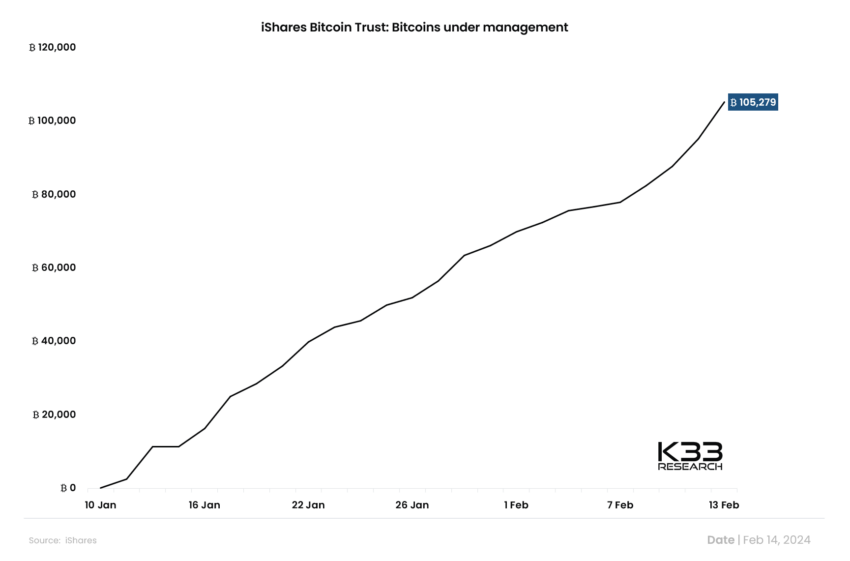

BlackRock Now Has Over 100,000 Bitcoin Under Management

On February 13, BlackRock’s Bitcoin ETF reached over 100,000 BTC under management. In fact, this milestone made it the first US spot Bitcoin ETF to surpass $1 billion in inflows, with $493.1 million coming in on that day alone.

This achievement underscores the growing traction of Bitcoin as a legitimate asset class in the eyes of institutional investors.

BlackRock’s Bitcoin ETF Makes New RecordsData from K33 Research unveiled that BlackRock’s Bitcoin ETF – iShares Bitcoin Trust (IBIT) – has surged past 100,000 Bitcoin under management.

IBIT has notably become the first US spot Bitcoin ETF to surpass the $1 billion inflow mark, with a remarkable $493.1 million influx on February 13 alone. This surge in investment positions IBIT firmly at the forefront, eclipsing competitors like Fidelity’s FBTC, which boasts an overall inflow of $881 million.

Read more: Who Owns the Most Bitcoin in 2024?

BlackRock ETF’s Bitcoin Under Management. Source: K33 Research

BlackRock ETF’s Bitcoin Under Management. Source: K33 Research

Farside Investors’ data further illuminates the soaring popularity of Bitcoin ETFs, revealing a staggering net inflow of $631.3 million on February 13. This daily influx represents a historic high, signaling the escalating confidence and interest in Bitcoin as a lucrative investment avenue.

The price of Bitcoin surged past the $51,500 threshold today, marking a notable milestone in its 2024 performance, with year-to-date gains reaching 21.50%.

“There’s hundreds of millions of dollars flowing into these Bitcoin ETFs per day. And there is only about $40 million to $45 million of net new Bitcoin being produced. So there’s 12.5 times more demand than there is supply being created every single day. If there is that much demand and that little supply, the price will go up to accommodate the demand. So my guess is Bitcoin gonna continue to grind up for the next couple of weeks,” renowned investor Anthony Pompliano said.

Read more: What Is a Bitcoin ETF?

Michael Saylor, a well-known Bitcoin supporter, is optimistic about its long-term value. He links the rise in capital inflow to Bitcoin’s increasing appeal as an investment. Saylor pointed out Bitcoin’s distinct features and independence from conventional risk assets. He also mentioned that ETFs provide mainstream investors with Bitcoin access, leading to demand that exceeds supply.

Top crypto platforms in the US | February 2024The post BlackRock Now Has Over 100,000 Bitcoin Under Management appeared first on BeInCrypto.