stability

- Censorship Resistance

By focusing on staked Ethereum — the only collateral asset that can provide an uncensorable and trustless native yield at scale — the Ethena protocol addresses all of the aforementioned issues while providing users access to fully custodial and backed stability with an embedded yield inherent to the protocol system. Most importantly, doing so without a dependence on the existing banking system.

Enabling Ethereum to evolve into a stable form of money will not only support significant capital inflows into both the centralized & decentralized ecosystems; it will also provide the most important native money asset across crypto markets.

$USDe OverviewThe mechanism backing $USDe will enable the first “Internet Bond” that will sit alongside the synthetic dollar, offering a crypto-native, yield-bearing, dollar-denominated savings instrument, derived from staked Ethereum returns and the funding and basis spread available in perpetual and futures markets.

Peg Stability Mechanism

$USDe derives its peg stability from executing automated and programmatic delta-neutral hedges with respect to the underlying collateral assets.

Hedging the price change risk of the collateral asset in the same size ensures the change in value of the collateral asset is offset by the change in value of the hedging leg.

This ensures the synthetic USD value of the collateral remains relatively stable in all market conditions.

Ethena Labs does not use any material leverage to margin the delta hedging derivatives positions beyond the natural state as a result of exchanges applying slight discounts to the value of staked Ethereum assets as margin collateral on the initial hedge and issuance of $USDe.

Key Information

- Users are able to acquire $USDe in permissionless external liquidity pools.

- Approved parties from permitted jurisdictions who pass KYC/KYB screening are able to mint & redeem $USDe on-demand with Ethena Labs contracts directly which will include only market making entities.

- There is no reliance upon traditional banking infrastructure as trustless collateral is held and stored within the crypto-system. $USDe is fully backed by users’ deposits at all times.

- Users are also able to complete Cross Market Arbitrage by minting & redeeming $USDe with Ethena and trading $USDe in external markets such as Binance or Curve pools to capture price dislocations.

Generated Yield

The yield generated by the protocol originates from two sources:

- Staked Ethereum consensus and execution layer rewards

Since the move to proof-of-stake, holding liquid staking Ethereum tokens provides a variable yield.

This yield is generated through:

- Consensus layer inflationary rewards.

- Execution layer fees paid to Ethereum stakers.

- MEV capture paid to Ethereum stakers.

All of these sources of yield are paid and denominated in $ETH. While the expected inflationary rewards are more predictable at the Consensus layer, the Execution layer yield is more volatile as it is dependent on the activity at the base layer.

2. Funding and basis spread earned from the delta hedging derivatives positions

- A portfolio can be considered to be “delta-neutral” if it has a delta of 0. This means the portfolio is NOT exposed to the price change in the underlying value of the asset.

- Following on from the example above, where Ethena naturally has a positive delta of 1 $ETH from a user depositing 1 $ETH of collateral, if Ethena hedges 1 $ETH worth of delta by going short a perpetual contract with a nominal position size equal to that 1 $ETH, the delta of Ethena’s portfolio is 0.

Underlying derivatives:

- Futures vs Perpetuals

A Futures Contract is a derivative instrument and is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. They are either physically or cash settled.

In contrast to traditional futures, Perpetual Contracts have no expiry date and include a concept called “Funding”. “Funding” incentivizes traders to keep the price of the Perpetual Contract relatively in line with the underlying asset index of which the contract is marked against.

- Inverse vs Linear Contracts

A linear payout is the simplest to describe and is used for many swaps. The price of a linear contract is expressed as the price of the underlying against the base currency. $ETH/$USDT is a linear perpetual and is quoted in Tether, with margin and PNL calculations denominated in Tether.

An inverse contract is worth a fixed amount of the quote currency. In the case of the $ETH/USD perpetual, each contract is worth $1 of Ethereum at any price. $ETH/USD is an inverse contract because it is quoted as $ETH/USD but the underlying is USD/$ETH or 1 / ($ETH/USD).

- Basis Spread

A basis trade is a trade in which the trader simultaneously purchases (sells) an asset and sells (buys) the futures contract for that asset. Since spot and futures are traded separately, their prices are not guaranteed to be the same at all times. In fact, their prices often diverge and this differential is known as the “basis”.

When minters provide assets in the process of minting $USDe, Ethena Labs opens corresponding short derivatives positions to hedge the delta of the received assets.

