Do not assume the apex predator remains at the top

Why CEXs may face a crossroads in the crypto evolution or, when the wolves will make way for the lions

Power isn’t permanent. It’s a pattern.

Power isn’t permanent. It’s a pattern.In the natural world, and in crypto, dominance is rarely a final state.

In the animal kingdom, apex predators don’t hold the throne by decree. They keep it by adapting to the terrain until, one day, the terrain changes. And then so does the king.

Crypto has had its wolves: fast, fierce, and unrelenting. CEXs like Binance, ByBit and Coinbase carved paths through chaos. They created sleek, user-friendly platforms that brought order to the wild. These wolves were needed. They turned a niche ideal into a global phenomenon.

But lately, if you squint toward the horizon, you’ll see another figure watching — larger, slower, quieter.

The lions are arriving.

For non-members, you can read the full story here.

The wolves: Speed, access, nominationWolves thrive in packs, and CEXs led the early charge in numbers. They gave crypto a face, UX, liquidity, and some degree of credibility. You could say they domesticated a feral technology.

Their success wasn’t just technical. It was cultural. In a world still unsure whether crypto was real, they became the reassuring bridge. Glossy apps. Easy onboarding. Branding that borrowed from traditional finance, but with a smirk.

But wolves, by nature, are built for conquest, not kingdoms. They run fast, adapt quickly, and move as one. What they’re not great at is enduring stillness or playing palace politics.

And that’s where the lions begin to stir.

The lions: Trust, terrain, strategyTradFi institutions and Web2 titans are not in a rush. They’ve watched from the high grass, eyes scanning the field. While CEXs have spent years battling regulation, compliance, and internal security lapses, the lions have been mapping a different route: integration.

Lions don’t need to chase. They let the terrain tilt in their favour.When your bank starts offering crypto inside your existing dashboard alongside your mortgage, retirement fund, and insurance, the game changes. No more on-ramp hurdles. No more explaining seed phrases to your aunt.

To the average user, crypto becomes just another asset. The thrill fades. The story softens. But the trust solidifies.

A new terrain revealed: AUM tells the tale

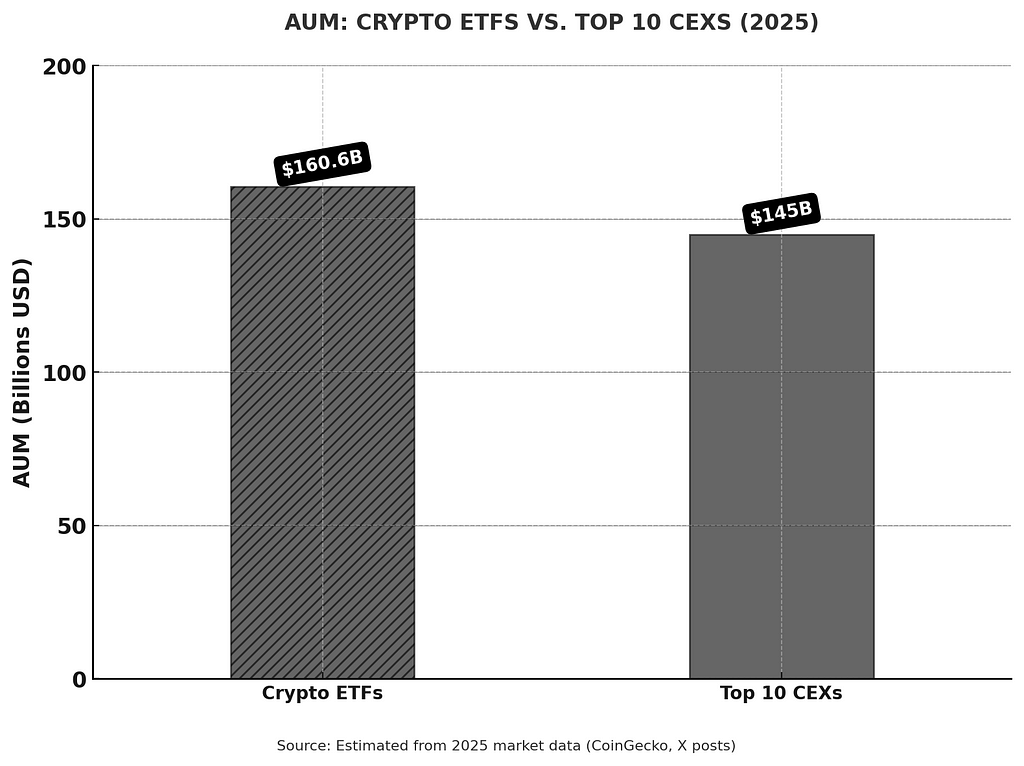

Dominance in crypto has often been symbolic: a dance of narratives, of user counts and interface polish. But capital flows quietly tell their own story. As of 2025, the total Assets Under Management (AUM) in Crypto ETFs have reached $160.6 billion, surpassing the $145 billion held across the Top 10 Centralised Exchanges.

