Is Crypto in a Bear Market Now? A Full Market Structure Assessment

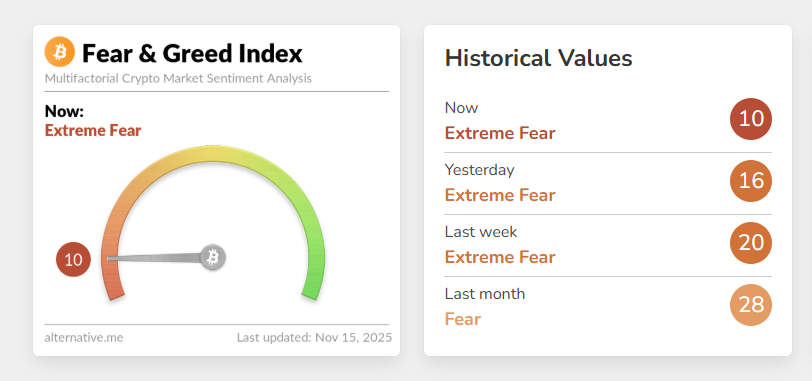

Bitcoin has dropped below $100,000 for the second time in a week, losing 12% in a month. The overall crypto market has lost over $700 billion in the past month, as the Fear and Greed Index has fallen to ‘extreme fear’.

So, do all of these market indicators signal a bear market? Let’s analyze the technical and historical data.

Sentiment Signals Are at Bear-Market LevelsThe Fear & Greed Index at 10 reflects extreme fear comparable to early 2022 and June 2022, both confirmed bear-market phases.

- Yesterday: 16

- Last week: 20

- Last month: 28

The trend shows accelerating fear, not stabilizing sentiment. Bear runs usually begin with this kind of persistent fear compression.

However, sentiment alone does not confirm a bear market — it only signals capitulation or exhaustion.

Crypto Fear & Greed Index. Source: Alternative

Bitcoin Has Broken Its Most Important Bull-Market Support

Crypto Fear & Greed Index. Source: Alternative

Bitcoin Has Broken Its Most Important Bull-Market Support

The 365-day moving average is the long-term structural pivot.

Current situation:

- The 365-day MA is near $102,000.

- Bitcoin is trading below it.

- The breakdown mirrors December 2021, when price lost the same MA and the bear market started.

Historically:

CycleMA Lost?Outcome2018YesFull bear market2021YesFull bear market2025Yes (now)Bear-phase risk risingFailing to reclaim this level quickly often confirms a cycle regime shift. This is one of the strongest technical arguments for a bear-market transition.

Bitcoin "Death Cross" Just Flashed!

The Death Cross (An ironically BULLISH indicator) has just triggered, EXACTLY timed with BTC tagging the lower boundary of the megaphone pattern it's in.

Several weeks ago we predicted this would happen around mid-November. Well, here we are.… https://t.co/quqAs4qhXn pic.twitter.com/xBDjoMFnrL