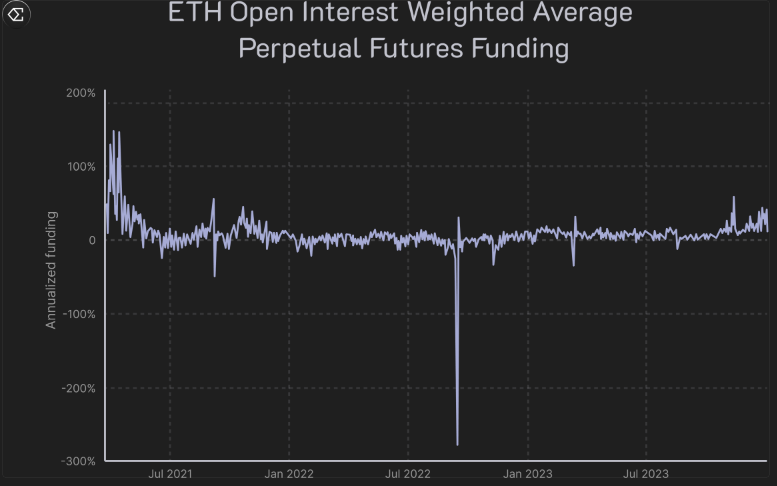

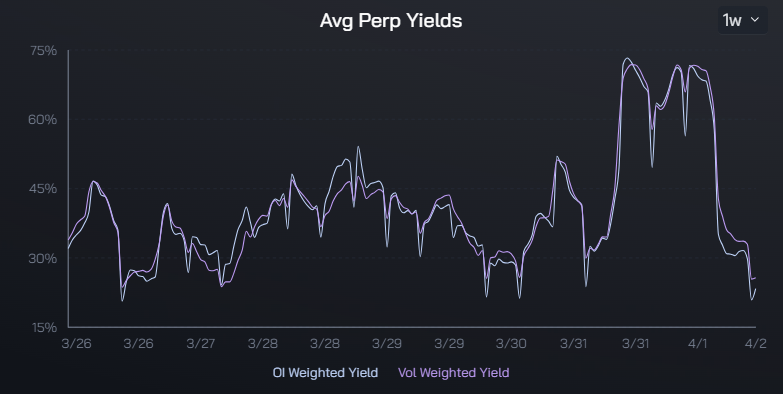

Historically due to the mismatch between demand & supply for exposure to digital assets, there has been a positive funding rate & basis spread earned by participants who are short this delta exposure.

While this earned rate is variable, in 2021 it yielded ~18%, in 2022 ~-0.6%, and in 2023 ~7% APY on a volume-weighted basis.

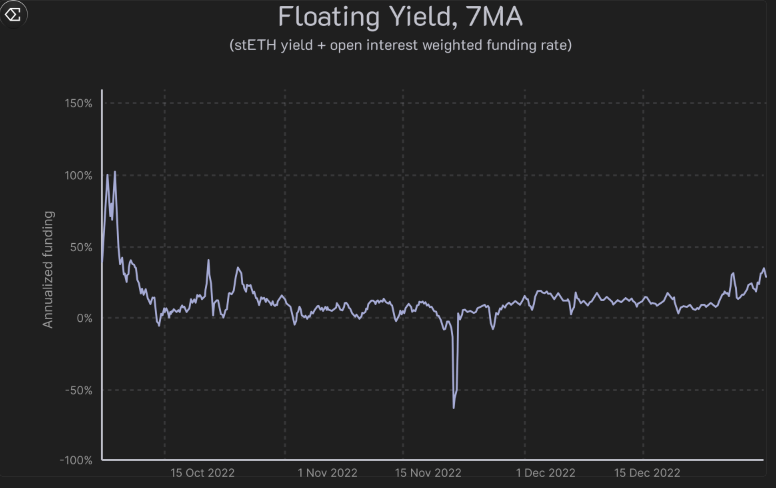

Ethena captures the only two large scale sustainable sources of yield in crypto. Here are some of the historical examples of $stETH yields and $ETH OI/volume weighted funding:

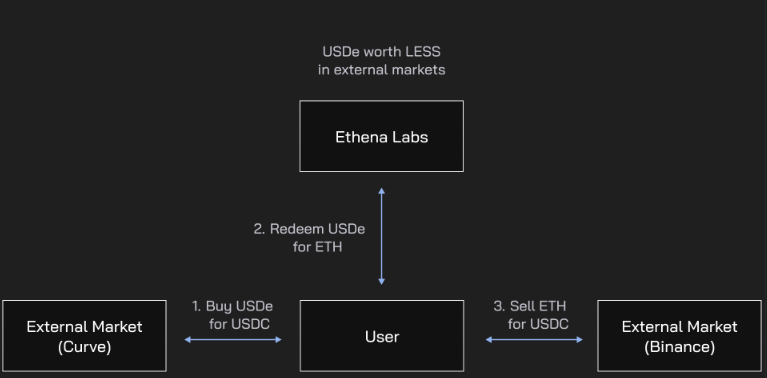

Peg Arbitrage Mechanism

Cross Market Arbitrage strategy enables any user approved to mint/redeem to profit from the difference between the price/amount users’ are able to mint/redeem $USDe with Ethena & the value of $USDe in an external market. An external market includes all centralized & decentralized spot markets such as “$USDe/$USDC” and AMM Protocols such as Uniswap or Curve.

If $USDe is worth LESS in an external market than from Ethena Labs, a user could:

- Buy 1x $USDe at 0.95 from Curve using $USDC.

- Redeem 1x $USDe at 1.00 from Ethena Labs receiving $ETH.

- Sell the received $ETH for $USDC on Curve.

- Profit.

If $USDe is worth MORE in an external market than from Ethena Labs, a user could:

- Mint $USDe using $ETH from Ethena Labs.

- Sell the $USDe in the Curve pool for > 1.00 for $USDC.

- Buy $ETH using $USDC on Curve.

- Profit.

- Funding Risk

An Ethena reserve fund exists and will step in on occasions when the combined yield between the LST asset, such as $stETH, and the funding rate for a short perpetual position, is negative. This ensures the collateral underpinning $USDe is unaffected. Ethena does not pass on any “negative yield” to users who stake their $USDe for $sUSDe.

