Shifting DeFi narratives: Memes soar as wallets position for dominance

DeFi is a game of narratives. However, these narratives are constantly changing, and the trends within them continuously evolve. Keeping up with the latest trends requires in-depth knowledge of what these narratives are and how they rapidly evolve in the crypto market.

This analysis is based on data from Dune Analytics, specifically from @cryptokoryo, who was among the first to group these narratives into quantifiable indices. Each index places equal weighting on the top five projects within that particular narrative, creating an imperfect but extremely useful dataset for analyzing the DeFi space.

The original data identified around 30 narratives, but a few have stood out as dominant since the beginning of the year. AI, encompassing AGIX, ALI, FET, OCEAN, ORAI, Friend.tech with Cobie, 0xRacerAlt, HsakaTrades, Banks, and Zhusu tokens; Memecoins with BONE, DOGE, ELON, FLOKI, SHIB, BOB, LADYS, PEPE, TURBO, and WOJAK tokens. The Bitcoin ETF narrative has also been prominent this year, with the index following the performance of BTC and BCH.

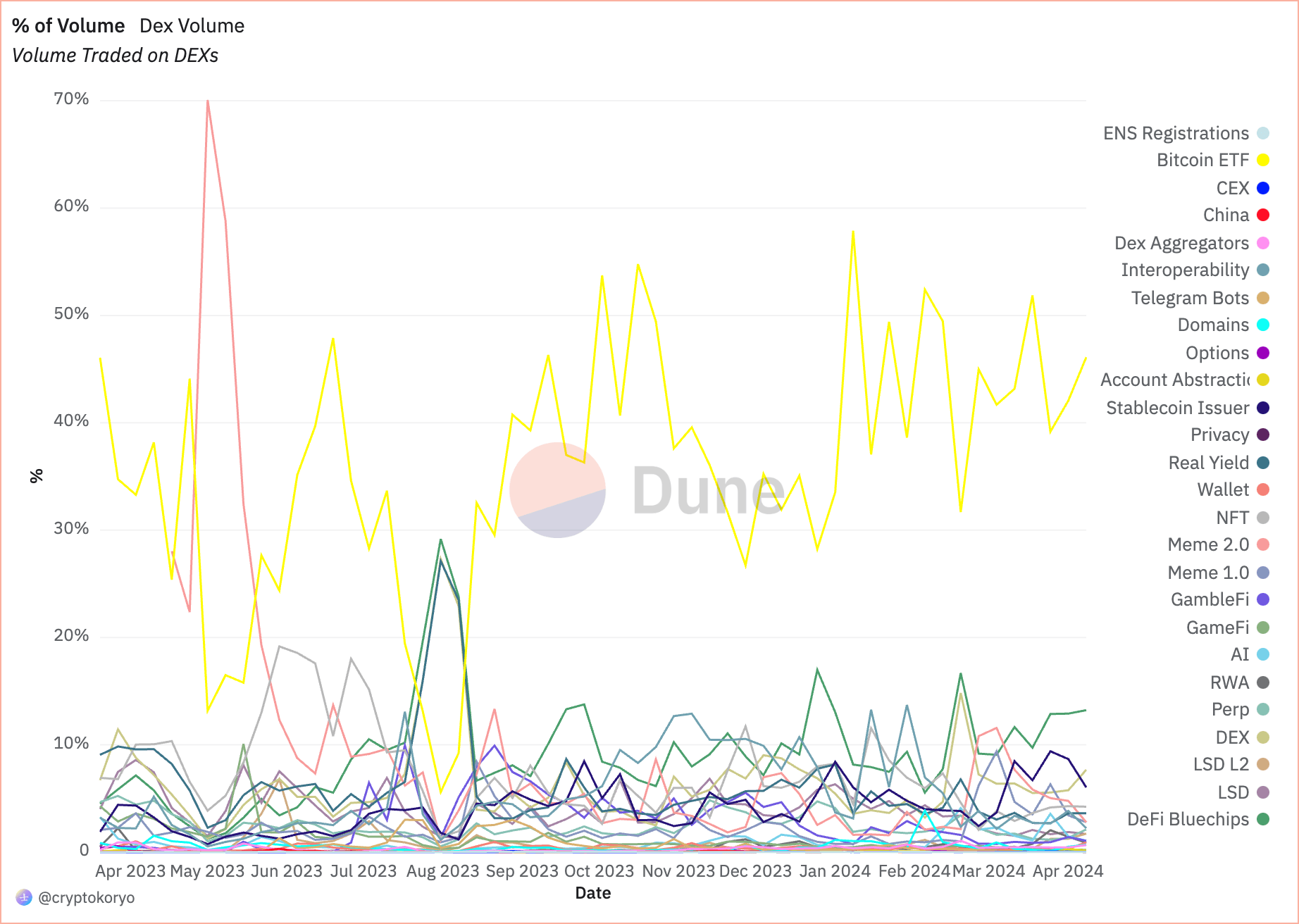

When it comes to trading volume, the Bitcoin ETF narrative is unrivaled. Data from Dune showed that BTC and BCH trading volume accounted for 46.1% of the total trading volume across narratives on April 8.

Graph showing the share of total trading volume across various crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Source: Dune Analytics)

Graph showing the share of total trading volume across various crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Source: Dune Analytics)

However, it might be wise to exclude BTC-related activity from the rest of the DeFi narrative as a completely different set of factors drives it.

