Bitcoin Flips Google and Amazon in Market Cap Rankings | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we explore Bitcoin’s position among top assets and the implications of rising treasury yields for Bitcoin. As investors progressively distrust US debt sustainability, fearing deficits, Bitcoin’s appeal as a hyperinflation hedge grows as the Federal Reserve (Fed) buying bonds signals inflation fears.

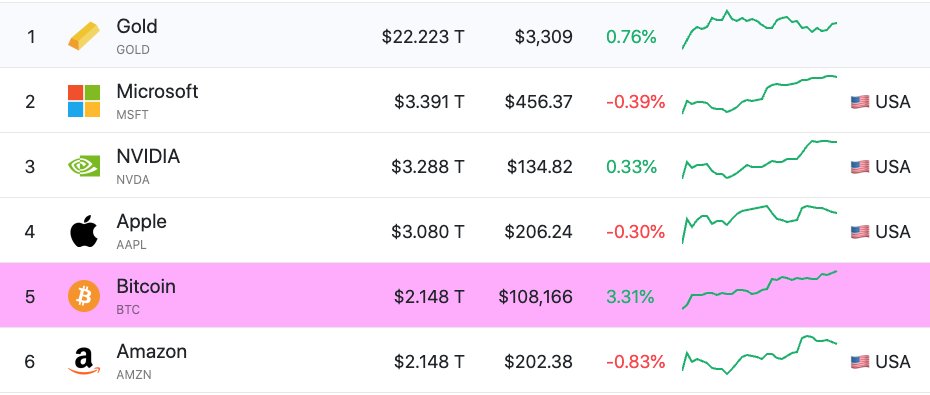

Crypto News of the Day: Bitcoin Overtakes Amazon and Google After All-Time HighA recent US Crypto News publication indicated that Bitcoin had overtaken Google in market cap rankings. At the time, its market cap stood at $1.86 trillion.

The latest data shows that Bitcoin’s market cap has risen to $2.16 trillion, a 14% increase since April 23. With this, Bitcoin has ascended to the sixth position on market cap metrics, effectively sidestepping Google as it closes in on Amazon.

“Bitcoin flips Google and is now the 6th largest asset on the planet, overtaking Alphabet (Google) with a market cap of over $2 Trillion. BTC now trails only Gold, Microsoft, Nvidia, Apple, and Amazon. This isn’t just a number—it’s history in the making,” wrote Bitward Investment co-founder and COO Dariusz Kowalczyk.

Assets by Market Cap. Source: Companies Market Cap

Assets by Market Cap. Source: Companies Market Cap

The sentiment on X (Twitter) is that Bitcoin is on the verge of flipping Amazon. This could happen soon, as there is only a modest 2.7% difference in the market cap of the two assets.

Other users are optimistic that Bitcoin could dethrone gold and become the largest asset by market cap rankings.

Indeed, the optimism comes with good reason, considering that Bitcoin remains among the top assets that have attained the $1 trillion market cap threshold in record time.

Amount of Time It Took To Reach $1 Trillion

Bitcoin: 12 years

Facebook: 17 years

Tesla: 18 years

Google: 21 years

Amazon: 24 years

Apple: 42 years

Microsoft: 44 years