Tether’s $500 Billion Valuation Sparks IPO Rumor

Tether CEO Paolo Ardoino has dismissed talks about the stablecoin issuer going public. His stance comes despite the company’s valuation.

These discussions come after Circle, Tether’s market peer and rival, launched its IPO (Initial Public Offering) and went live on the NYSE.

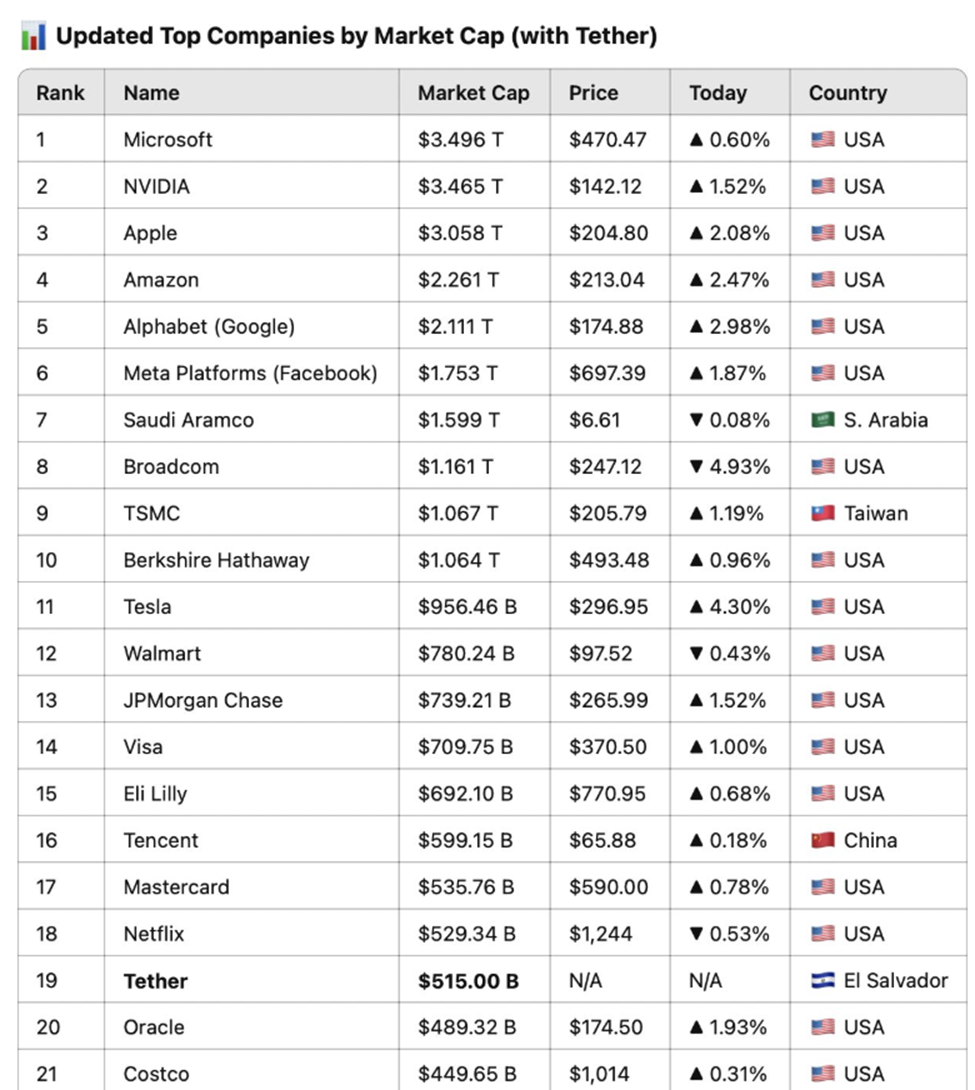

Paolo Ardoino Quashes IPO TalksMarket analysis values the stablecoin giant at $515 billion. According to Jon Ma, a builder on Artemis, this is enough to make Tether the 19th most valuable company globally. Specifically, it would place Tether ahead of heavyweights like Costco and Coca-Cola.

“If Tether went public TODAY, Tether would be the 19th largest company in the world at $515 billion. That’s ahead of Costco and Coca Cola,” wrote Ma.

Top Companies by Market Cap. Source: Jon Ma on X

Top Companies by Market Cap. Source: Jon Ma on X

Jon Ma extrapolated that based on Tether’s $13 billion in 2024 net profits and projected EBITDA of $7.4 billion for 2025, the firm could command a $515 billion valuation if public.

“Tether valuation at $515 billion is a beautiful number. Maybe a bit bearish considering our current (and increasing) Bitcoin + Gold treasury, yet I’m very humbled. Also truly excited for the next phase of growth of our company,” Ardoino wrote.

Despite the bullish projection, Ardoino clarified that Tether has no intention of going public. In a follow-up post, he succinctly stated, “No need to go public.” This signals confidence in the company’s current private structure and trajectory.

No need to go public.

— Paolo Ardoino