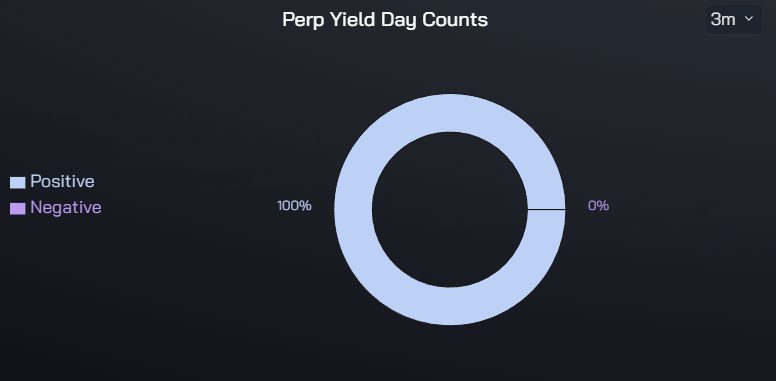

- Positive Bias

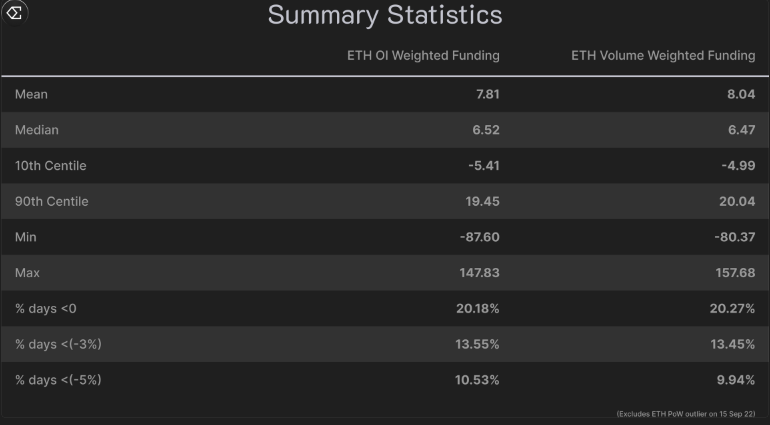

$ETH funding rates have exhibited natural positive bias and contango, with an average annualized rate of between 6% — 7.5% over the last 3 years on an open interest or volume-weighted basis, including the 2022 bear market.

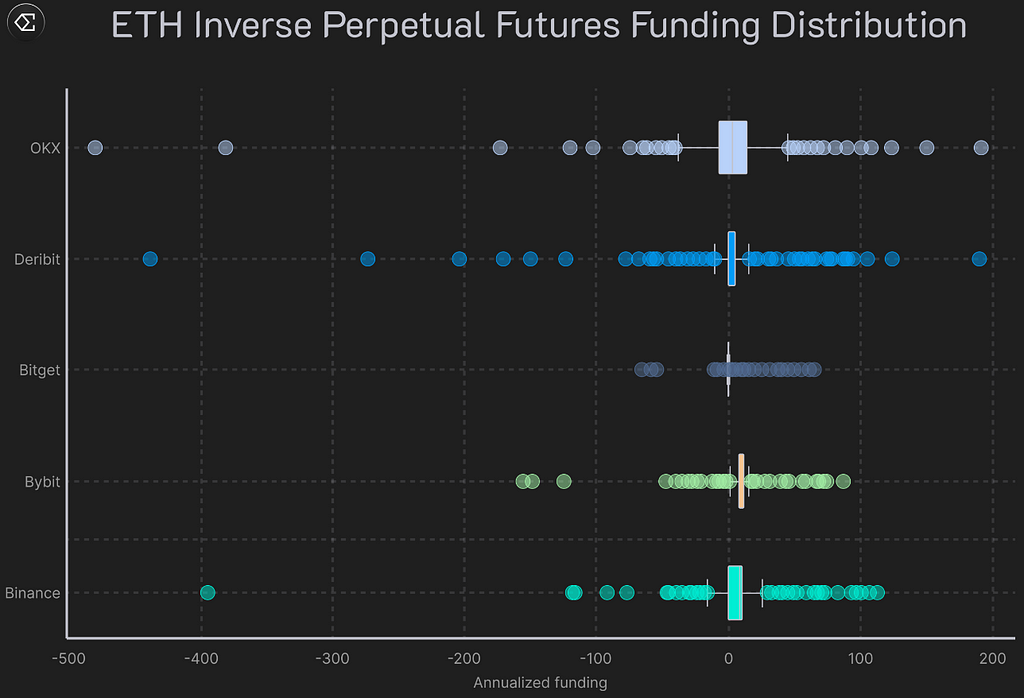

Below, they have charted the 30d moving average of funding rates and that positive bias is evident, particularly in 2021 and 2023.

Charting the distribution of funding rates per contract we can further see the positive bias per exchange, with the coloured box per contract indicating the middle 50% of datapoints. That middle 50% of funding data is predominantly positive values on most exchanges.

- Margin of Safety

Using LST collateral, such as $stETH, as collateral for $USDe, provides an additional margin of safety in the form of the 4–5% annualized yield earned on $stETH.

Combining annualized $stETH yields and funding rate values, they observe only 10.8% of days had a sum negative yield. That compares positively when compared to the ~20.5% of days yielding a negative funding rate when not also incorporating the $stETH yield.

There has only been one quarter in the last 3 years where the average sum yield was negative and this data was polluted by the $ETH PoW arbitrage period which was a one-off event that dragged funding deeply negative.

