3 US Economic Data to Shape Bitcoin Sentiment This Week

Several key US economic data points between December 15 and 19, 2025, position Bitcoin at a crucial point. Analysts are divided between fears of a significant correction and hopes that the Federal Reserve’s policy might mitigate potential impacts.

Upcoming BOJ data also adds to the mix, with Bitcoin bracing for a turbulent week as markets assign a 98% chance that the Bank of Japan will raise rates to 75 basis points on December 19. This move often triggers 20-30% drops.

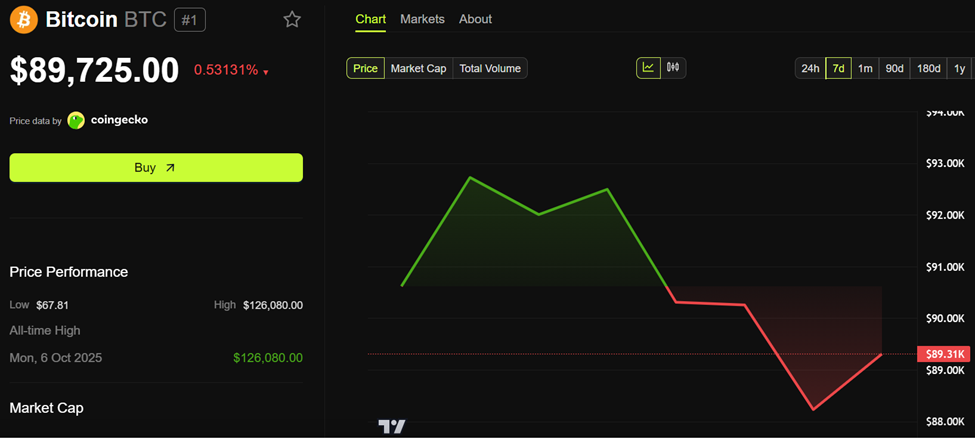

US Economic Data Crypto Traders Must Watch This WeekWith the Bitcoin price consolidating near the $90,000 psychological level, macroeconomic signals are expected to play a significant role in shaping Federal Reserve rate expectations and short-term price direction this week.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

The following US economic data points could move markets this third week of December.

Nonfarm Payrolls (NFP) – Tuesday, December 16, 8:30 AM ETThe November Nonfarm Payrolls report is the first comprehensive snapshot of US labor conditions since September. It is also a key input into how markets price the Fed’s policy path into 2026.

Consensus forecasts indicate a sharp slowdown in job creation, with just 50,000 jobs expected, down from October’s 119,000, while the unemployment rate is projected to rise to 4.5% from 4.4%.

Recent private payroll data has already tilted sentiment toward a softer outcome. ADP’s latest report showed a surprise contraction of 32,000 jobs, reinforcing expectations that labor market momentum is cooling faster than previously thought.

Traders are increasingly framing NFP as a decisive catalyst, especially with Bitcoin stuck in a tight range near $90,000.

Goldman: We estimate nonfarm payrolls rose by +10k in October and by +55k in November, a touch above consensus of +50k in November but below the prior three-month average of +62k. We estimate that private payrolls increased by +70k in October and +50k in November (vs. consensus… pic.twitter.com/wodmiFKE8w

— Neil Sethi (@neilksethi) December 14, 2025A stronger-than-expected print could revive hawkish Federal Reserve expectations, potentially pressuring BTC toward the $85,000 support zone. Conversely, a weak report, particularly one below the 40,000 to 50,000 range, would likely strengthen dovish narratives, opening the door for a rebound toward $95,000 or higher as liquidity hopes resurface.

Overall, sentiment remains cautious, with many highlighting the risk of sharp moves amid thinning liquidity.

Initial Jobless Claims – Thursday, December 18, 8:30 AM ETWeekly Initial Jobless Claims is also another US economic data point to watch this week. This data point will offer a more immediate read on labor market stress. It shows the number of US citizens who filed for unemployment insurance for the first time the previous week.

Claims for the week ending December 13 are expected to come in at 223,000, down from the prior week’s 236,000, which itself marked a sharp jump from 192,000.