A Deep Dive into Semaphore-Powered Private Payments

Web3, or the third-generation web, has gained an aura of prophetic change — one that fundamentally alters how the internet operates, generates value, and shapes economic models. This transformation, driven by blockchain technology, moves us toward a decentralized web that supports secure transactions without the need for intermediaries.

This is where Web3 opens up vast commercial possibilities. Businesses can leverage decentralized applications for payments, finance, digital identity management, and beyond. This potential has been made obvious by the emergence of digital markets through cryptocurrencies, virtual or augmented realities, and asset tokenization .

The fundamental layer of this potential is blockchain technology, praised for its ability to create “trustless” systems, and meant as the alternative for the increasing distrust in traditional institutions. Despite recent setbacks involving high-profile crypto firms such as FTX and Silvergate, which have sparked investor skepticism, the foundational promise of Web3 gets stronger every day with an ever increasing rate of adoption.

Contrary to many naysayers some years ago, blockchain’s decentralized nature continues to offer a transformative vision for various sectors. For instance, DeFi (Decentralized Finance) has gained significant traction by providing decentralized financial services, which can democratize access to financial systems worldwide. NFTs (Non-Fungible Tokens) are revolutionizing not only digital art but also brand engagement and marketing. Take Nike, for instance, whose virtual sneaker collection generated approximately $185 million between April and November 2022. Similarly, luxury brands like Dolce & Gabbana, Tiffany & Co, and Adidas have tapped into virtual collections, exploring new revenue models in the digital realm.

Web3 enhances internal collaboration and mobilization. Financial giants like JP Morgan, HSBC, and Standard Chartered have invested in digital plots on metaverse platforms, transforming their internal interfaces and fostering better collaboration among employees.

Web3 allows companies to redefine relationships with their stakeholders towards greater transparency and autonomous control over data. This can lead to more personalized services and cost reductions. For example, De Beers uses blockchain to trace the provenance of diamonds, ensuring authenticity and ethical sourcing.

Research and InsightsSeveral reports and studies highlight the growing importance and potential of Web3:

- A Deloitte report notes that 76% of surveyed executives believe that digital assets will be a strong alternative to or outright replacement for fiat currencies in the next 5–10 years.

- McKinsey predicts that by 2030, the metaverse could generate up to $5 trillion in economic value.

- The World Economic Forum emphasizes that blockchain could streamline supply chains, enhance transparency, and reduce fraud, potentially adding $3.1 trillion to global trade.

- Evolving Regulatory Landscape: The regulatory environment is evolving to address the challenges and risks associated with digital assets. The European Union’s Markets in Crypto-Assets (MiCA) Regulation aims to provide a comprehensive regulatory framework to protect investors and ensure market integrity, potentially restoring confidence in the sector.

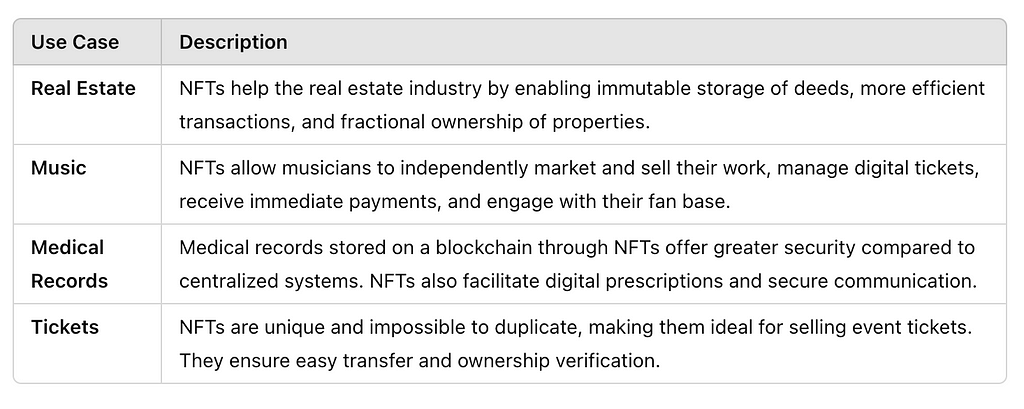

- Diversification of Use Cases: Web3’s potential extends beyond cryptocurrencies. For instance, non-fungible tokens (NFTs) have found applications in art, music, and gaming, offering new revenue streams and business models. Gartner predicts that by 2026, 25% of people will spend at least one hour daily in the metaverse for work, shopping, education, or entertainment.