This shift isn’t loud, but it is tectonic.

Where once the wolves of crypto hunted on the open plains of user acquisition and retail buzz, the lions have entered from the margins. They bring with them institutional gravity. ETFs, backed by regulatory clarity and household names, have captured more than just funds; they’ve begun to capture trust (see notes for more details).

It’s not about decentralisation (yet)CEXs often build with the assumption that decentralisation is the end goal. But to most people, it isn’t, not yet. Most users want ease, familiarity, and safeguards. If their existing bank or fintech app offers BTC and ETH with fewer steps and more perceived safety, why go rogue?

This is where lions have the advantage. They already own the terrain most people live in. They don’t need to teach you how to walk a new path. They simply pave over the one you’re already on.

The real miss: Branding and belongingCEXs possibly made a mistake: they branded themselves as the destination, not the transition.

They assumed they were the peak, when really they were the plateau. Branding focused on features, charts, and occasional meme-speak. But it rarely built trust in a long-term story.

More critically, they missed the chance to reframe themselves as the new bank for the people — a decentralised financial sanctuary for the masses. Instead, they leaned hard into the identity of trading hubs: fast, technical, and profit-driven. That may attract the early adopters, but it fails to win over the quiet majority who want clarity, security, and a sense of future-proof belonging.

Meanwhile, TradFi institutions know how to tell slow, trustworthy narratives. They’ve spent decades perfecting it. They whisper promises of stability, not revolution. And while that may sound boring to crypto purists, to the masses, it’s comforting.

Never assume the apex stays the apexIn nature, the thing that makes you dominant: speed, size, strength can become the very thing that makes you vulnerable in a different climate. Specialisation is a double-edged claw.

CEXs now face that moment. If they want to remain more than an opening chapter, they need to evolve beyond utility. Build stronger identities. Humanise their platforms. Shift from performance to purpose.

The war for user adoption isn’t technical, it’s emotional.Because in the long run, it’s not the loudest howl that echoes. It’s the one that learns to speak the new language of the land.

What happens to the wolves?The wolves got us here. And that deserves respect.

But the lions are watching. And they don’t need to fight to win , they just need to wait.

Notes:

- BlackRock: As the sponsor of the iShares Bitcoin Trust (IBIT, $59.858B AUM), BlackRock is a prime example of a TradFi lion. Its entry into crypto via ETFs, with strong net flows (+$425.50M), shows how it leverages its brand as a trusted asset manager to attract investors who might shy away from CEXs like Binance.

- Fidelity: With the Fidelity Wise Origin Bitcoin Fund (FBTC, $18.777B AUM), Fidelity embodies the article’s point about TradFi offering familiarity. Its established reputation in retirement and investment services allows it to present crypto as “just another asset,” reducing the perceived risk for mainstream users.

- Grayscale: While not a traditional bank, Grayscale’s Ethereum Trust (ETHE, $3.468B AUM) and Bitcoin Trust (GBTC, $3.197B AUM) bridge TradFi and crypto. Its high fees (e.g., 2.50% for ETHE) reflect a premium for trust, aligning with the article’s emphasis on branding over decentralisation.

- JPMorgan and Goldman Sachs: These banks have explored crypto custody and blockchain solutions, as noted in sources like Reuters (mentioned in the article). They don’t need to compete directly with CEXs’ trading platforms; instead, they integrate crypto into wealth management, appealing to high-net-worth clients who value security over crypto’s rebellious ethos.

References:

Blockworks: https://blockworks.co/news/tradfi-firms-in-crypto-waters

CoinGecko: https://www.coingecko.com/en/exchanges

CryptoGrowth: https://x.com/CryptoGrowth_/status/1919803451699298753

Finews: https://www.finews.asia/finance/43135-hashkey-capital-jupiter-zheng-crypto-bitcoin-ether-tradfi-defi

Reuters: https://www.reuters.com/technology/fintechs-crypto-companies-seek-bank-charters-growth-2025-03-18/

Ulam labs: https://www.ulam.io/blog/the-best-crypto-friendly-banks-worldwide#

Do not assume the apex predator remains at the top was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.