MetaPlanet Defies Bitcoin Bear: Leveraging for Long-Term Treasury

Bitcoin has plunged into bear market territory, yet institutional adoption remains robust. Tokyo-listed MetaPlanet recently secured a significant $100 million loan, collateralized by its existing Bitcoin holdings.

The funds will be used to acquire additional BTC and to launch a share buyback program strategically. This aggressive move highlights a widening divergence in perception: short-term price movers versus long-term institutional believers. Believers view the current dip as a critical accumulation phase.

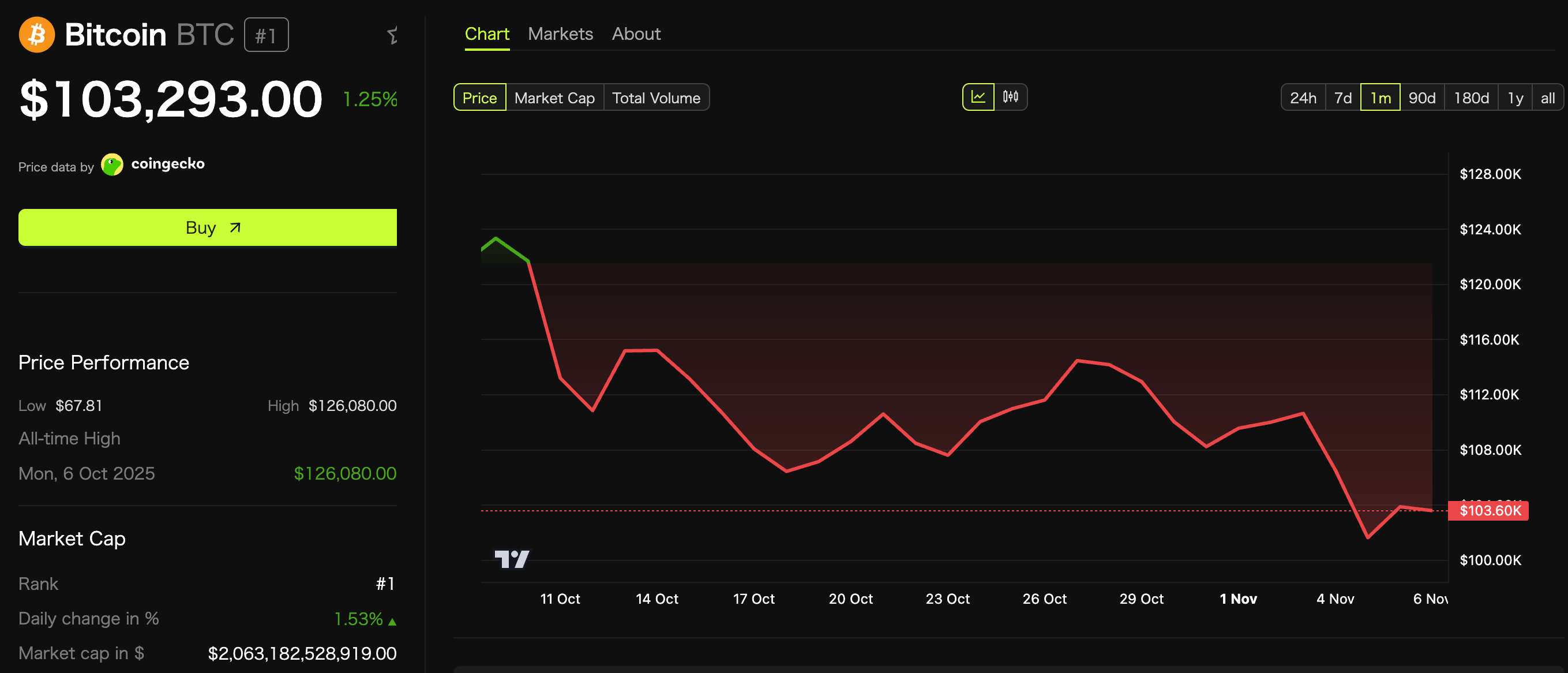

MetaPlanet Leverages Bitcoin Holdings for Strategic ExpansionThe world’s leading cryptocurrency, Bitcoin (BTC), confirmed its entry into a bear market. This status is defined by a rapid price fall exceeding 20% from its October all-time high. As a result, the slide briefly saw the asset tumble below the psychologically significant $100,000 support level.

Bitcoin Price Chart: BeInCrypto

Bitcoin Price Chart: BeInCrypto

On the other hand, in sharp contrast to the market’s negative sentiment, the Tokyo-listed corporate treasury firm MetaPlanet announced an aggressive, long-term commitment. In short, the company secured a $100 million loan by using its substantial Bitcoin reserves as collateral.

MetaPlanet already holds 30,823 BTC (valued at approximately $3.51 billion). Crucially, the new loan accounts for only 3% of its total Bitcoin holdings. This secure collateral margin helps maintain stability even during a severe market slump. The Japanese firm earmarked these funds for three areas: expanding its revenue-generating business, executing a share repurchase program, and acquiring additional Bitcoin.

A portion of the funds will be used for Bitcoin options trading. This income-generating business generates steady revenue while retaining the underlying BTC. The company’s Bitcoin-derived revenue has grown significantly over the past year. This calculated move signifies the institution’s view. They perceive the current price environment as a strategic opportunity, not a crisis.

The Divergence: Short-Term Volatility vs. Long-Term ConvictionThe actions of institutional players like MetaPlanet strongly underscore a key divergence. This gap exists between short-term market noise and deep, long-term conviction. Retail investors often react to day-to-day volatility. However, sophisticated firms focus on the asset’s macroeconomic narrative as a store of value.

These firms employ strong treasury strategies. Using debt financing during a bear market indicates an unwavering belief in Bitcoin’s future price trajectory. This financing serves both capital appreciation and shareholder value enhancement.

Metaplanet has secured a $100M BTC-backed loan, leveraging its existing Bitcoin reserves to strengthen its long-term treasury strategy.

The funds will be used to expand $BTC holdings and support broader capital initiatives. pic.twitter.com/BunhOhyS4i

Crypto analysts and key opinion leaders (KOLs) online also echo this semtiment. “Metaplanet has secured a $100M BTC-backed loan, leveraging its existing Bitcoin reserves to strengthen its long-term treasury strategy,” @Cryptic_Web3 noted.

The post MetaPlanet Defies Bitcoin Bear: Leveraging for Long-Term Treasury appeared first on BeInCrypto.