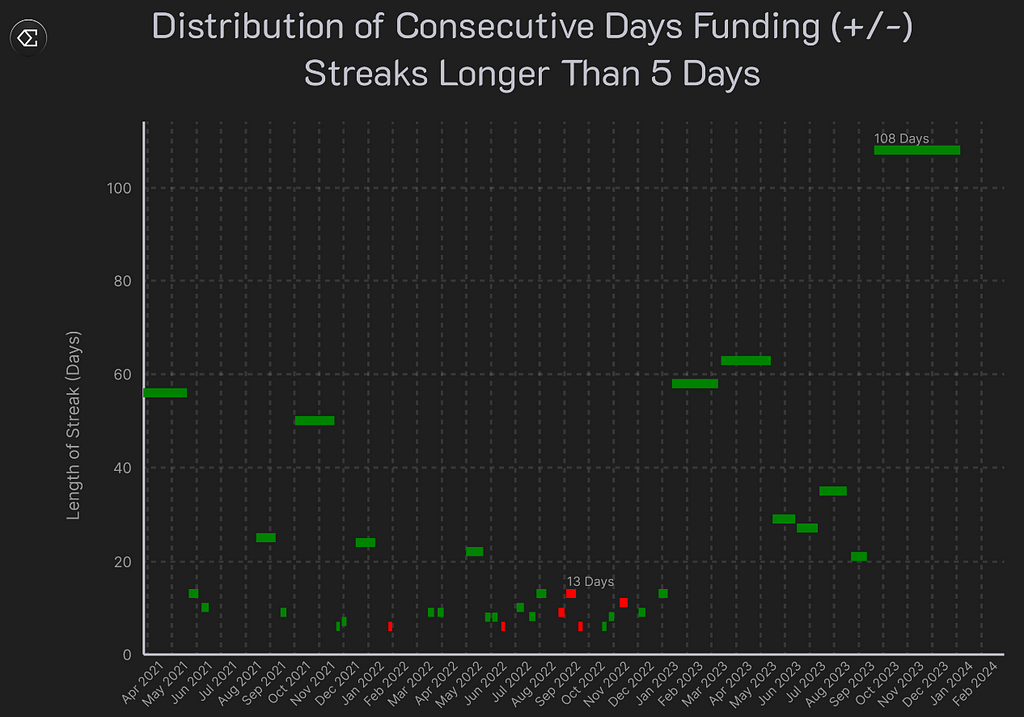

- Mean-reversion

Reversion to a positive mean can be seen in the longest consecutive days of either positive or negative funding rates. Negative funding rates revert quicker, with the longest streak of consecutive days with negative funding lasting just 13 days.

The longest streak of positive funding days has been 108 days, set in 2023 and charted below:

2. Liquidation Risk

At a high level, exchanges’ risk engines ensure each user has sufficient collateral, or “Maintenance Margin”, to margin existing positions. Many exchanges now offer incremental liquidation as to reduce the cost to the user & the exchange, where a position is slowly closed vs immediately in-full.

Ethena uses staked Ethereum assets, such as Lido’s $stETH, to collateralize short $ETH/USD and $ETH/$USDT Perpetual positions across CeFi Exchanges. Ethena therefore is using a different asset, $stETH, than the underlying asset of the derivatives positions, $ETH.

As a result of the risk engines of their partners, these two assets assigned collateral value to margin derivatives positions are often valued as a result of the price & liquidity across two separate independent markets on the exchange. This is where the “Liquidation Risk” exists.

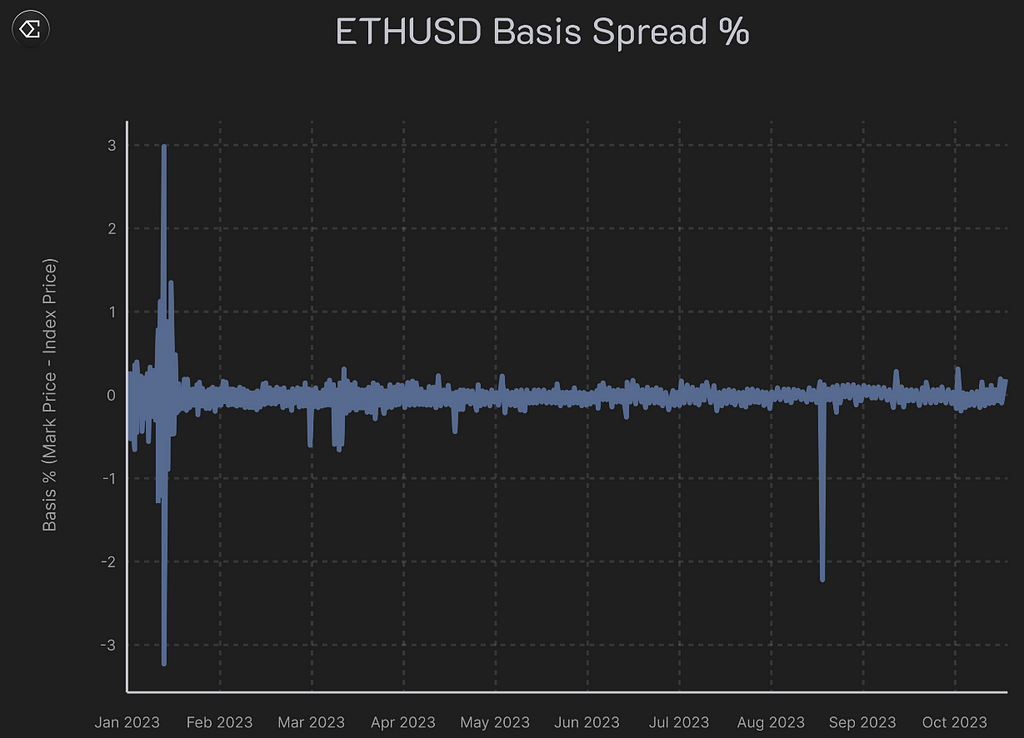

- Spread

Given the importance to the protocol of the value of the staked Ethereum collateral trading in line with $ETH, it’s worth sharing historical data for context.

Lido’s $stETH’s Spread History

Since the Shapella upgrade of the Ethereum network, wherein one of the features was that enabled users to unstake their $stETH, the $stETH/$ETH discount has never been more than 0.3%.

Exchange $stETH Spread History

While each exchange’s risk & liquidation engines are different, the above graph demonstrates the difference between the “Mark Price” and the “Index Price” for $stETH & an exchange partner’s $ETH/USD Perpetual in 2023. The “Mark Price” is how the exchange partner values an $ETH/USD Perpetual position while the $stETH “Index Price” is that of the $stETH spot asset collateral.

