ProjectionLab Review: The DIY Financial Planning Tool

Are you wondering if ProjectionLab is the best tool to help you plan for retirement and your other financial goals? This ProjectionLab Review will break down what you need to know.

When it comes to managing my money, I love using tools that help me feel in control. I’ve tried many apps over the years, but sometimes you want something that goes deeper than a budget tracker. That’s why I decided to test out ProjectionLab.

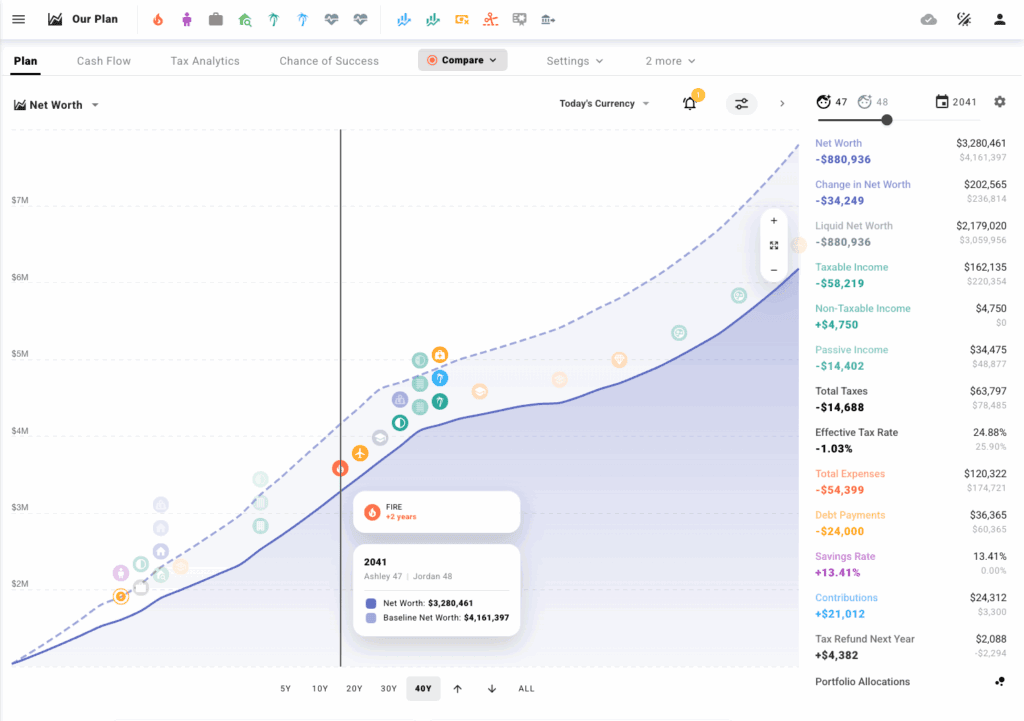

ProjectionLab is a powerful tool that lets you map out your financial future – all the way from this year to the next 50+ years. If you like to plan for retirement, big purchases, or just want to see “what-if” scenarios, you might love this tool too.

As someone who is interested in planning for retirement (and early retirement or FI aka financial independence), I really enjoyed using ProjectionLab and playing around with the different features and seeing my retirement plan all laid out in front of me.

You can try ProjectionLab for free by clicking here.

ProjectionLab ReviewIn this ProjectionLab review, I’m going to walk you through what it is, how it works, who it’s for, and how much it costs.

What is ProjectionLab?ProjectionLab is a financial planning tool and calculator. It’s not a daily budget app – it’s designed for big-picture planning, like planning for early retirement.

ProjectionLab can help you:

- See your retirement plan’s chance of success.

- Map out your income, expenses, savings, and investments for the future.

- Plan for big life changes like early retirement, a sabbatical, buying a house, or moving.

- Run “what-if” scenarios to see how different choices affect your money.

- Use Monte Carlo simulations to test best- and worst-case outcomes.

- Track your future cash flow and net worth in easy-to-read charts.

- Stress-test your financial plan so you feel more prepared and confident.

- Do it all while keeping your data private because there is no forced account linking.

What makes ProjectionLab stand out is that it’s privacy-first. You don’t have to link your financial accounts if you don’t want to. Instead, you enter your income, expenses, debts, assets, and goals manually. It’s independent and run by a small team, which means they don’t sell your data.