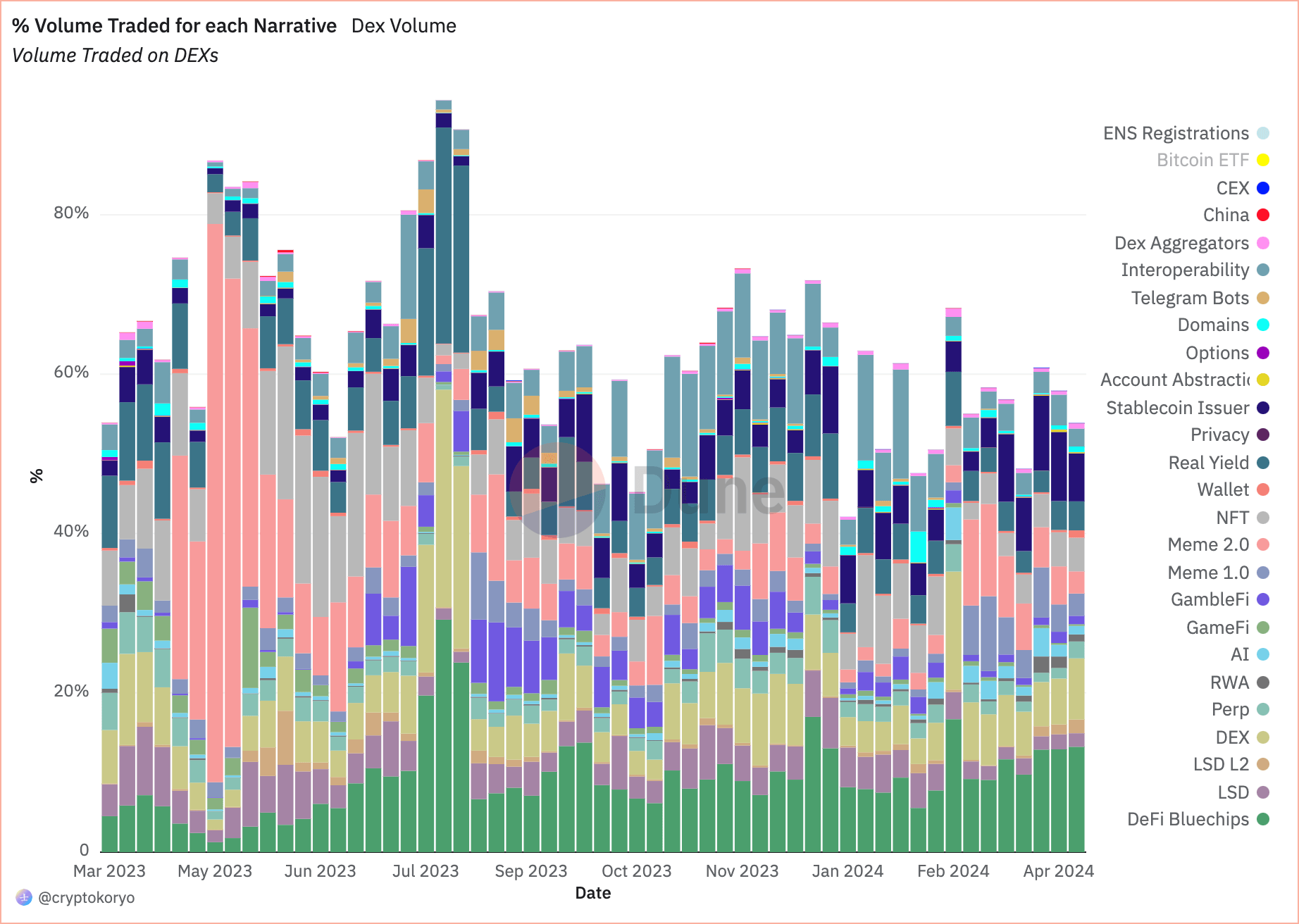

Focusing solely on DeFi, we see that DeFi Bluechips (AAVE, COMP, CRV, MKR, and UNI) accounted for the majority of the trading volume.

Graph showing the share of total trading volume across various crypto narratives excluding Bitcoin ETFs from Mar. 20, 2023, to Apr. 11, 2024

Graph showing the share of total trading volume across various crypto narratives excluding Bitcoin ETFs from Mar. 20, 2023, to Apr. 11, 2024