- Decentralization and Trust

One of the most significant advantages of Web3 is its decentralized nature. Transactions and data are managed by a distributed network of computers (nodes) rather than a single central authority. This not only enhances security but also cultivates trust among users, as transactions are transparent and verifiable by anyone on the network. - User Empowerment and Privacy

Web3 technologies give users control over their data and digital identities. Instead of relying on third parties to manage personal information, users can interact directly and securely. This shift reduces the risk of data breaches and misuse, making online interactions more private and secure. - Innovative Financial Models

Web3 introduces decentralized finance (DeFi), which enables peer-to-peer financial transactions without traditional intermediaries like banks. DeFi platforms offer services such as lending, borrowing, and trading, often with higher yields and lower fees compared to conventional financial systems. This democratizes access to financial services and opens up new investment opportunities. - Enhanced Transparency and Security

Blockchain, the underlying technology of Web3, provides an immutable ledger of transactions. This ensures that all data and transactions are transparent and cannot be altered retrospectively. Such transparency is particularly beneficial for industries requiring rigorous audit trails, such as finance and supply chain management. - Tokenization and Digital Ownership

Web3 facilitates the creation of digital tokens representing assets, which can be traded or utilized within various platforms. This tokenization offers greater liquidity and the potential for fractional ownership of assets like real estate, art, and even intellectual property. Non-fungible tokens (NFTs), a type of digital asset, have already revolutionized the art and entertainment industries by enabling digital ownership and provenance tracking.

Web3 is about rethinking entire business models. Here are some of the sectors that have been already strongly impacted:

- Financial Services: With decentralized finance (DeFi), traditional banking faces competition from blockchain-based solutions offering transparency and lower transaction costs.

- Data Processing and Storage: Companies can shift to decentralized storage solutions, reducing dependency on large central providers and enhancing data security.

- E-commerce: Smart contracts and blockchain can revolutionize transactions, reducing fraud and increasing trust between buyers and sellers.

- Healthcare, Energy, Music, Media, and Gaming: These industries can use blockchain for everything from secure patient records to transparent energy transactions and digital rights management.

Investing in Web3 can be approached in several ways:

Cryptocurrencies: Along popular cryptocurrencies like Bitcoin, Ethereum, you can also invest in emerging altcoins that power Web3 applications and focus on real-world solutions like the SourceLess powered STR Token.

DeFi Platforms: Engage with decentralized finance platforms to earn interest, lend assets, or participate in yield farming. Platforms like Aave, Compound, and Uniswap are prominent in this space .

NFTs and Digital Assets: Invest in NFTs and other digital assets that represent ownership of unique items or digital goods .

Web3 Stocks: Consider buying shares in companies that are leading the development of Web3 technologies. This includes firms working on blockchain infrastructure, decentralized applications, and related technologies .

Key Developments and Future Outlook

Key Developments and Future OutlookSo far, 2024 has been quite a good year for Web3, with several trends marking its evolution:

- Enhanced Interoperability: Technologies that improve cross-chain interactions are expected to address market fragmentation, creating a more cohesive blockchain ecosystem (Dapp Expert).

- Stablecoins and Security: The stablecoin market is likely to expand, offering more secure and reliable digital currencies. Regulatory developments will play a crucial role in this sector’s evolution.

- Integration with AI: The synergy between blockchain and artificial intelligence is set to bring new advancements in security and efficiency, further driving Web3 innovation.

Our developments at SourceLess, such as blockchain-based digital identity systems and decentralized domain services, provide both tools for managing digital interactions and investment opportunities in cutting-edge technology.

- Blockchain Consulting: Tailored strategies to help businesses integrate blockchain technology effectively.

- Smart Contract Development: Robust and secure smart contract solutions for various applications.

- Decentralized Applications (dApps): Custom dApp development to meet unique business needs.

- Tokenization Services: Comprehensive tokenization services to digitize and manage assets securely.

With its potential to decentralize power, enhance security, and create new financial ecosystems, Web3 offers unparalleled opportunities for forward-thinking investors. As a company that not only understands the intricacies of Web3 but is also committed to pioneering advancements in this transformative space, SourceLess supports big partnerships and the educates towards the full potential of this massive digital evolution.

For more information on how you can invest in your Web3 future with Sourceless, visit our website and join our community and connect with other web3 enthusiasts and developers on our Telegram channel SourceLess Community.

Web3 Investment Basics in the New Digital Economy was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.