- Internal Risk Management Processes

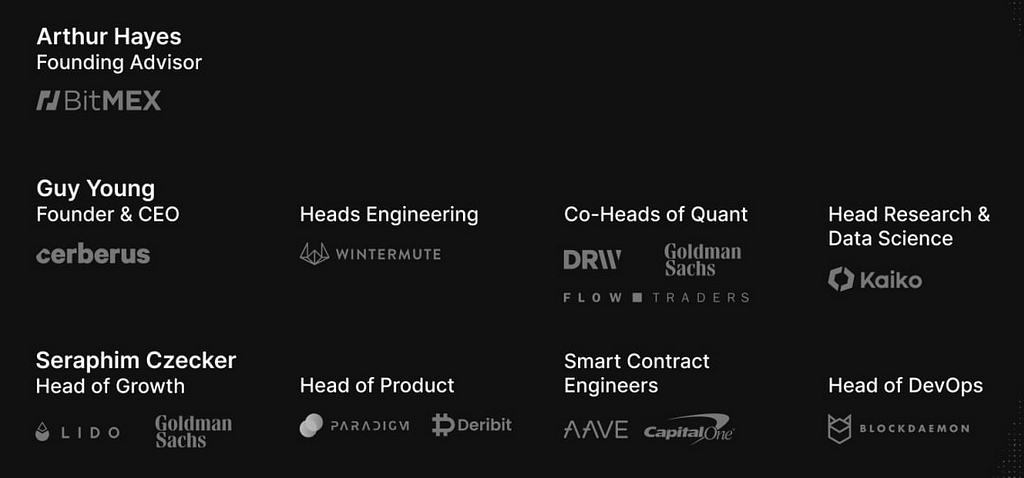

Ethena principally trades systematically across multiple exchanges as they accommodate users minting & redeeming $USDe, their need to cycle positions across exchanges to realize unrealized PnL, as well as their active need to manage liquidation risk across exchanges. Ethena has globally distributed team members who are manually able to intervene & are available 24/7 with experience in system maintenance from Wintermute, Flow Traders, Genesis Trading, DRW, and Tower Research.

Given one of the core value propositions of $USDe is to remain relatively stable, Ethena never wishes to be or to come close to being liquidated. The steps below detail how Ethena would intervene in the case of a market abnormality as well as are realistic assumptions when evaluating the risk to the collateral of $USDe.

To mitigate “Liquidation Risk” as a result of the aforementioned risk scenarios:

- Ethena will systematically delegate additional collateral to improve the margin position of their hedging positions in the event either risk scenario eventuates.

- Ethena is able to cycle collateral delegated between exchanges temporarily to support specific situations.

- Ethena has access to a reserve fund that they are able to rapidly deploy to support hedging positions on exchanges.

- In the event of an extreme occurrence, such as a critical smart contract flaw in the staked Ethereum asset, Ethena will immediately mitigate the risk with the sole motivation being that we protect the value of the collateral. This includes closing the hedging derivatives leg to avoid liquidation risk becoming a concern as well as trading out of the affected asset into another.

- Reserve Fund

A “Reserve Fund” is a concept of all CeFi Exchanges wherein a proportion of trading & liquidation fees are deposited to insure users of the exchange against potential losses or failures of the exchange’s risk & liquidation engine. Exchange reserve funds ensure all users in profit are made whole.

Composition of Reserve Fund

Stable uncorrelated collateral to cover funding payments in same currency denomination:

- Stablecoin collateral including USDC and USDT for USD-M contracts

- Smaller stETH collateral allocation for ETH-M contracts

- USDe and USD Liquidity Provider positions

Security of Reserve Funds

Controlled by 7/12 multi-sig with keys held by contributors sitting both within and outside of Ethena Labs, with insufficient keys held by Ethena Labs to unilaterally execute transactions.

Capitalization of Reserve Fund

For the duration of the shard campaign the reserve fund will be funded by a portion of the yield generated by the Protocol asset backing which relates to the proportion of $USDe that is not staked.

The reserve fund will also be capitalized with funds raised from investors, and longer-term a take-rate will be applied to the yield generated, which will be redirected to the reserve fund to grow alongside the outstanding balance of $USDe.

- Auto Deleveraging (ADL)

Auto Deleveraging “ADL” refers to when an exchange forcibly closes a user’s profitable position at the bankruptcy price of a bankrupt user to end the risk exposure to the exchange.

ADL typically only occurs after an exchange’s reserve fund has been depleted and is unable to cover the outstanding shortfall. It’s important to note that not all exchanges use ADL as a mechanism, such as Deribit.

These days, ADL is extremely unlikely to be triggered given the aforementioned reasons in the “Reserve Fund” section, but primarily because of the present-day size of exchange reserve funds to absorb losses.

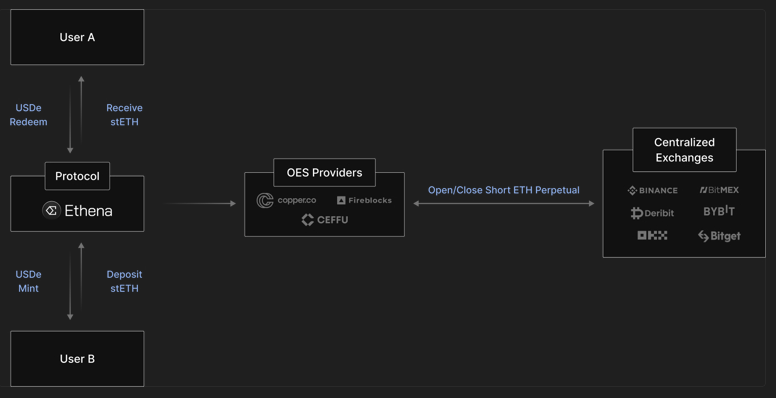

3. Custodial Risk

There are three principal risks with using an Off-Exchange Settlement provider for custody:

- Accessibility and Availability.