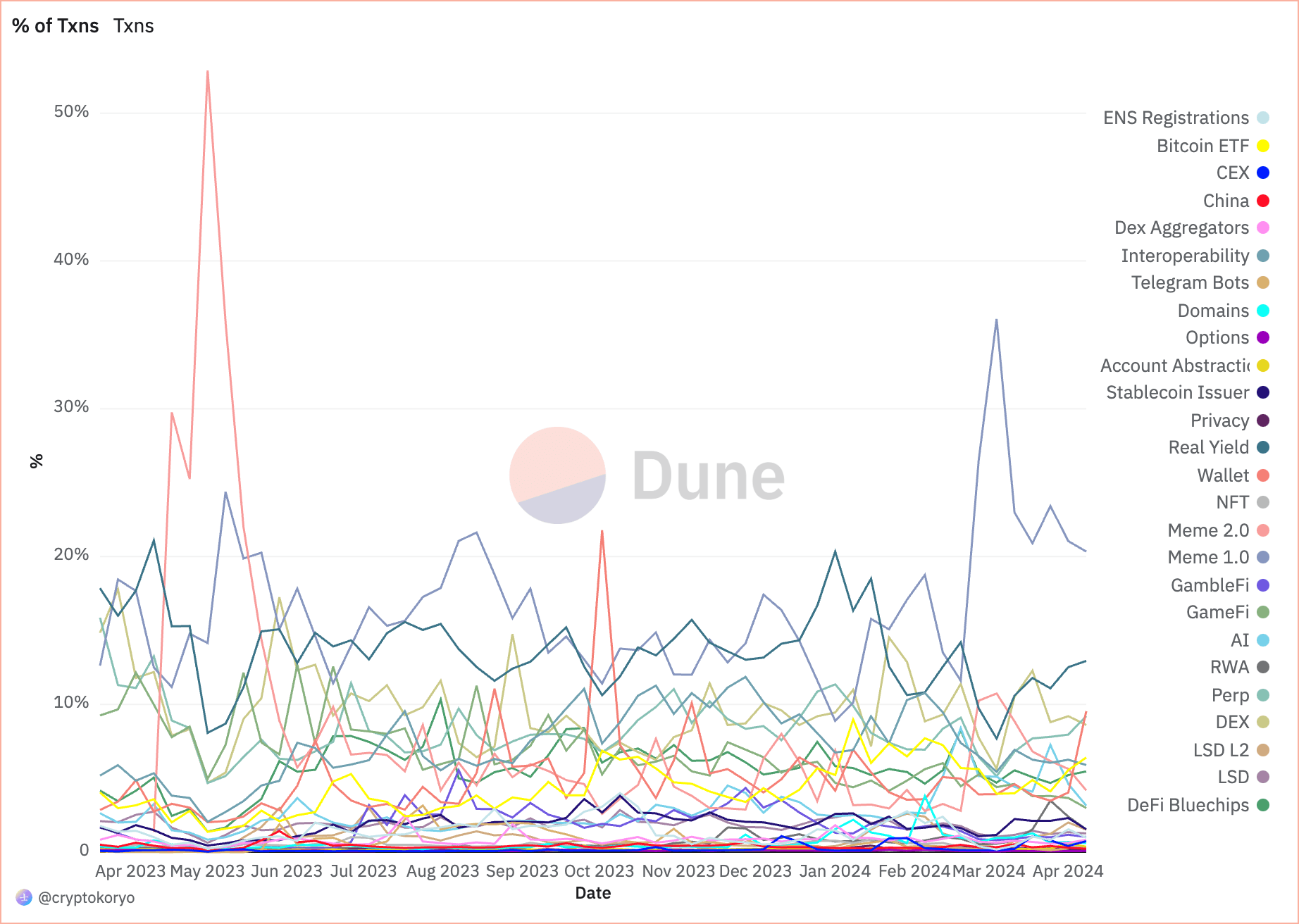

Regarding the total number of transactions, one narrative has been dominating for the better part of the last two months—memes. More specifically, the original memecoin index that tracks the performance of BONE, DOGE, ELON, FLOKI, and SHIB. It peaked on April 3, accounting for 36.4% of the transactions from these narratives, and has consistently accounted for around a quarter of the transactions since.

Graph showing the share of the total number of transactions across various crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Dune Analytics)