How ProjectionLab worksSetting up your plan can take a little time at first, but it’s worth it, and I found it pretty easy to do. Here’s what you do:

- Sign up for a free ProjectionLab account by clicking here.

- Add all your income streams, such as your salary, side hustles, rental income, and anything else.

- Input your expenses, debts, student loans, and savings goals.

- Build scenarios for your financial goals like buying a home, retiring early, or taking a year off.

- Use their Monte Carlo simulations to run thousands of possible outcomes, so you see what might happen in good years and bad.

- See how taxes might affect your plan with their tax analytics.

Everything is laid out in easy-to-read charts, graphs, and cash-flow models. You can tweak your assumptions anytime.

Below is their Getting Started video, and I found this really helpful:

ProjectionLab Features I LikeOne of my favorite things about ProjectionLab is how many advanced tools it gives you – all in one place. Here’s a closer look at some of the main features and why I think they stand out.

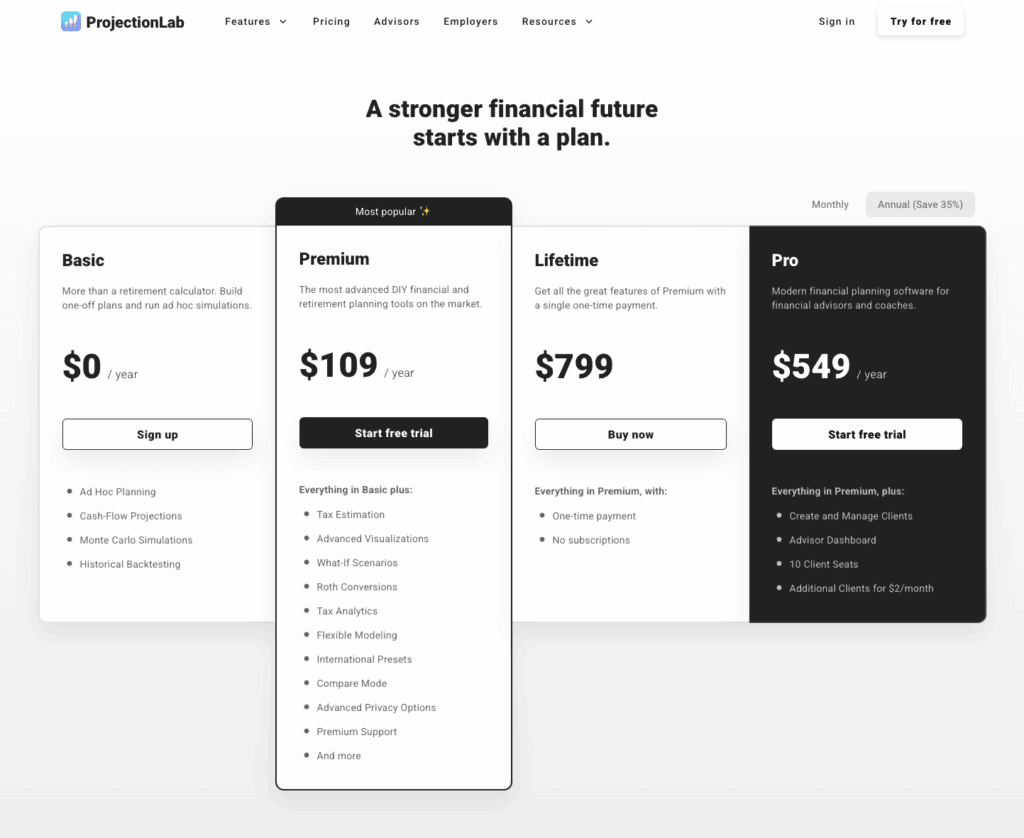

1. A free option to get startedOne thing I really like about ProjectionLab is that they actually have a basic free version. It’s not just a teaser – you can build one-off plans, test your ideas with Monte Carlo simulations, run cash-flow projections, and even do historical backtesting without paying anything upfront.

Of course, if you want to save and revisit your plans later, or unlock more advanced tools like detailed tax analytics and custom scenarios, you’ll need the Premium plan. But I think it’s great that they let you try the main features for $0 per year to see if you like it first.

This makes it feel less intimidating to get started – you can play around, learn how it works, and decide later if you want to upgrade.