Ethena’s ability to deposit, withdraw, and delegate to & from exchanges. Any of these abilities being unavailable or degraded would impede the trading workflows & availability of the mint/redeem $USDe functionality. It is important to note that this should NOT affect the stability of the peg or the value of the collateral underpinning $USDe.

- Performance of Operational Duties.

In the event of an exchange failure, the protocol is reliant upon cooperation and reasonable legal behaviour to facilitate the expedient transfer of any unrealized PnL at risk with an exchange. Ethena mitigates this risk by settling PnL with exchanges frequently to avoid large balances being owed to the protocol. For example, Copper’s Clearloop settles PnL between exchange partners and Ethena every 4 hours.

- Operational Failure of Custodian.

While we are not aware of any material operational failures or insolvencies for large-scale crypto custodians, this does remain a possibility. While assets are held in segregated accounts, insolvency of a custodian would pose operational issues for the creation and redemption of $USDe as Ethena manages the transfer of assets to alternative providers.

Backing assets within these solutions are not owned by the custodian nor is the custodian or its creditors expected to have a legal claim on the assets. This is a result of OES providers either utilizing bankruptcy-remote trusts or MPC wallet solutions.

These three risks are remedied by Ethena not exposing too much collateral to a single OES provider and ensuring concentration risk is managed. It’s important to keep in mind that we use multiple OES providers with the same exchanges to mitigate both of the aforementioned risks.

4. Exchange Failure Risk

Ethena retains complete control and ownership of the assets via Off-Exchange Settlement providers with no collateral ever being deposited with any exchange. This limits Ethena’s exposure to idiosyncratic events on any one exchange to the outstanding PnL between Off-Exchange Settlement providers’ settlement cycles.

As such, in the event of an exchange failure, Ethena would delegate the collateral to another exchange and hedge the outstanding delta that was previously covered by the failed exchange. In the event of an exchange failure, the derivatives positions are considered closed with Ethena holding/owing no further obligation to the exchange estate.

Capital preservation is front of mind for Ethena. In the event of extreme circumstances, Ethena will always work to protect the value of the collateral & $USDe stable peg.

5. Collateral Risk

Therefore there are two functional risks that are front of mind:

- Staking/Unstaking from $ETH <-> LST

Users’ ability to stake $ETH with Lido and to receive 1:1 $stETH:$ETH ensures the price of the two assets do NOT typically diverge. Prices between $stETH:$ETH could begin to slightly diverge if there is a greater demand to stake/unstake $ETH/$stETH than available either via the Lido exit queue or external markets enabling swaps (Curve, Bybit, etc).

At this point in time, all protocols reliant on $stETH (and any $ETH LST), accept this liquidity risk profile. This means the amount of $stETH that can be unstaked with Lido might be subject to delay or the user may have to accept a slight discount if required to trade immediately in external markets.

Approved users of Ethena are able to redeem $USDe for $stETH (or any $ETH LST) at any time on-demand or request an alternate asset and tap Ethena’s ability to access multiple pools of liquidity.

LST liquidity on CeFi Exchanges is low, with about $2m of $stETH depth within 2% of the mid-price. Greater $stETH liquidity across multiple liquidity sources would help reduce the risk related to the Lido validator exit queue delay potential.

Ethena is actively working with CeFi & DeFi exchange partners as well as Lido to support & motivate increasing liquidity to ameliorate this issue.

- Loss of confidence in the integrity of the LST

The loss of confidence in the integrity of an LST might occur because of the discovery of a critical smart contract bug in the LST. In this event, users would all likely attempt to unstake or swap out of the LST for alternative collateral as quickly as possible. This would likely lead to long exit validator queues with protocols, such as Lido, as well as liquidity drying up on DeFi and CeFi Exchanges.

Ethena Labs actively monitors the integrity of the ecosystem as well as maintains strong relationships with CeFi & DeFi exchanges in combination with other sources of liquidity. Given capital preservation is front of mind, Ethena would proactively swap from the LST to a stable store of collateral in the extremely unlikely event an LST’s smart contract is discovered to have a critical flaw that cannot be remediated by their treasury or it’s backers.

Solution DesignEthena Labs solution has both onchain and offchain composite components & services.

The onchain components include the smart contracts that enable the minting, redeeming, staking, and unstaking of $USDe.

The offchain components include services that manage the delta hedging positions with respect to deposited collateral.

Audits

AuditsEthena has undertaken a multi-phased audit program to ensure the highest level of security on the procotol.

Phase 1: conducted initial audit with Zellic on the v1 of the protocol where no critical or high level vulnerabilities were found. Phase 2: architecture design review and economic risk factor analysis with Spearbit’s Kurt Barry former Lead Engineer at MakerDAO

Phase 3: phased audit with industry leading firms:

Phase 4: independent audit with Pashov with individual experience of over 50 audits