Graph showing the share of the total number of transactions across various crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Dune Analytics)

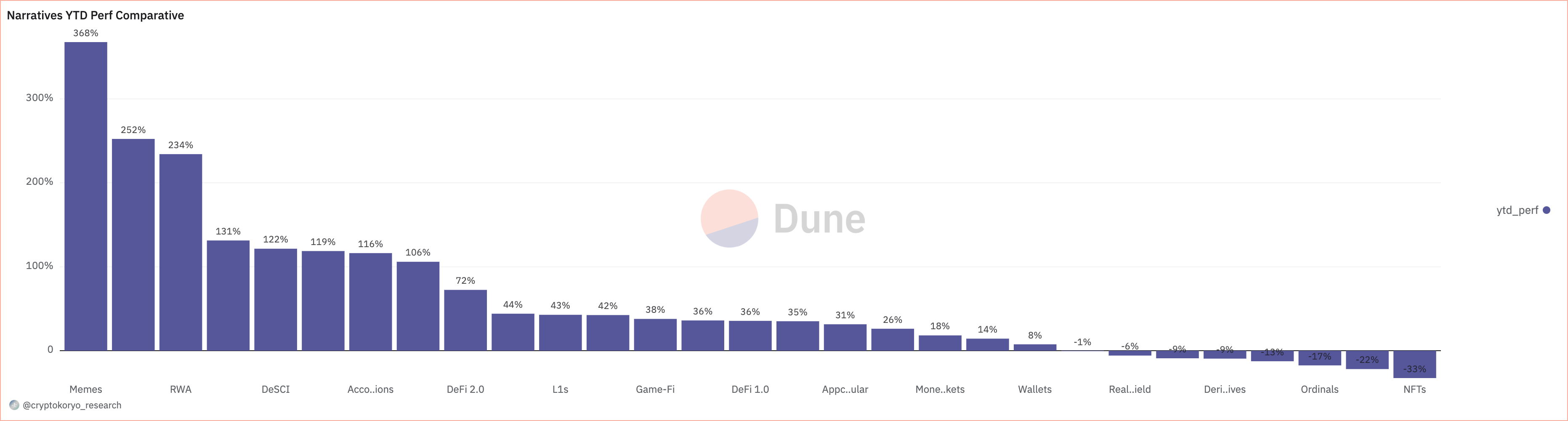

Looking at the year-to-date (YTD) performance of these narratives further confirms memes’ supremacy. Memes have shown a 368% YTD return as of April 11, drastically outperforming the second-ranked narrative — layer-2 liquid staking tokens ASX, LBR, PENDLE, and TENET (252%).