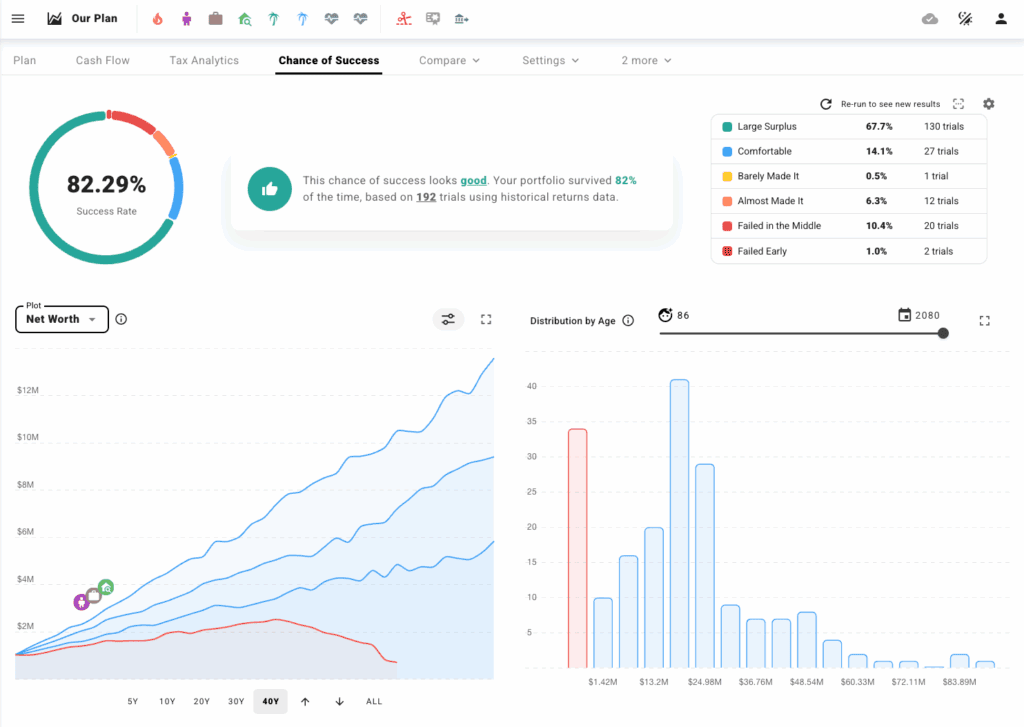

2. Monte Carlo simulations

2. Monte Carlo simulations

This is probably ProjectionLab’s most popular feature. If you’ve ever worried about what happens when the stock market goes up and down, this tool is for you.

Monte Carlo simulations run thousands of possible scenarios for your retirement plan. You can see best-case, worst-case, and average outcomes – all laid out in easy-to-read charts.

Personally, I like that it helps me feel prepared for different market conditions instead of just hoping for the best. It’s a simple way to stress-test your plan without needing a degree in statistics.

Note: People sometimes take “chance of success” too literally and assume they need to hit 100%. But an 85% success rate doesn’t mean there’s a 15% chance of failure. It just means that in 15% of scenarios, you might need to be flexible … spend a bit less, earn some part-time income, or adjust your plan for a short time. That flexibility is often what makes a plan not fail.