Phase 5: public audit with Code4rena

Phase 6: economic and financial risk audit by Chaos Labs

Phase 7: upcoming public bug bounty program with Immunefi

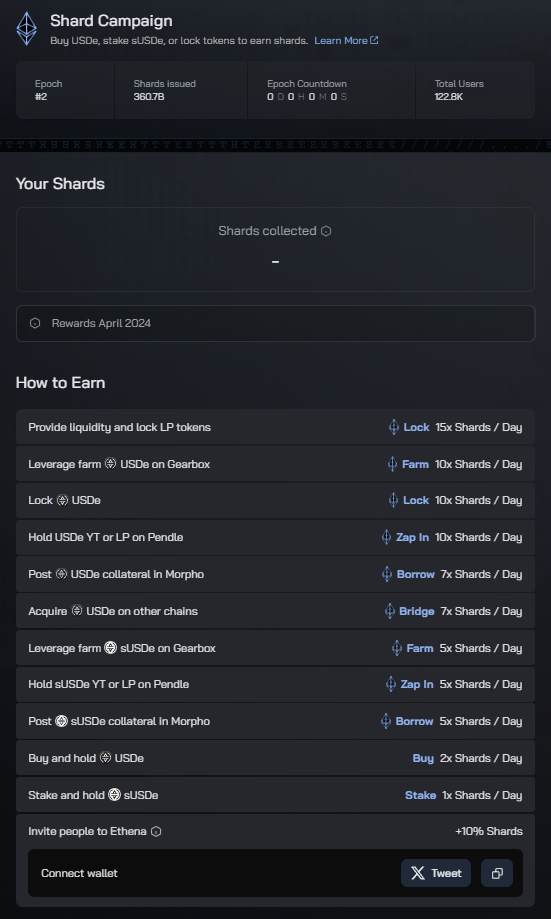

Ethena Core Contributors Airdrop

Airdrop

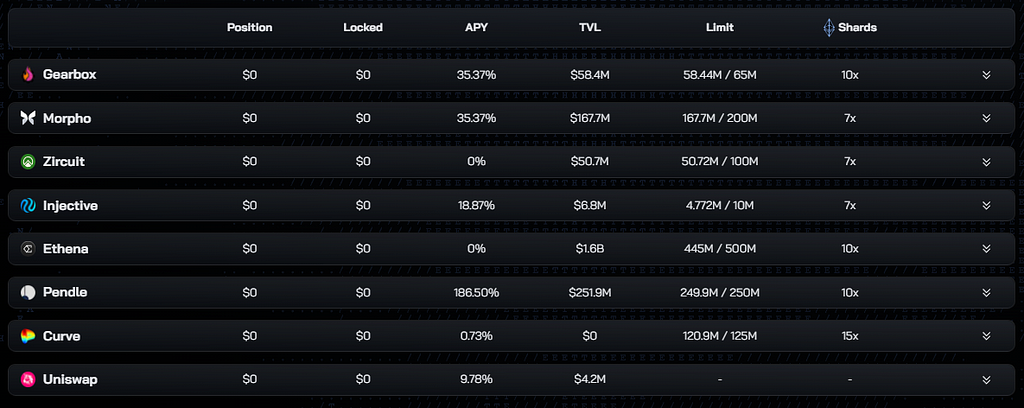

Ethena’s airdrop involves farming “Shards”. As you can see above, these are the amount of Shards you can gain per day if you do a certain activity whether its staking, locking $USDe and a lot more.

As of today, there are 122.8k users who have participated in this airdrop campaign and a total of 360.7B Shards issued up until Epoch #2.

These are the current integrated protocols relating to Ethena’s $USDe that also provides Shards per day when you do a certain activity onchain.

Metrics- Positions

It seems that the asset that is mostly use to collateralize $USDe is $ETH itself with a total of $795M in value followed by $USDT with a total of $401M in value.

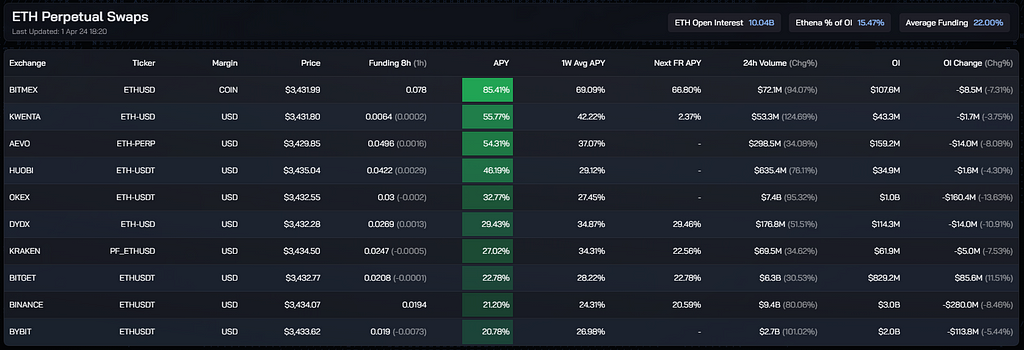

OKX has the highest perp yields amounting to 32.77% and Bybit has the lowest yield amounting to 10.95%.

Aevo $ETH perp has the highest yield amounting to 54.31%.

Deribit leads the highest futures OI followed by OKX and Binance with amounts above $250M.

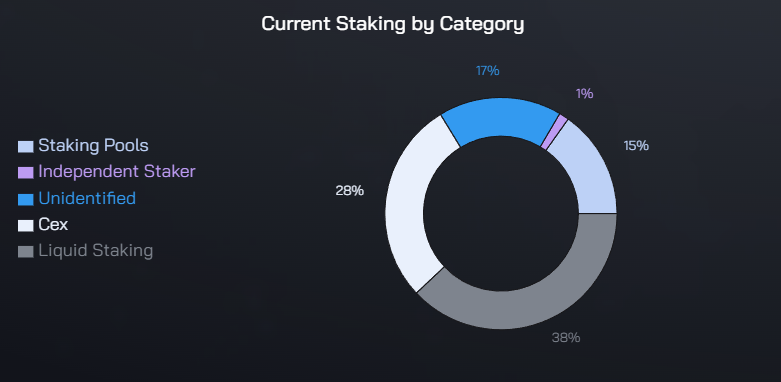

- Staking

$cbETH (Coinbase $ETH) and $rETH (Rocketpool $ETH) have the most stable pegs among 7 LSTs shown in the chart above.