Real-world assets (RWA), tokenized tangible assets that exist in the real world, ranked third with a YTD performance of 234%. The worst-performing narratives this year have been NFTs, with a YTD loss of 33%, while Gamble-Fi, with BCB, BETU, FUN, RLB, and WINR, trailed closely behind with a 22% YTD loss.

Chart showing the year-to-date (YTD) percent return for crypto narratives as of Apr. 11, 2024 (Source: Dune Analytics)

Chart showing the year-to-date (YTD) percent return for crypto narratives as of Apr. 11, 2024 (Source: Dune Analytics)

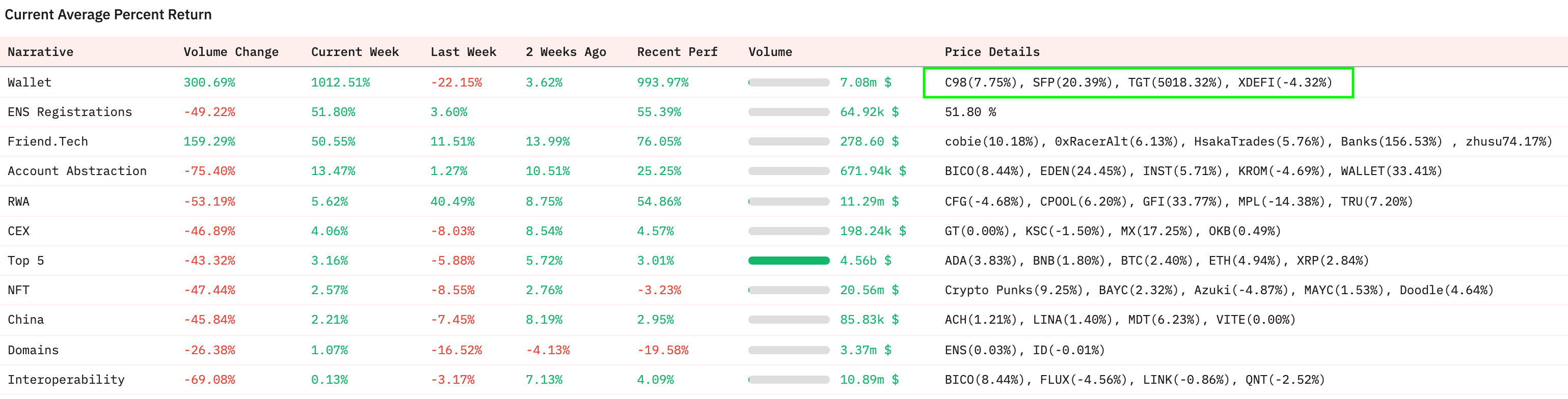

While memes seem to be a long-term trend this year, a newcomer has the potential to shake up the DeFi narrative in the coming weeks: wallets. The index tracking the performance of Trust Wallet Token (TWT), SafePal (SFP), Coin98 (C98), THORWallet (TGT), and XDEFI Wallet (XDEFI) showed an average weekly return of 1,012% on April 8, propelling it to the top of the crypto narratives.

