US Judge Says Altcoins In Secondary Market Sales Are Securities

In a decision that could significantly shape the future of crypto trading, a US judge has ruled that altcoins sold in secondary markets are indeed securities. This ruling stems from a high-profile case involving former Coinbase manager Ishan Wahi, his brother Nikhil Wahi, and their close friend Sameer Ramani.

The trio were initially accused of insider trading of crypto asset securities.

Judge Says Altcoins Constitute Investment Contract SecuritiesThe case, initially brought to light by the Securities and Exchange Commission (SEC), centered on the trio’s illegal trading of tokens based on confidential information.

Ishan Wahi, entrusted with advanced knowledge of Coinbase’s asset listings, shared this sensitive information with Nikhil Wahi and Sameer Ramani. Utilizing these insights, Ramani alone amassed $817,602 in illicit trading profits. According to the SEC, this was a clear violation of securities laws.

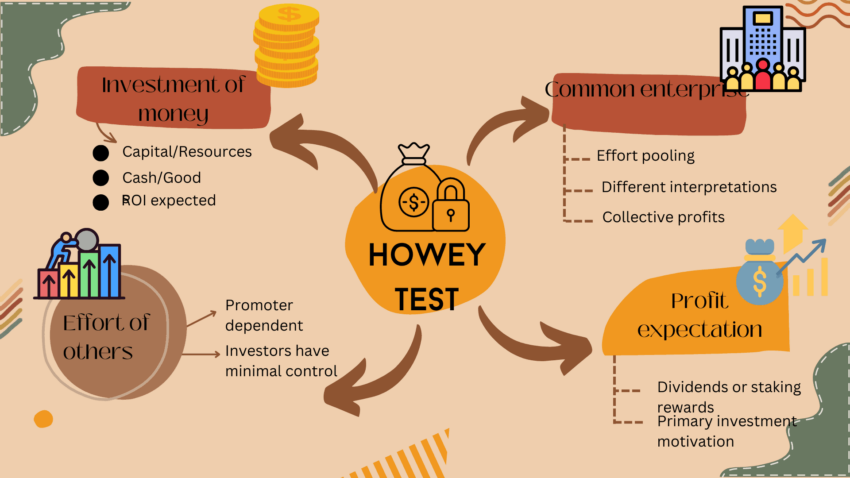

“According to the SEC, the tokens in which Ramani traded were investment contracts and, therefore, securities, because each involved the investment of money, in a common enterprise, with a reasonable expectation of profit derived from the efforts of others,” the court document stated.

The judge’s decision ultimately hinged on the definition of investment contracts and, by extension, securities. The tokens in question met the criteria of investment contracts. This is because they involved an investment of money in a common enterprise with an expectation of profits predominantly from the efforts of others.

Read more: What Is the Howey Test and How Does It Impact Crypto?

The 4 prongs of the SEC’s Howey Test to label an asset as a security or commodity. Source: Kyrian Alex

The 4 prongs of the SEC’s Howey Test to label an asset as a security or commodity. Source: Kyrian Alex

This classification underscores the critical role of issuers’ promotional activities, highlighting promises of significant investment returns, supply restrictions to boost token values, and efforts to enhance secondary market liquidity.

Could the SEC Outlaw Altcoin Trading on Exchanges?This ruling further aligns with the SEC’s broader stance on digital assets. It is exemplified by its successful action against LBRY’s LBC token for being an unregistered security. The LBRY team conceded defeat in October 2023,

“LBRY Inc. must die, there is no escaping this,” the team stated.

The implications of this decision are far-reaching. It could set a precedent that impacts how altcoins are treated in secondary markets.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in January 2024

Legal experts argue that this could lead to a reassessment of which tokens are considered securities. This could potentially affect their trading on centralized crypto exchanges.

Last year, Benjamin Cole from Fordham University said that a victory for the SEC in this domain might force exchanges to quickly determine the securities status of tokens. This could have a significant impact on the stability and operation of centralized crypto platforms.

“It could cripple centralized crypto exchanges,” Cole said.

The post US Judge Says Altcoins In Secondary Market Sales Are Securities appeared first on BeInCrypto.