Is Michael Saylor’s Bitcoin Empire Built on Dilution, Debt, and Financial Risk?

Michael Saylor has built a reputation rewriting the corporate playbook. What began as MicroStrategy, a modest software firm, has morphed into Strategy, the world’s largest Bitcoin (BTC) treasury.

However, with $8.2 billion in debt, $735 million in fresh dilution, and an expanding suite of exotic financial products, critics warn Saylor is steering the company into uncharted, high-risk territory.

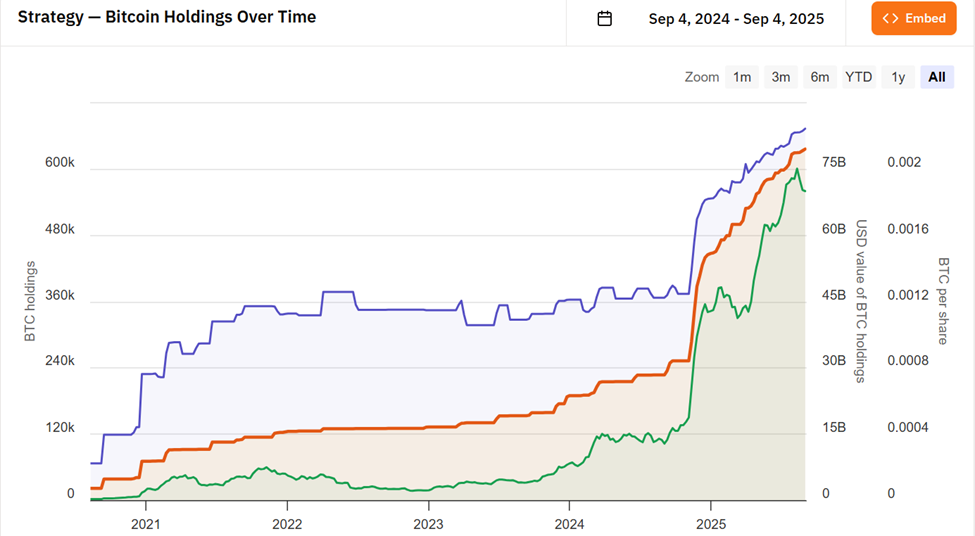

Debt, Dilution, and Bitcoin Exposure Put Strategy in the Hot SeatOver the past three years, Strategy has steadily abandoned its legacy identity. Investors no longer value the firm on discounted cash flows but almost exclusively on its 636,505 BTC reserves and Saylor’s monetization ability.

MicroStrategy’s BTC Holdings. Source: Bitcoin Treasuries

MicroStrategy’s BTC Holdings. Source: Bitcoin Treasuries

The executive chair has been upfront about his mission, to build out the yield curve for Bitcoin credit through new securities such as STRK, STRF, STRD, and STRC.

$STRC is $MSTR’s stealth weapon.

While others sell stock to survive, Saylor launches 1-month paper to print fiat → buy BTC → boost NAV — all while keeping equity tight.

This isn’t leverage.

It’s a Bitcoin yield curve in disguise.

Hyperbullish.