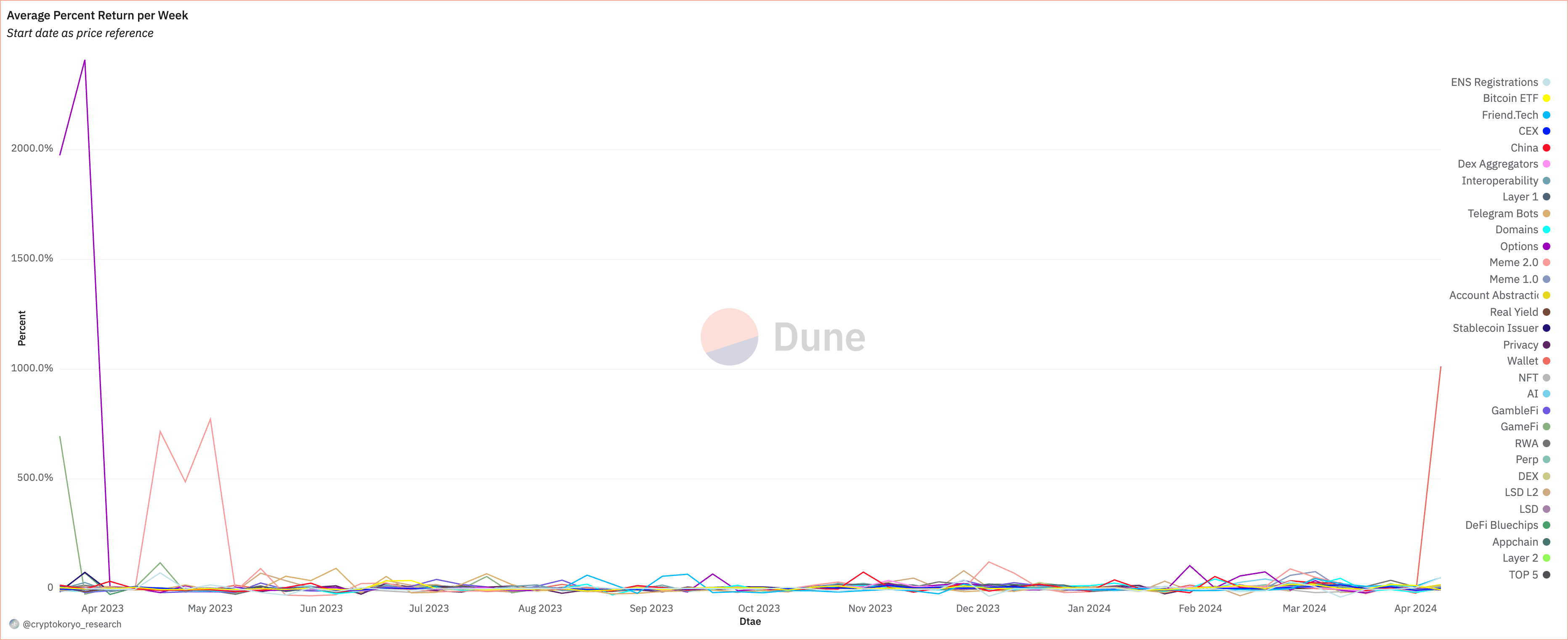

Graph showing the average percent return per week for crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Source: Dune Analytics)

Graph showing the average percent return per week for crypto narratives from Mar. 20, 2023, to Apr. 11, 2024 (Source: Dune Analytics)

Delving deeper into the narrative reveals that THORWallet’s native token, TGT, exhibited a 5,018% weekly return on April 8, while SafePal’s native token increased by just over 20%.

Table showing the average percent return and price performance breakdown for the top 11 crypto narratives on Apr. 11, 2024 (Source: Dune Analytics)

Table showing the average percent return and price performance breakdown for the top 11 crypto narratives on Apr. 11, 2024 (Source: Dune Analytics)

Although this certainly represents an anomaly, there’s a possibility that wallets and their native tokens will continue to sustain their popularity, albeit not at these levels.

The second-highest ranking narrative in terms of weekly returns was ENS Registrations, which posted a 51.8% return during the same timeframe. Friend.tech closely followed with a 50.55% weekly return, showing a much more sustainable trajectory in recent weeks.

The DeFi space is a testament to the ever-evolving nature of the crypto market, with narratives shaping and reshaping the direction of interests and money flow.

While “traditional” assets like those included in the Bitcoin ETF narrative continue to command the majority of attention and trading volume, newer narratives, particularly those focusing on DeFi-native use cases and applications, are not far behind.

The extraordinary performance of memes this year shows the market’s unsatiable appetite for speculation. This appetite is further fueled by social media and its influence on the retail segment of the market. However, the rise in wallet tokens seems to signal a growing interest in infrastructure and tools that, at least on paper, enhance security and user experience. This, alongside the fluctuating fortunes of NFTs and Gamble-Fi narratives, seems to show a young but promising move towards value and sustainable models within the DeFi space.

In the coming months, the ability to anticipate and adapt to these narrative shifts will be crucial for anyone participating in the DeFi market. The insights gleaned from analyzing these trends not only offer a glimpse into the current state of the market but also hint at the future direction of DeFi innovation and investment.

The post Shifting DeFi narratives: Memes soar as wallets position for dominance appeared first on CryptoSlate.