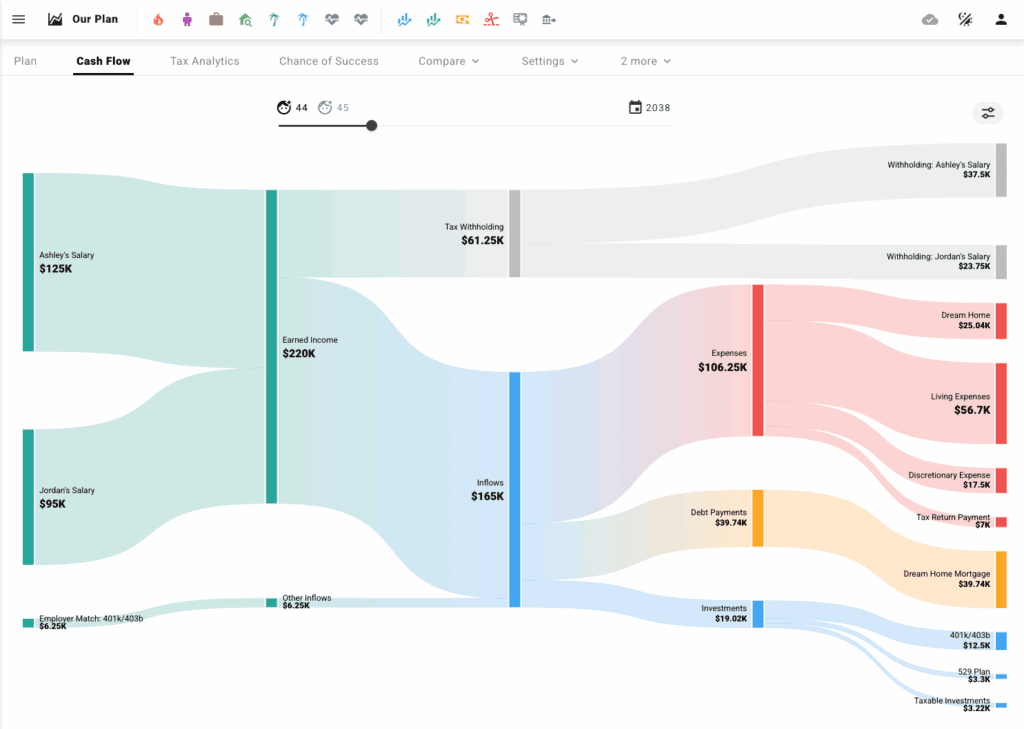

3. Cash flow modeling

3. Cash flow modeling

Most budgeting tools only show you what you’re spending each month, but ProjectionLab goes way deeper. You can add your different income streams (like a day job, side hustles, or rental properties) and see exactly where that money goes over time.

You can also model things like paying off debt, saving for large purchases, or taking a year off work. I love how visual this is – you can see dips, peaks, and how your cash flow changes as your life changes.

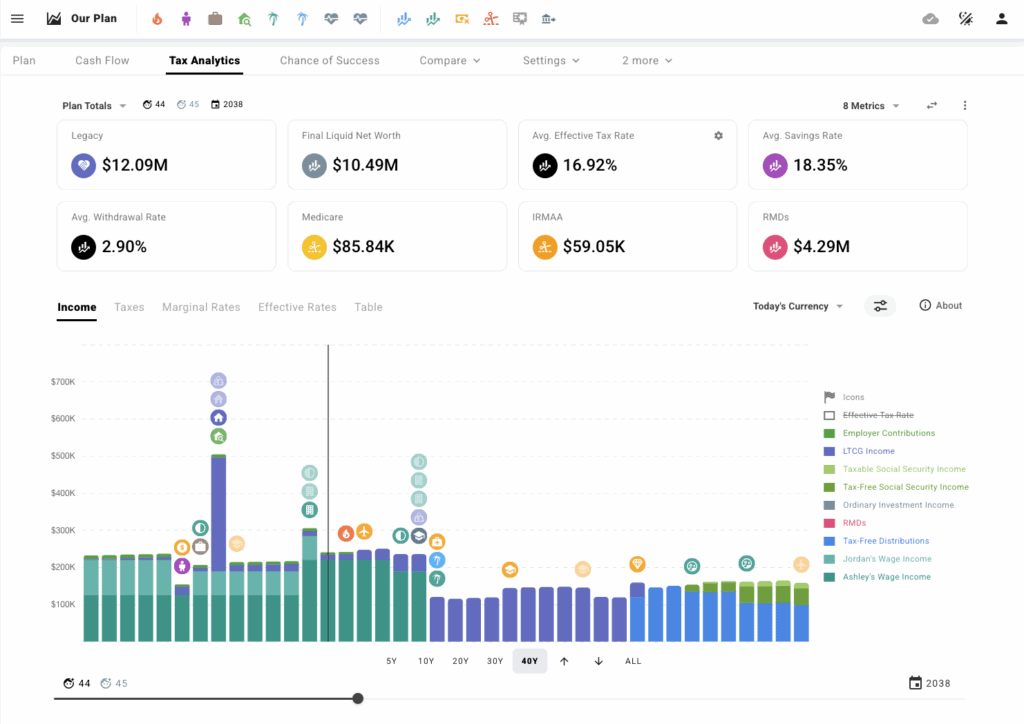

4. Tax analytics

4. Tax analytics

Taxes are one of the biggest things that can make or break a financial plan. ProjectionLab’s tax analytics tool lets you see how taxes will affect your plan now and in the future.

