$160,000 Bitcoin Could Be ‘Conservative’ Price Target, According to Trader That Called 2022 Bear Market Bottom

A trader known for several accurate crypto market calls says that Bitcoin (BTC) could soar beyond $160,000 this bull cycle if its current market structure holds up.

Pseudonymous analyst Dave the Wave tells his 143,000 followers on the social media platform X that based on Bitcoin’s price action from 2020, the crypto king could hit $160,000 before May and continue to soar.

“A BTC $160,000 target, should we see a continued parabolic run, is actually quite conservative on this comparison.”

Source: Dave the Wave/X

Source: Dave the Wave/X

Dave the Wave uses his own version of logarithmic growth channels (LGC) to attempt to forecast market cycle tops and bottoms while filtering out short-term volatility and noise.

Looking at his chart, the trader suggests that Bitcoin is printing a similar price pattern as 2020 where it breaks out of an ascending channel and into a parabolic impulse upward, completing a 154% move.

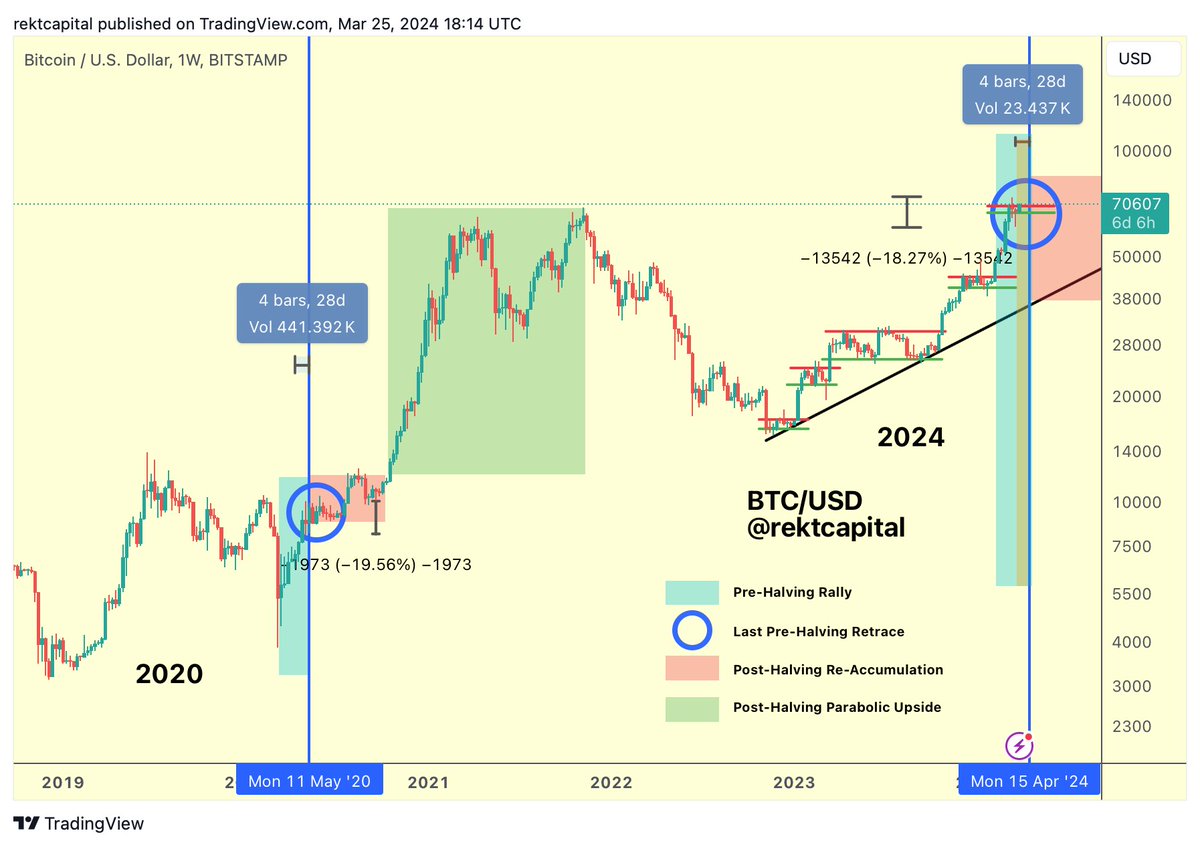

Pseudonymous crypto trader Rekt Capital is also drawing a comparison between Bitcoin’s current cycle and 2020 as BTC heads into the April halving event when miners’ rewards are cut in half. He suggests that Bitcoin could consolidate in the high $60,000 range as it enters the halving and later breakout similar to the 2020-2021 cycle.

“This current cycle has been a story of re-accumulation ranges (green-red). And one interesting possibility for price going into the halving is further consolidation at highs (i.e. re-accumulation). This turn of technical events would be historically accurate. It would satisfy the fact that a pre-halving retrace occurs 28-14 days before the halving. And it would satisfy the fact that pre-halving retraces transition into post-halving re-accumulation.

If Bitcoin manages to turn the old all-time high of ~$69,000 into new support then this ‘re-accumulation range’ idea would be invalidated because price would be ready for price expansion into price discovery. If however, Bitcoin isn’t able to turn ~$69,000 into support before the halving this re-accumulation range could become a reality and would be in line with historical price tendencies around the halving.”

Source: Rekt Capital/X

Source: Rekt Capital/X

Bitcoin is trading for $69,847 at time of writing, down slightly in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $160,000 Bitcoin Could Be ‘Conservative’ Price Target, According to Trader That Called 2022 Bear Market Bottom appeared first on The Daily Hodl.