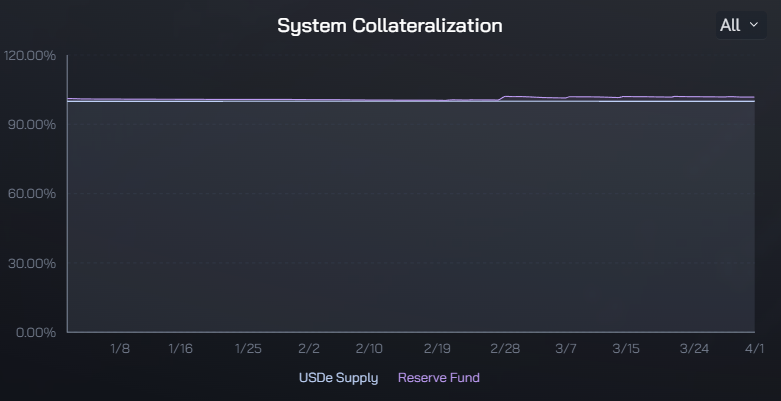

- Solvency

$USDe’s peg has been maintained to have a price ranging from $0.9961 to $1.008.

Ethena’s Reserve Fund grew 27x or 2700% from February 20 up to date.

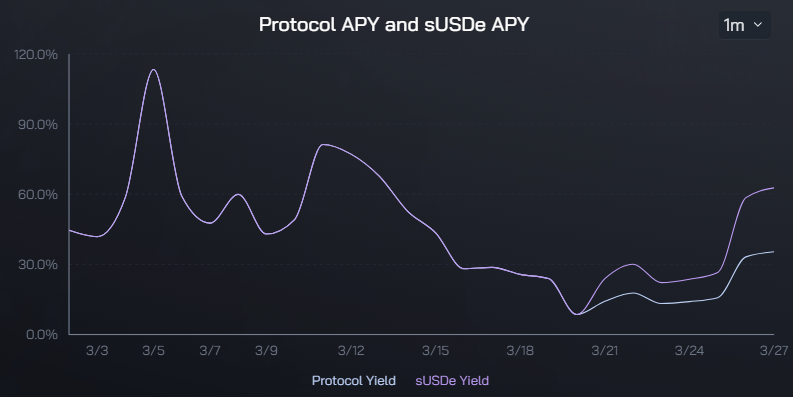

- Yields

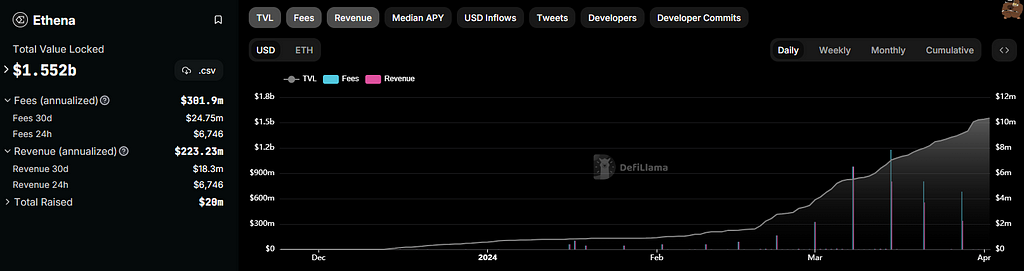

- TVL, Fees and Revenue

- Developer Commits

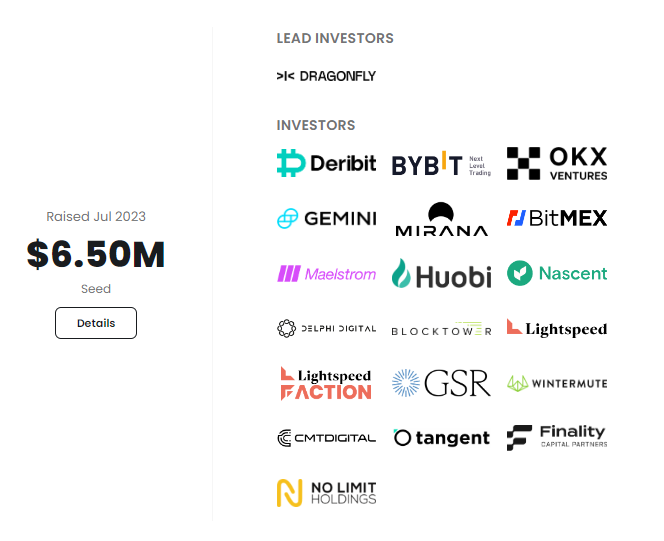

- Fundraising

$ENA

$ENA

Initial Circulating Supply of $ENA will be 1.425B (9.5% of max token supply)

Initial Circulating Supply of $ENA will be 1.425B (9.5% of max token supply)

This ICO is conducted in Binance Launchpool. You can farm $ENA by staking either $BNB or $FDUSD.

There is also a launchpool happening on Bybit from April 2 to 9.

Official LinksWebsite: https://www.ethena.fi/

Twitter/X: https://twitter.com/ethena_labs

Discord: https://discord.com/invite/HVfuYyNm8S

Telegram: https://t.me/ethena_labs

Docs: https://ethena-labs.gitbook.io/ethena-labs

If you like this research, kindly react and follow me here and on Twitter for more research soon. I delve into a wide range of projects in different chains and sectors to research. Thank you for reading!

Time to research: Ethena was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.