It adjusts for things like filing status, different tax brackets, or living in different states. You can also experiment with advanced strategies like Roth conversions.

I think this tool is great because it can help you to:

- See how much you’ll actually keep after taxes, not just your gross income.

- Understand how different income types (like dividends, rental income, or side hustles) are taxed.

- Model what happens to your taxes if you move to another state or country (such as to see how a higher-tax state impacts your financial freedom and financial goals).

- Compare how different filing statuses (single, married filing jointly, etc.) impact your plan.

- For early retirement or FIRE (Financial Independence, Retire Early) plans, see how pulling money from taxable vs. tax-advantaged accounts affects your total tax bill.

- Test different tax strategies and optimize your future taxes. Many ProjectionLab customers are able to save more than $10,000 in taxes over their lifetime thanks to ProjectionLab.

And more!

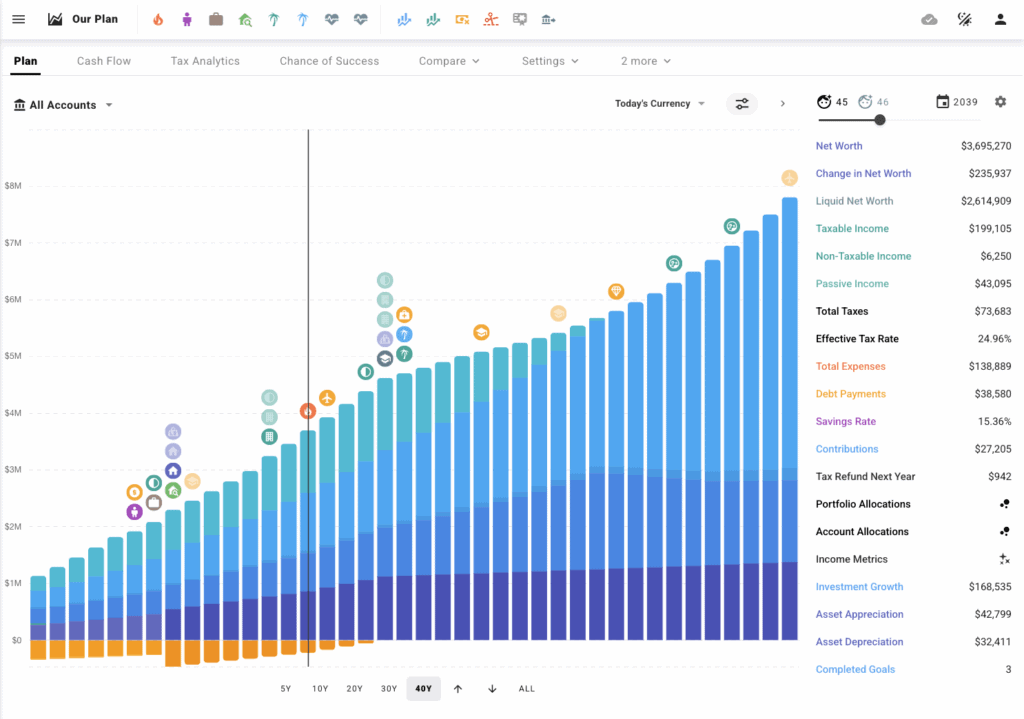

5. Net worth projections

5. Net worth projections

With ProjectionLab, you can calculate and track your net worth. You can see your assets, liabilities, and net worth all in one place, which is really helpful.

And, if you’ve ever wondered what your net worth might look like in 5, 10, or even 30 years, this feature is really motivating.

ProjectionLab lays it out in clear charts so you can see when you might hit big milestones – like paying off your mortgage or reaching your FIRE number. You can play around with spending less or earning more to see how those changes affect your future net worth, too.

6. Privacy and securityThis isn’t exactly a “tool,” but it’s one of the main reasons I wanted to try ProjectionLab. There’s no forced account linking – you decide what to share. Everything you input stays secure with local encryption.

Since they’re self-funded, they’re not making money by selling your data or showing you ads. I know that this is something that stops many people these days from using an online retirement planning tool, and I felt that ProjectionLab was very safe to use.

Who Is ProjectionLab For?ProjectionLab is best for people who want more control over their financial future. It’s great for:

- DIY planners who like to run scenarios and understand how financial decisions impact their financial future (such as with buying vs. renting a home, starting a family, etc.)

- The FIRE community (Financial Independence, Retire Early)

- People with multiple income streams, properties, or complex finances

- Anyone who values privacy and doesn’t want their data sold

If you only want a daily budget app, this probably isn’t for you – but if you love “what-if” planning, you’ll enjoy it. ProjectionLab is a great addition to any budgeting app, and many people use YNAB or Monarch Money along with ProjectionLab.

Pros and Cons of ProjectionLabHere’s what I think are the pros and cons of ProjectionLab:

Pros:

- Highly customizable

- It’s an affordable alternative to traditional financial planning services

- Great privacy – no forced account linking

- Advanced scenarios and realistic simulations

- Beautiful, clear visuals

Cons:

- Manual setup takes time (this isn’t really a con because it’s worth it so that you can get a complete financial picture)

How Much Does ProjectionLab Cost?

How Much Does ProjectionLab Cost?

ProjectionLab has a basic option that is free, as well as paid options.

You can choose monthly or annual plans depending on what features you want. The Premium plan is $109 per year if you pay annually, which works out to about $9 per month. The Premium version also has a 7-day money-back guarantee if you want to test it out first.

They also have a ProjectionLab Lifetime plan, which is $799 as a one-time payment to get ProjectionLab forever with no other monthly or annual cost.

Frequently Asked QuestionsBelow are answers to common questions about ProjectionLab.

Is ProjectionLab worth it?If you love playing with numbers, testing “what-if” scenarios, or planning for early retirement, ProjectionLab is definitely worth trying. It’s a unique tool that helps you feel more confident about the future, and it doesn’t sell your data. I recommend it for anyone who wants more than just a simple budget app. It’s especially useful if you have multiple properties, rental income, or plan to retire early.

Is ProjectionLab free?There is a free ProjectionLab version, as well as paid versions. It depends on what you’re looking for. If you want to save your data, then that is a premium feature.

Is ProjectionLab easy to use?Yes, but expect to spend some time setting it up. Once you do, the charts and simulations are very user-friendly (they have helpful YouTube videos, a great Discord community, and a great customer support team).

Is ProjectionLab safe?Yes, they don’t force you to link your bank accounts, and they use encryption to keep your data secure.

ProjectionLab Review – SummaryI hope you enjoyed my ProjectionLab Review.

Planning your financial future can feel overwhelming, but tools like ProjectionLab make it easier to see the big picture.

If you’re the kind of person who wants more than just a budgeting app – someone who wants to really see how their money decisions might play out over the next 5, 10, or even 50 years – then ProjectionLab could be a great fit for you. I like that this tool goes beyond the basics and gives you a flexible, visual way to map out your financial future.

It’s powerful enough for people who have complex situations, like multiple income streams, rental properties, seasonal living, or early retirement plans. I especially appreciate that you can run realistic Monte Carlo simulations, track your net worth over time, and see exactly how your cash flow changes with different life choices.

I also like that you can start with a basic free version to test things out, and upgrade only if you want to save your plans or unlock advanced features like detailed tax analytics and custom scenarios.

Overall, ProjectionLab is a smart choice if you want to feel more confident about your future, whether that means retiring early, buying a vacation home, or just being prepared for life’s “what-ifs.” It’s a tool I see myself using whenever I want to test out a big idea and feel reassured that my plan actually makes sense.

If you’re curious, you can build a plan for free and see if you like it. I’d love to hear what you think, too – let me know if you try ProjectionLab and how it works for your life!

You can try ProjectionLab for free by clicking here.

Have you tried ProjectionLab? Do you like planning your financial future with a tool like this, or do you prefer sticking to spreadsheets or working with a financial planner?

Note: To protect my privacy, the images in this ProjectionLab Review are not of my personal finances – they were provided by ProjectionLab.

Recommended reading:

- How To Come Up With A Financial Plan Without Visiting A Professional

- How To Start Investing For Beginners With Little Money

- How To Get Rich: The Steps To Build Wealth Now

- 20 Ways To Organize Your Life

- 13 Best Early Retirement Books

- Answers To The Most Common Questions About How To Save For Retirement

- How I Retired At Age 30 with $500,000

The post ProjectionLab Review: The DIY Financial Planning Tool appeared first on Making Sense Of Cents.